DE Division of Corporations Fee Schedule 2020-2026

What is the DE Division Of Corporations Fee Schedule

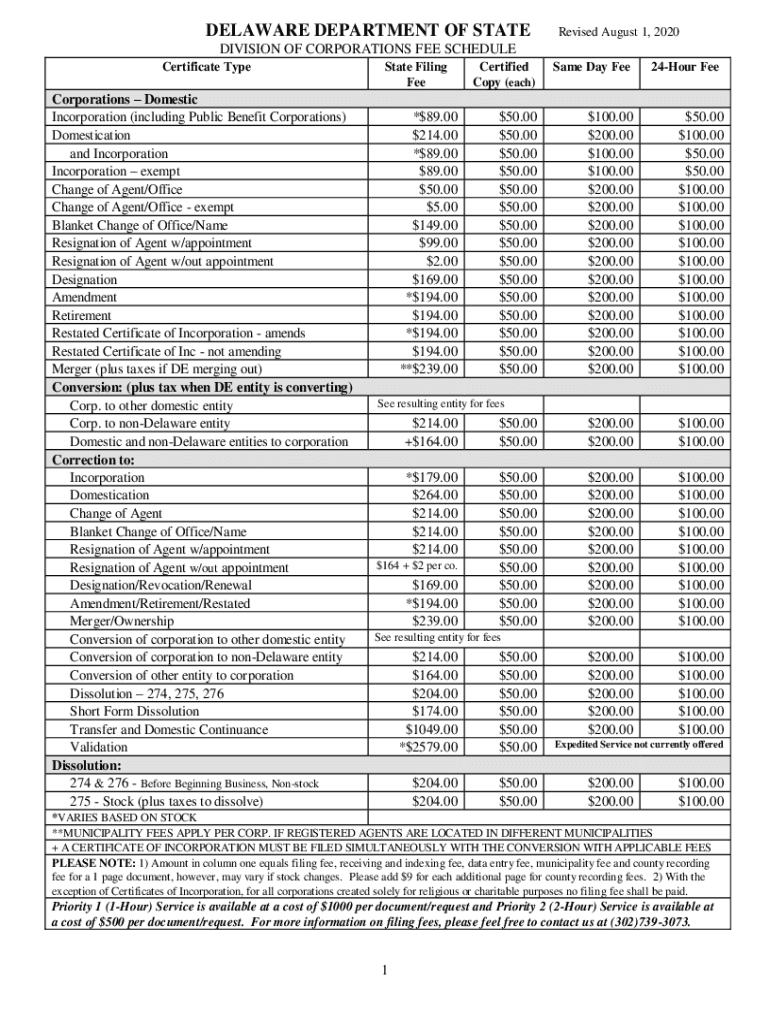

The DE Division Of Corporations Fee Schedule outlines the various fees associated with business entity filings in Delaware. This schedule is essential for businesses operating in the state, as it details the costs for services such as incorporation, annual franchise taxes, and other corporate filings. Understanding this fee structure is crucial for business owners to ensure compliance and budget for necessary expenses.

How to use the DE Division Of Corporations Fee Schedule

Using the DE Division Of Corporations Fee Schedule involves reviewing the listed fees to determine the costs associated with your specific filing needs. Each service, such as forming a new corporation or filing annual reports, has a corresponding fee. Business owners should consult this schedule regularly to stay informed about any changes in fees and to accurately plan for their business expenses.

Steps to complete the DE Division Of Corporations Fee Schedule

Completing the DE Division Of Corporations Fee Schedule requires several steps:

- Identify the specific service you need, such as incorporation or annual report filing.

- Review the fee associated with that service on the schedule.

- Prepare the necessary documentation required for the filing.

- Submit the completed documents along with the appropriate fee to the Delaware Division of Corporations.

Legal use of the DE Division Of Corporations Fee Schedule

The legal use of the DE Division Of Corporations Fee Schedule ensures that businesses comply with state regulations. By adhering to the fee structure, businesses can avoid penalties and maintain good standing with the state. It is important to follow the guidelines provided in the schedule to ensure that all filings are processed correctly and in a timely manner.

Required Documents

When utilizing the DE Division Of Corporations Fee Schedule, certain documents are typically required for various filings. These may include:

- Certificate of Incorporation or Formation

- Annual Franchise Tax Report

- Amendments to corporate documents

Ensuring that all necessary documents are prepared and submitted alongside the appropriate fees is crucial for successful processing.

Form Submission Methods

The DE Division Of Corporations Fee Schedule can be utilized through various submission methods. Business owners may choose to file documents online, by mail, or in person at the Delaware Division of Corporations office. Online submissions are often the fastest method, while mail and in-person options may take longer due to processing times.

Quick guide on how to complete 2020 de division of corporations fee schedule

Complete DE Division Of Corporations Fee Schedule effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the correct template and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and eSign your documents quickly without interruptions. Manage DE Division Of Corporations Fee Schedule on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign DE Division Of Corporations Fee Schedule without any hassle

- Locate DE Division Of Corporations Fee Schedule and click on Get Form to begin.

- Use the tools we supply to complete your document.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign DE Division Of Corporations Fee Schedule and guarantee excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 de division of corporations fee schedule

Create this form in 5 minutes!

How to create an eSignature for the 2020 de division of corporations fee schedule

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is the DE Division Of Corporations Fee Schedule?

The DE Division Of Corporations Fee Schedule outlines the costs associated with filing various types of documents with the Delaware Division of Corporations. It includes fees for business entity formation, annual reports, and other services. Understanding these fees is crucial for businesses to budget effectively for their compliance needs.

-

How does airSlate SignNow simplify document signing related to the DE Division Of Corporations?

airSlate SignNow offers a streamlined process for electronic signatures that are compliant with the DE Division Of Corporations standards. This simplifies the way businesses handle their documents, eliminating the need for physical signatures and allowing for faster processing. By using airSlate SignNow, businesses can ensure they meet all legal requirements efficiently.

-

What types of documents can I eSign related to the DE Division Of Corporations Fee Schedule?

You can eSign various documents related to the DE Division Of Corporations Fee Schedule, including incorporation forms, annual reports, and amendments. airSlate SignNow provides customizable templates that help ensure all required fields are completed accurately. This enhances compliance and helps avoid additional fees related to filing errors.

-

Are there any subscription costs associated with using airSlate SignNow for DE Division Of Corporations filings?

Yes, while airSlate SignNow offers various pricing plans, they remain a cost-effective solution for handling your DE Division Of Corporations filings. Plans are tailored to different business needs, ensuring that you pay only for the features you use. It's advisable to review the pricing details on their website to choose a plan that best fits your requirements.

-

Can airSlate SignNow integrate with other tools to help manage DE Division Of Corporations tasks?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRM systems and accounting software. This integration facilitates a more cohesive workflow for managing your DE Division Of Corporations tasks, ensuring that all related documents are easily accessible and organized.

-

What are the benefits of using airSlate SignNow for DE Division Of Corporations filings?

Using airSlate SignNow for DE Division Of Corporations filings offers several benefits, including increased efficiency and reduced turnaround times. The platform enables electronic signatures, which speeds up the filing process signNowly. Additionally, the user-friendly interface ensures that businesses can easily comply with requirements outlined in the DE Division Of Corporations Fee Schedule.

-

Is there support available for businesses using airSlate SignNow for DE Division Of Corporations-related filings?

Yes, airSlate SignNow provides robust customer support to assist businesses with any queries related to DE Division Of Corporations filings. Their team is equipped to help users navigate the platform and ensure that all documents comply with the necessary standards. This support is invaluable for businesses eager to streamline their filing processes.

Get more for DE Division Of Corporations Fee Schedule

Find out other DE Division Of Corporations Fee Schedule

- How To Sign California Stock Certificate

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple

- How Do I Sign South Carolina Stock Certificate

- Sign New Hampshire Terms of Use Agreement Easy

- Sign Wisconsin Terms of Use Agreement Secure

- Sign Alabama Affidavit of Identity Myself

- Sign Colorado Trademark Assignment Agreement Online

- Can I Sign Connecticut Affidavit of Identity

- Can I Sign Delaware Trademark Assignment Agreement

- How To Sign Missouri Affidavit of Identity

- Can I Sign Nebraska Affidavit of Identity

- Sign New York Affidavit of Identity Now

- How Can I Sign North Dakota Affidavit of Identity

- Sign Oklahoma Affidavit of Identity Myself

- Sign Texas Affidavit of Identity Online

- Sign Colorado Affidavit of Service Secure

- Sign Connecticut Affidavit of Service Free