Canada T5013 SCH 1 E 2013

What is the Canada T5013 SCH 1 E

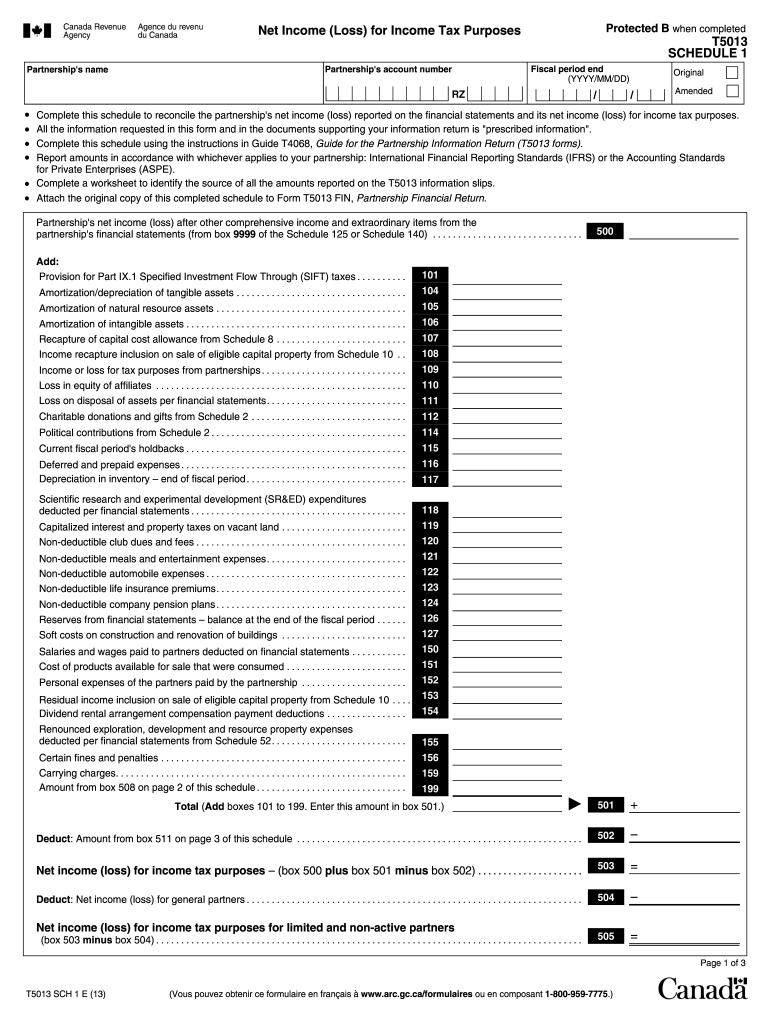

The Canada T5013 SCH 1 E form is a tax document used primarily by partnerships in Canada to report income, deductions, and tax credits to the Canada Revenue Agency (CRA). This form is essential for partnerships that earn income from business activities, investments, or other sources. It provides a breakdown of each partner's share of the income and expenses, allowing the CRA to assess the tax obligations of individual partners accurately. Understanding this form is crucial for ensuring compliance with Canadian tax laws and for accurately reporting income on personal tax returns.

How to use the Canada T5013 SCH 1 E

Using the Canada T5013 SCH 1 E involves several steps that ensure accurate reporting of partnership income. First, the partnership must gather all relevant financial information, including income statements and expense records. Next, the form must be filled out with details such as the partnership's name, business number, and the financial year in question. Each partner's share of income and expenses should be calculated and reported accurately. After completing the form, it must be submitted to the CRA along with any necessary supporting documents. Utilizing digital tools can streamline this process, making it easier to complete and submit the form electronically.

Steps to complete the Canada T5013 SCH 1 E

Completing the Canada T5013 SCH 1 E involves a systematic approach:

- Gather financial records: Collect all necessary documents related to income and expenses for the partnership.

- Fill in partnership details: Enter the partnership's name, business number, and the applicable tax year on the form.

- Report income and expenses: Detail the total income earned and the expenses incurred during the tax year.

- Allocate amounts to partners: Calculate each partner's share of the income and expenses, ensuring accuracy in the distribution.

- Review and verify: Double-check all entries for accuracy and completeness before submission.

- Submit the form: File the completed T5013 SCH 1 E with the CRA, ensuring that it is done before the deadline.

Legal use of the Canada T5013 SCH 1 E

The legal use of the Canada T5013 SCH 1 E is governed by Canadian tax law, which mandates that partnerships accurately report their income and expenses. Failure to use this form correctly can result in penalties or audits by the CRA. It is important for partnerships to understand the legal implications of the information reported on this form, as it directly affects the tax liabilities of both the partnership and its individual partners. Compliance with the requirements outlined by the CRA ensures that partnerships remain in good standing and avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Canada T5013 SCH 1 E are crucial for compliance. Generally, the form must be filed within five months after the end of the partnership's fiscal year. For partnerships with a fiscal year ending on December 31, the due date is typically May 31 of the following year. It is essential for partnerships to be aware of these deadlines to avoid late filing penalties. Additionally, partners should be informed of their individual reporting deadlines, as they must report their share of the partnership income on their personal tax returns.

Who Issues the Form

The Canada T5013 SCH 1 E form is issued by the Canada Revenue Agency (CRA). The CRA is responsible for administering tax laws and ensuring compliance among taxpayers in Canada. Partnerships must obtain the form from the CRA's official resources, ensuring that they are using the most current version. The CRA provides guidelines and support for completing the form, which can be beneficial for partnerships navigating the complexities of tax reporting.

Quick guide on how to complete 2013 canada t5013 sch 1 e

Easily Prepare Canada T5013 SCH 1 E on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to easily obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly and without hold-ups. Manage Canada T5013 SCH 1 E on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

Edit and eSign Canada T5013 SCH 1 E Effortlessly

- Locate Canada T5013 SCH 1 E and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose provided by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Canada T5013 SCH 1 E while ensuring outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 canada t5013 sch 1 e

Create this form in 5 minutes!

How to create an eSignature for the 2013 canada t5013 sch 1 e

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is Canada T5013 SCH 1 E?

The Canada T5013 SCH 1 E is a tax form used for reporting partnership income in Canada. It provides the required information for partners to complete their tax returns accurately. Understanding this form is essential for businesses involved in partnerships to ensure compliance with Canadian tax laws.

-

How does airSlate SignNow help with Canada T5013 SCH 1 E?

airSlate SignNow streamlines the process of preparing and signing the Canada T5013 SCH 1 E. Our platform allows users to easily create, edit, and eSign documents securely, ensuring that partnership forms are completed efficiently and accurately. This reduces the time spent on paperwork, allowing businesses to focus on their core operations.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to suit different business needs. Whether you're an individual or a larger enterprise, you can find a cost-effective solution that fits your budget while ensuring access to features necessary for handling critical documents like the Canada T5013 SCH 1 E. Visit our pricing page for detailed information on our plans.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow. This includes popular tools like Google Drive, Salesforce, and Dropbox, making it easy for you to manage documents like the Canada T5013 SCH 1 E across different platforms. These integrations help you work more efficiently and keep all your important data connected.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a host of features for effective document management, including customizable templates, in-person signing, and automated workflows. These tools assist users in managing required documents like the Canada T5013 SCH 1 E effortlessly. Our intuitive interface ensures a smooth experience for users, boosting productivity.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your sensitive documents, including the Canada T5013 SCH 1 E, are protected. We utilize industry-standard encryption and secure servers to safeguard your data, giving you peace of mind while managing your partnership documents.

-

How can I ensure accurate completion of the Canada T5013 SCH 1 E using airSlate SignNow?

To ensure accurate completion of the Canada T5013 SCH 1 E, you can utilize our customizable templates and checklists. These features guide you through the required fields, helping you avoid common mistakes. With airSlate SignNow, you also have access to support resources if you have questions while filling out the form.

Get more for Canada T5013 SCH 1 E

- Aims abnormal involuntary movement scale facial and oral bb ok form

- Odh form 757 2009

- Oregon practitioner recredentialing application 2004 form

- English oregon child support program oregonchildsupport form

- How to change your name legally in lane county oregon form

- Printable tanning client cards form

- Sp dhs 7494 2014 form

- Oha 8951 in home care agency license application oha 8951 in home care agency license application public health oregon form

Find out other Canada T5013 SCH 1 E

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word