Canada CRA T3012A 2018

What is the Canada CRA T3012A

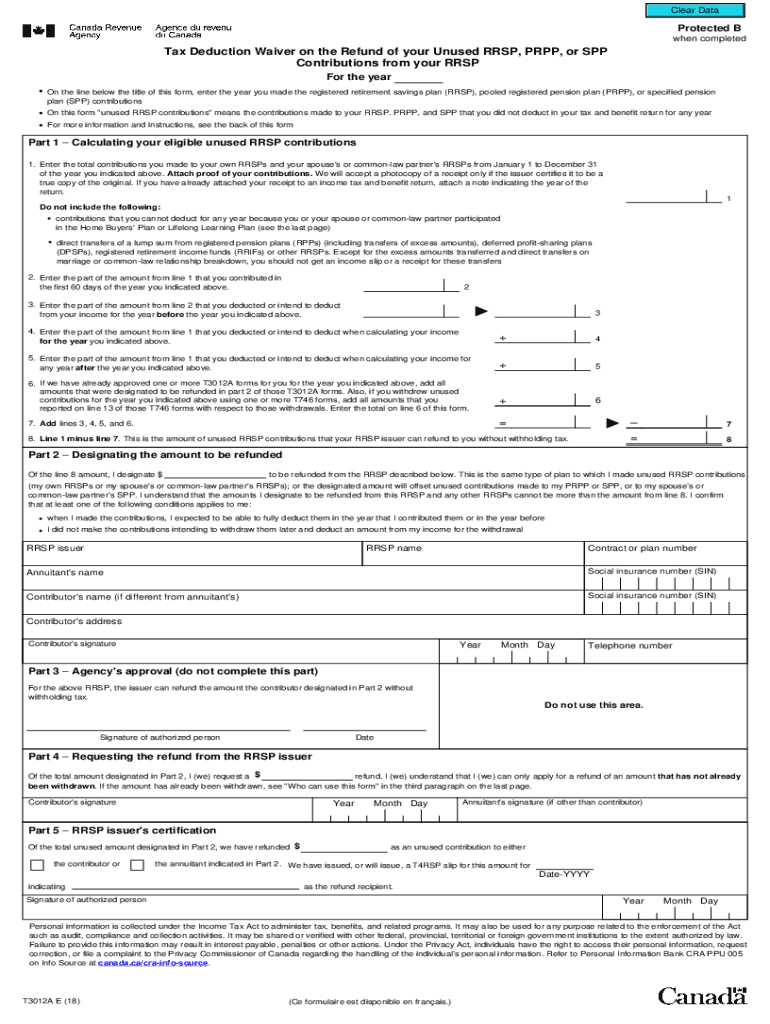

The Canada CRA T3012A form is a tax-related document used by individuals and businesses in Canada to apply for a tax exemption on certain types of income. This form is particularly relevant for those who receive payments that may otherwise be subject to withholding tax. Understanding its purpose is essential for ensuring compliance with Canadian tax regulations.

How to use the Canada CRA T3012A

Using the Canada CRA T3012A involves several key steps. First, ensure that you meet the eligibility criteria for tax exemption. Next, complete the form accurately, providing all required information, including your personal details and the nature of the income. Once filled out, submit the form to the Canada Revenue Agency (CRA) to initiate the exemption process. It is advisable to keep a copy for your records.

Steps to complete the Canada CRA T3012A

Completing the Canada CRA T3012A requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including identification and income statements.

- Fill out the form with accurate personal information, ensuring all fields are completed.

- Provide details about the income for which you are seeking exemption.

- Review the form for accuracy before submission.

- Submit the completed form to the CRA via the appropriate method.

Legal use of the Canada CRA T3012A

The Canada CRA T3012A is legally binding when completed and submitted correctly. It serves as a formal request for tax exemption, and its acceptance by the CRA can significantly impact your tax obligations. To ensure its legal standing, comply with all relevant tax laws and regulations when filling out and submitting the form.

Eligibility Criteria

To qualify for using the Canada CRA T3012A, applicants must meet specific eligibility criteria. Generally, this includes being a resident of Canada or having income sourced from Canada that qualifies for exemption. Additionally, individuals must not be subject to other tax withholding requirements. Reviewing these criteria before applying can help prevent delays in processing.

Form Submission Methods

The Canada CRA T3012A can be submitted through various methods, ensuring flexibility for users. Options typically include:

- Online submission through the CRA's secure portal.

- Mailing a hard copy of the completed form to the designated CRA address.

- In-person submission at a local CRA office, if applicable.

Who Issues the Form

The Canada CRA T3012A form is issued by the Canada Revenue Agency (CRA), the governmental body responsible for tax administration in Canada. The CRA provides guidelines and resources to assist individuals and businesses in understanding how to properly complete and submit the form, ensuring compliance with Canadian tax laws.

Quick guide on how to complete 2018 canada cra t3012a

Easily Prepare Canada CRA T3012A on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your files quickly without any delays. Handle Canada CRA T3012A on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related operation today.

The Easiest Way to Edit and eSign Canada CRA T3012A Effortlessly

- Obtain Canada CRA T3012A and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Canada CRA T3012A while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 canada cra t3012a

Create this form in 5 minutes!

How to create an eSignature for the 2018 canada cra t3012a

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What is the Canada CRA T3012A form and who needs it?

The Canada CRA T3012A form is a tax form used by individuals and businesses to apply for the Home Accessibility Tax Credit. It is essential for homeowners making eligible renovations to enhance accessibility. If you are applying for this tax credit, understanding the Canada CRA T3012A is crucial.

-

How can airSlate SignNow assist with the Canada CRA T3012A form?

airSlate SignNow simplifies the process of completing the Canada CRA T3012A form by allowing you to fill out and eSign documents quickly. Its intuitive platform facilitates seamless document handling and ensures compliance with CRA regulations. This helps you focus on your renovations without worrying about paperwork mishaps.

-

What are the pricing options for using airSlate SignNow for the Canada CRA T3012A?

airSlate SignNow offers flexible pricing plans that cater to both individual users and businesses needing to manage the Canada CRA T3012A form efficiently. You can choose from monthly or annual subscriptions, maximizing your cost-effectiveness while ensuring you have all necessary features at your fingertips.

-

Are there any features in airSlate SignNow specifically for the Canada CRA T3012A?

Yes, airSlate SignNow includes features that are particularly beneficial for managing the Canada CRA T3012A form, such as customizable templates, automated workflows, and secure lawyer-reviewed eSigning options. These features enhance your ability to handle the form accurately and in a timely manner.

-

Can I integrate airSlate SignNow with other applications for managing the Canada CRA T3012A?

Absolutely! airSlate SignNow seamlessly integrates with various applications that help streamline the process of managing the Canada CRA T3012A. Whether you use CRM tools or financial software, these integrations ensure a cohesive ecosystem that simplifies your workflow.

-

What benefits does airSlate SignNow offer when dealing with the Canada CRA T3012A?

Using airSlate SignNow for the Canada CRA T3012A provides numerous benefits, including faster turnaround times, enhanced security for sensitive data, and improved accuracy in document completion. The platform’s user-friendly interface ensures that users of all technical levels can manage tax documents effectively.

-

Is airSlate SignNow compliant with Canada CRA T3012A regulations?

Yes, airSlate SignNow is designed to be fully compliant with Canada CRA regulations surrounding the T3012A form. This compliance includes secure document handling and proper storage of eSignatures, giving you peace of mind as you complete your tax documents.

Get more for Canada CRA T3012A

Find out other Canada CRA T3012A

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template