T2sch1 2018-2026

What is the T2sch1?

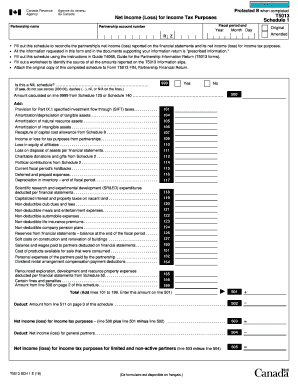

The T2sch1, also known as the Schedule 1 for corporations, is a crucial form used in Canada for tax purposes. It is designed to calculate the net income of a corporation and determine the amount of tax payable. This form is essential for corporations that need to report their income and deductions accurately to the Canada Revenue Agency (CRA). Understanding the T2sch1 is vital for ensuring compliance with Canadian tax regulations. The form includes sections for various types of income, deductions, and adjustments that affect a corporation's taxable income.

Steps to complete the T2sch1

Completing the T2sch1 involves several key steps. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the sections related to your corporation's income, which may include business income, investment income, and other revenue sources. After that, input any allowable deductions, such as operating expenses, capital cost allowances, and other relevant deductions. Ensure that all calculations are accurate, as errors can lead to penalties or audits. Finally, review the completed form thoroughly before submitting it to the CRA.

Legal use of the T2sch1

The T2sch1 must be used in accordance with Canadian tax laws to ensure its legal validity. Corporations are required to file this form annually, and it must reflect accurate financial information. Misrepresentation or failure to file can result in significant penalties. It is important to maintain proper records and documentation to support the figures reported on the T2sch1. Additionally, the form must be signed by an authorized representative of the corporation, affirming that the information provided is true and complete.

Required Documents

To complete the T2sch1, several documents are required. These include:

- Financial statements, including balance sheets and income statements

- Records of all income sources, such as sales and investment income

- Documentation for deductions, including receipts and invoices for business expenses

- Previous tax returns, if applicable, to ensure consistency in reporting

Having these documents ready will facilitate a smoother completion process and help ensure compliance with tax regulations.

Form Submission Methods

The T2sch1 can be submitted to the CRA using various methods. Corporations may choose to file electronically through the CRA's online portal, which is often the fastest and most efficient method. Alternatively, the form can be mailed to the CRA, although this method may result in longer processing times. In-person submissions are generally not available for this form. It is essential to keep a copy of the submitted form and any related documents for your records.

Examples of using the T2sch1

The T2sch1 is utilized by various types of corporations, including:

- Small businesses reporting their annual income and expenses

- Corporations claiming deductions for capital investments

- Companies with multiple revenue streams, such as product sales and investments

Each example highlights the importance of accurately reporting financial information to the CRA, ensuring that the corporation meets its tax obligations.

Quick guide on how to complete t2sch1

Complete T2sch1 effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage T2sch1 on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

The simplest way to modify and eSign T2sch1 with ease

- Locate T2sch1 and click Get Form to begin.

- Employ the tools we provide to complete your document.

- Select pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all information and then click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign T2sch1 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t2sch1

Create this form in 5 minutes!

How to create an eSignature for the t2sch1

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is t5013sch1 and why is it important for my business?

The t5013sch1 form is essential for reporting income from partnerships and joint ventures. Understanding how to use this form is crucial for tax compliance and efficient financial management. By integrating the t5013sch1 process with airSlate SignNow, businesses can streamline document management and eSigning.

-

How can airSlate SignNow help me with the t5013sch1 form?

airSlate SignNow simplifies the process of preparing and signing the t5013sch1 form. With our user-friendly platform, you can easily fill out, customize, and send your t5013sch1 documents for eSignature, ensuring accuracy and compliance with tax regulations.

-

Are there any additional costs involved when using airSlate SignNow for t5013sch1?

airSlate SignNow offers transparent pricing without hidden fees, specifically for managing documents like the t5013sch1. Our competitive plans allow you to utilize the full capabilities of the platform while keeping your budgeting in check, making it a cost-effective solution.

-

What features does airSlate SignNow provide for the t5013sch1 document?

With airSlate SignNow, features such as customizable templates, automatic reminders, and secure storage are available for your t5013sch1 documents. These features enhance efficiency and ensure that your important tax forms are handled properly and securely.

-

Can I integrate airSlate SignNow with my current software for handling t5013sch1 documents?

Yes, airSlate SignNow offers seamless integrations with various accounting and business applications, streamlining your workflow for managing the t5013sch1 form. This interoperability enhances productivity by allowing you to manage your documents in one centralized location.

-

Is eSigning the t5013sch1 secure with airSlate SignNow?

Absolutely! airSlate SignNow employs advanced encryption methods and complies with global security standards to protect your data when eSigning the t5013sch1 form. You can have peace of mind knowing that your sensitive financial information is safe and secure.

-

What benefits does using airSlate SignNow for the t5013sch1 form provide?

Using airSlate SignNow for your t5013sch1 form offers numerous benefits, including increased efficiency, reduced paperwork, and quicker turnaround times for document signing. This translates to less time spent managing forms and more time focusing on your core business activities.

Get more for T2sch1

- 3 day eviction notice rental eviction resources rentaleviction form

- Job candidate interview form samplewordscom

- 2017 military member application miramar rc flyers form

- Employee personal injuryoccupational illness report form

- Gpcsf probate 2017 2019 form

- Form 2738 a 2015 2019

- Form rev 1705 2017 2019

- Nrci mch 01 e 2016 2019 form

Find out other T2sch1

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe