IRS Publication 5412 R SP Form

What is the IRS Publication 5412 R SP

The IRS Publication 5412 R SP is a document issued by the Internal Revenue Service that provides guidelines and information related to specific tax regulations. It serves as a resource for taxpayers, helping them understand their responsibilities and the necessary steps to comply with federal tax laws. This publication is essential for individuals and businesses seeking clarity on tax-related matters, ensuring they are well-informed about the requirements set forth by the IRS.

How to use the IRS Publication 5412 R SP

Using the IRS Publication 5412 R SP involves reviewing the guidelines outlined within the document to ensure compliance with tax regulations. Taxpayers should carefully read the publication to understand the specific requirements that apply to their situation. This may include understanding eligibility criteria, required documentation, and any relevant deadlines. Utilizing this publication effectively can help prevent errors and ensure that all necessary information is accurately submitted to the IRS.

Steps to complete the IRS Publication 5412 R SP

Completing the IRS Publication 5412 R SP requires a systematic approach to ensure all necessary information is provided accurately. Follow these steps:

- Review the publication thoroughly to understand the requirements.

- Gather all necessary documents and information required for completion.

- Fill out the form carefully, ensuring all sections are completed as instructed.

- Double-check the information for accuracy and completeness.

- Submit the completed form according to the guidelines provided in the publication.

Legal use of the IRS Publication 5412 R SP

The legal use of the IRS Publication 5412 R SP is crucial for ensuring compliance with federal tax laws. This publication outlines the legal framework within which taxpayers must operate. Adhering to the guidelines ensures that individuals and businesses meet their tax obligations without facing penalties. Understanding the legal implications of the information provided in the publication can help taxpayers navigate complex tax situations effectively.

Key elements of the IRS Publication 5412 R SP

Key elements of the IRS Publication 5412 R SP include:

- Definitions of important terms related to tax regulations.

- Eligibility criteria for various tax situations.

- Required documentation for compliance.

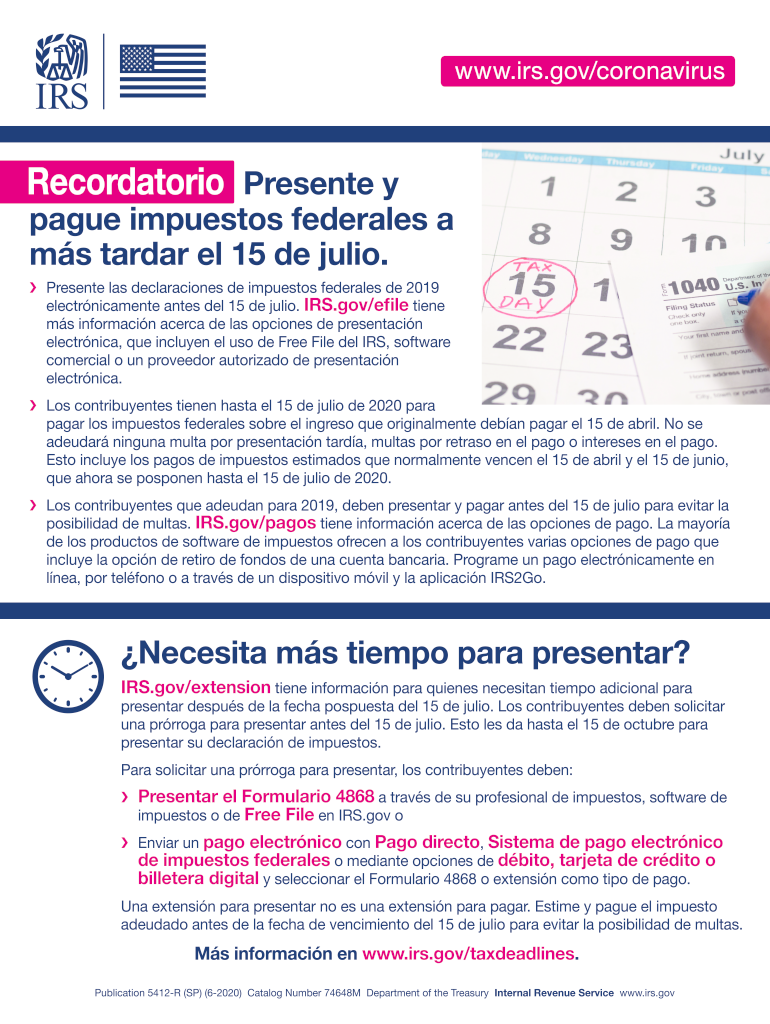

- Filing deadlines and important dates to remember.

- Instructions for completing the form accurately.

Filing Deadlines / Important Dates

Filing deadlines and important dates associated with the IRS Publication 5412 R SP are critical for taxpayers to note. These dates dictate when forms must be submitted to avoid penalties. It is essential to keep track of these deadlines to ensure compliance and timely submission of all required documentation. Taxpayers should regularly check for updates from the IRS regarding any changes to these important dates.

Quick guide on how to complete 2020 irs publication 5412 r sp

Complete IRS Publication 5412 R SP effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents promptly without delays. Handle IRS Publication 5412 R SP seamlessly on any platform with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign IRS Publication 5412 R SP with ease

- Locate IRS Publication 5412 R SP and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive content using tools specifically available from airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to apply your changes.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes requiring the reprinting of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign IRS Publication 5412 R SP and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 irs publication 5412 r sp

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is IRS Publication 5412 R SP?

IRS Publication 5412 R SP provides important guidelines and updates related to electronic signature compliance for tax documents. Understanding this publication helps businesses ensure they meet IRS regulations, especially when implementing e-signature solutions like airSlate SignNow.

-

How can airSlate SignNow help with compliance to IRS Publication 5412 R SP?

airSlate SignNow offers features that ensure your electronic signatures meet the standards set by IRS Publication 5412 R SP. By leveraging advanced security protocols and user-friendly workflows, businesses can confidently sign documents while complying with IRS regulations.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow includes a variety of features designed for efficient document signing, such as customizable templates, multi-party signing, and automatic reminders. These tools help streamline the document signing process, ensuring compliance with IRS Publication 5412 R SP.

-

Is airSlate SignNow a cost-effective solution for businesses?

Yes, airSlate SignNow is a cost-effective solution that provides powerful e-signature capabilities at competitive pricing. With various plans available, businesses can choose the one that fits their needs while ensuring compliance with IRS Publication 5412 R SP.

-

Can airSlate SignNow integrate with other software systems?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, including CRM and document management systems. This ensures that all your signed documents adhere to IRS Publication 5412 R SP while enhancing your overall workflow efficiency.

-

What are the benefits of using airSlate SignNow for IRS-related documents?

Using airSlate SignNow for IRS-related documents provides numerous benefits, including enhanced security, faster processing times, and easier compliance with regulations like IRS Publication 5412 R SP. This solution also reduces paper usage, saving both time and resources.

-

How secure is the signing process with airSlate SignNow?

The signing process with airSlate SignNow is highly secure, featuring encryption and secure cloud storage. This level of security is essential to ensure compliance with IRS Publication 5412 R SP, giving users peace of mind when handling sensitive tax documents.

Get more for IRS Publication 5412 R SP

Find out other IRS Publication 5412 R SP

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney