Tax Deduction Waiver on the Refund of Your Canada Ca 2020

Understanding the Tax Deduction Waiver on the Refund of Your Canada CA

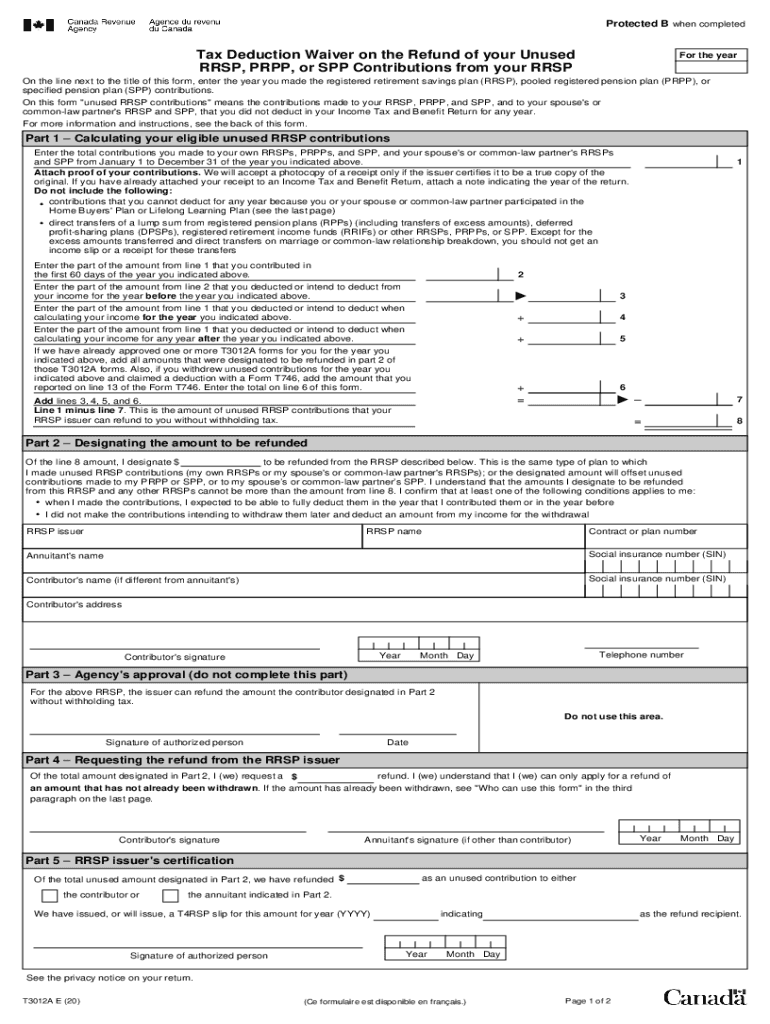

The Tax Deduction Waiver on the refund of your Canada CA is a crucial element for individuals who have made contributions to registered plans such as RRSPs (Registered Retirement Savings Plans) or SPPs (Supplemental Pension Plans). This waiver allows taxpayers to avoid deductions on certain refunds, which can significantly impact their overall tax liability. Understanding how this waiver works is essential for effective tax planning and ensuring compliance with Canadian tax regulations.

Steps to Complete the Tax Deduction Waiver on the Refund of Your Canada CA

Completing the Tax Deduction Waiver involves several steps that ensure accuracy and compliance. First, gather all necessary documents related to your contributions, including receipts and statements from your financial institution. Next, fill out the T3012A form accurately, ensuring that all required fields are completed. After completing the form, review it for any errors before submitting it to the Canada Revenue Agency (CRA). It is also advisable to keep a copy of the submitted form for your records.

Key Elements of the Tax Deduction Waiver on the Refund of Your Canada CA

Several key elements define the Tax Deduction Waiver. These include eligibility criteria, the specific contributions that qualify for the waiver, and the process for claiming it. Eligible contributions typically include those made to RRSPs and SPPs within the tax year. Additionally, understanding the implications of the waiver on your overall tax return is vital, as it can affect your taxable income and potential refunds.

Eligibility Criteria for the Tax Deduction Waiver on the Refund of Your Canada CA

To qualify for the Tax Deduction Waiver, taxpayers must meet specific eligibility criteria. Generally, individuals must have made contributions to a registered plan and must not have previously claimed a deduction for those contributions. Furthermore, the contributions must be within the allowable limits set by the CRA for the tax year in question. It is essential to verify your eligibility to ensure compliance and avoid any penalties.

Form Submission Methods for the Tax Deduction Waiver on the Refund of Your Canada CA

Submitting the T3012A form can be done through various methods, including online submission, mail, or in-person at designated CRA offices. Online submission is often the most efficient method, allowing for quicker processing times. If submitting by mail, ensure that you send it to the correct address and consider using a trackable mailing option. In-person submissions may be subject to local office hours and availability.

Filing Deadlines for the Tax Deduction Waiver on the Refund of Your Canada CA

Filing deadlines for the Tax Deduction Waiver are critical to avoid penalties and ensure timely processing. Typically, the T3012A form must be submitted by the tax return deadline for the year in which the contributions were made. It is advisable to keep track of these deadlines and plan your submissions accordingly to ensure compliance with CRA requirements.

Quick guide on how to complete tax deduction waiver on the refund of your canadaca

Handle Tax Deduction Waiver On The Refund Of Your Canada ca seamlessly on any device

Digital document management has become favored among companies and individuals. It presents a perfect eco-conscious substitute for conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents promptly without any setbacks. Manage Tax Deduction Waiver On The Refund Of Your Canada ca on any system with airSlate SignNow apps for Android or iOS and enhance any document-driven procedure today.

The simplest way to edit and electronically sign Tax Deduction Waiver On The Refund Of Your Canada ca with ease

- Locate Tax Deduction Waiver On The Refund Of Your Canada ca and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that intention.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to preserve your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate reprinting documents. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Tax Deduction Waiver On The Refund Of Your Canada ca and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax deduction waiver on the refund of your canadaca

Create this form in 5 minutes!

How to create an eSignature for the tax deduction waiver on the refund of your canadaca

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is the 2018 CRA T3012A form and why do I need it?

The 2018 CRA T3012A form is a tax-related document used in Canada that helps individuals report income, deductions, and calculate taxes owed. Businesses utilizing airSlate SignNow can easily eSign and send this document, making tax submission more efficient. It's essential for ensuring compliance with Canadian tax laws.

-

How can airSlate SignNow streamline the 2018 CRA T3012A process?

By using airSlate SignNow, you can electronically sign and send the 2018 CRA T3012A form quickly. The platform allows multiple users to collaborate on the document, reducing delays and miscommunication. It simplifies the submission process, ensuring that your tax documents are handled promptly and securely.

-

Are there any costs associated with using airSlate SignNow for the 2018 CRA T3012A?

Yes, airSlate SignNow offers various pricing plans to meet different needs, including options suitable for businesses dealing with the 2018 CRA T3012A. The pricing is competitive and covers unlimited eSignatures, document storage, and template creation. This cost-effective solution means you won’t have to worry about paper-based processes anymore.

-

What features does airSlate SignNow offer for managing the 2018 CRA T3012A?

airSlate SignNow provides features like automated workflows, document templates, and an intuitive interface for managing the 2018 CRA T3012A. Users can set up reminders, track document status, and ensure all parties complete their eSignatures promptly. These features enhance productivity and simplify the document management process.

-

Can I integrate airSlate SignNow with other applications for the 2018 CRA T3012A?

Absolutely, airSlate SignNow integrates seamlessly with various applications, making it easy to manage the 2018 CRA T3012A alongside your existing tools. Popular integrations include CRM systems and cloud storage services, allowing for a streamlined workflow. This flexibility enhances your overall productivity and document management capabilities.

-

Is airSlate SignNow secure for handling the 2018 CRA T3012A?

Yes, airSlate SignNow prioritizes the security of your documents, including the 2018 CRA T3012A. The platform uses advanced encryption protocols to protect sensitive information during transmission and storage. You can confidently eSign and share documents knowing that your data is secure.

-

How does eSigning the 2018 CRA T3012A improve efficiency?

eSigning the 2018 CRA T3012A with airSlate SignNow signNowly improves efficiency by eliminating the need for printing, scanning, and mailing physical documents. This digital process reduces turnaround times and allows for easier tracking of document status. As a result, your tax filing process becomes much faster and more reliable.

Get more for Tax Deduction Waiver On The Refund Of Your Canada ca

Find out other Tax Deduction Waiver On The Refund Of Your Canada ca

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal