Rrsp Overcontribution Form 2024-2026

What is the Rrsp Overcontribution Form

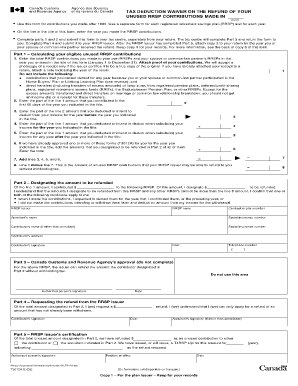

The Rrsp Overcontribution Form is a crucial document for individuals who have exceeded their Registered Retirement Savings Plan (RRSP) contribution limits in the United States. This form is designed to help taxpayers report any excess contributions made to their RRSP accounts, ensuring compliance with federal tax regulations. By accurately completing this form, individuals can avoid potential penalties and manage their retirement savings more effectively.

How to use the Rrsp Overcontribution Form

Using the Rrsp Overcontribution Form involves several straightforward steps. First, gather all necessary financial documents related to your RRSP contributions. Next, carefully fill out the form, providing accurate information about your excess contributions, including the amounts and the tax year they pertain to. After completing the form, review it for accuracy and submit it to the appropriate tax authority. This process helps ensure that your overcontributions are documented correctly and that you remain in good standing with tax regulations.

Steps to complete the Rrsp Overcontribution Form

Completing the Rrsp Overcontribution Form requires attention to detail. Follow these steps:

- Collect your RRSP contribution records for the relevant tax year.

- Identify the total amount of contributions made beyond the allowable limit.

- Fill in your personal information, including your name, address, and Social Security number.

- Report the excess contribution amount clearly on the form.

- Sign and date the form to certify that the information provided is accurate.

- Submit the form to the IRS or your state tax authority as required.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Rrsp Overcontribution Form. Typically, the form must be submitted by the tax filing deadline for the year in which the excess contributions were made. This is usually April 15 of the following year. Failing to file by this deadline may result in penalties or interest on the excess amount. Keeping track of these dates is crucial for maintaining compliance and avoiding additional financial burdens.

Penalties for Non-Compliance

Not addressing overcontributions to your RRSP can lead to significant penalties. The IRS imposes a tax of one percent per month on the excess contributions until they are withdrawn or properly reported. This penalty can accumulate quickly, making it vital to complete and submit the Rrsp Overcontribution Form promptly. Understanding these penalties can help individuals take proactive steps to manage their retirement savings effectively.

Required Documents

To complete the Rrsp Overcontribution Form accurately, certain documents are necessary. These may include:

- Your RRSP contribution receipts for the tax year in question.

- Any correspondence from the IRS regarding your RRSP contributions.

- Records of your total RRSP contribution limits for the year.

Having these documents on hand will facilitate a smoother completion process and ensure that all information provided is accurate and comprehensive.

Create this form in 5 minutes or less

Find and fill out the correct rrsp overcontribution form

Create this form in 5 minutes!

How to create an eSignature for the rrsp overcontribution form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Rrsp Overcontribution Form?

The Rrsp Overcontribution Form is a document used to report excess contributions made to a Registered Retirement Savings Plan (RRSP). It helps individuals manage their RRSP contributions effectively and avoid penalties. By using the Rrsp Overcontribution Form, you can ensure compliance with tax regulations.

-

How can airSlate SignNow help with the Rrsp Overcontribution Form?

airSlate SignNow provides a seamless platform for creating, sending, and eSigning the Rrsp Overcontribution Form. Our user-friendly interface allows you to complete the form quickly and securely. With airSlate SignNow, you can streamline your document management process and ensure timely submissions.

-

Is there a cost associated with using the Rrsp Overcontribution Form on airSlate SignNow?

While the Rrsp Overcontribution Form itself is free to use, airSlate SignNow offers various pricing plans that provide additional features and benefits. These plans are designed to be cost-effective, ensuring you get the best value for your document management needs. Explore our pricing options to find the right fit for your business.

-

What features does airSlate SignNow offer for the Rrsp Overcontribution Form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking for the Rrsp Overcontribution Form. These features enhance the efficiency of your document workflow and ensure that your forms are completed accurately. Additionally, our platform supports collaboration among multiple users.

-

Can I integrate airSlate SignNow with other applications for the Rrsp Overcontribution Form?

Yes, airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the Rrsp Overcontribution Form. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to enhance your document management process. This integration capability makes it easier to manage your forms alongside other business operations.

-

What are the benefits of using airSlate SignNow for the Rrsp Overcontribution Form?

Using airSlate SignNow for the Rrsp Overcontribution Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored securely and can be accessed anytime, anywhere. Additionally, the eSigning feature speeds up the approval process, allowing you to focus on other important tasks.

-

How secure is the Rrsp Overcontribution Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The Rrsp Overcontribution Form and all other documents are protected with advanced encryption and secure access controls. We comply with industry standards to ensure that your sensitive information remains confidential and secure throughout the signing process.

Get more for Rrsp Overcontribution Form

- State bar exams questions and sample answers bing form

- Louisiana state bar examination criminal law lascba form

- Acr002 air conditioning and refrigeration contractor license application form

- Httpsapi28ilovepdfcomv1download form

- You may not have to pay vehicle excise tax or rta tax when you register your vehicle in washington form

- Dbpr cilb 15 change of status individual to qualifying business form

- State form 53391 r4 9 18

- Cilb 9 form

Find out other Rrsp Overcontribution Form

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed