DIVISION of CORPORATIONS FEE SCHEDULE 2016

What is the DIVISION OF CORPORATIONS FEE SCHEDULE

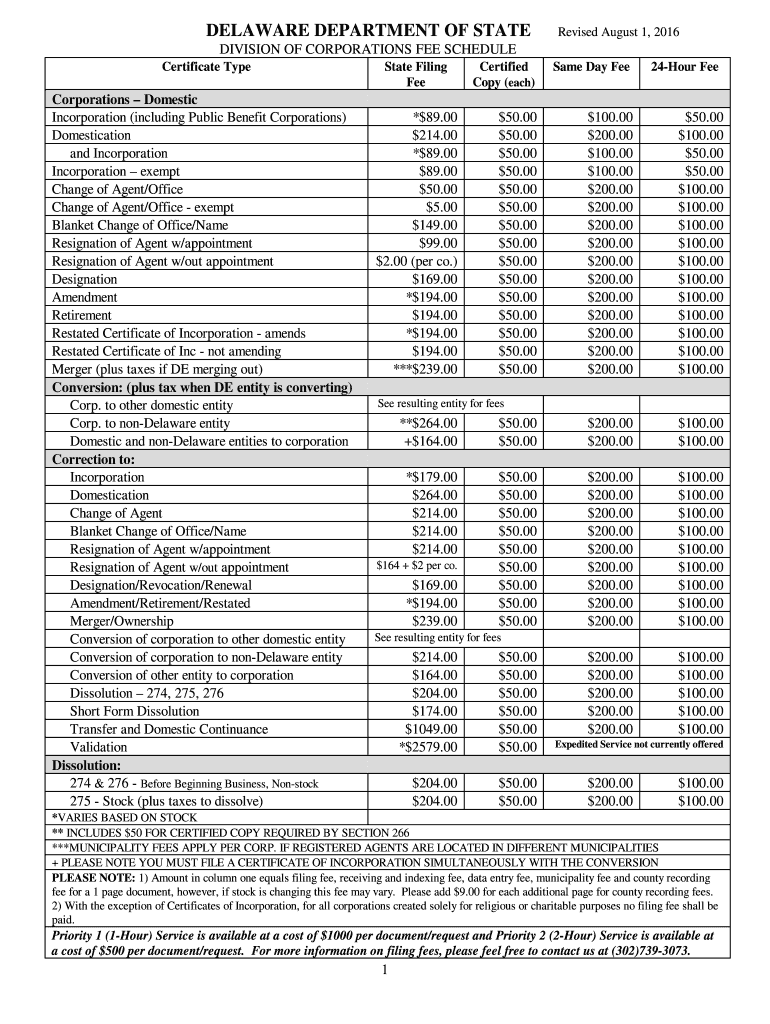

The Division of Corporations Fee Schedule outlines the various fees associated with the filing and maintenance of business entities in the United States. This schedule is essential for businesses, as it provides a clear understanding of the costs involved in registering, renewing, and maintaining corporate status. Fees may vary based on the type of entity, such as a corporation, limited liability company (LLC), or partnership, and can include initial filing fees, annual report fees, and penalties for late submissions.

How to use the DIVISION OF CORPORATIONS FEE SCHEDULE

Using the Division of Corporations Fee Schedule involves reviewing the specific fees applicable to your business entity type. Start by identifying your business structure, as fees differ for corporations, LLCs, and partnerships. Once you have this information, refer to the fee schedule to determine the exact amounts required for filing and renewal. It is also important to note any additional fees that may apply, such as expedited processing fees or fees for amendments to existing filings.

Steps to complete the DIVISION OF CORPORATIONS FEE SCHEDULE

Completing the Division of Corporations Fee Schedule requires several steps to ensure accurate submission. First, gather all necessary information about your business entity, including its name, type, and registration details. Next, calculate the applicable fees based on the fee schedule. After determining the total amount, prepare your payment method, which may include checks, credit cards, or electronic payments. Finally, submit the completed fee schedule along with any required forms to the appropriate state agency.

Legal use of the DIVISION OF CORPORATIONS FEE SCHEDULE

The legal use of the Division of Corporations Fee Schedule is crucial for compliance with state regulations governing business entities. Accurate completion and timely submission of the fee schedule help maintain good standing with the state, preventing penalties or administrative dissolution. Additionally, understanding the legal implications of the fees can aid in budgeting and financial planning for your business operations.

Required Documents

To complete the Division of Corporations Fee Schedule, certain documents are typically required. These may include:

- Business registration forms specific to your entity type.

- Proof of payment for the applicable fees.

- Any amendments or additional filings that may affect your fee structure.

Ensuring that all required documents are included with your submission is essential for processing your application without delays.

Form Submission Methods (Online / Mail / In-Person)

The Division of Corporations Fee Schedule can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online: Many states offer electronic filing options for convenience and speed.

- Mail: Physical submissions can be sent to the appropriate state office, typically requiring printed forms and payment.

- In-Person: Some businesses may prefer to submit their fee schedule directly at their local state office.

It is important to check your state’s specific requirements for submission methods to ensure compliance.

Quick guide on how to complete division of corporations fee schedule

Effortlessly Prepare DIVISION OF CORPORATIONS FEE SCHEDULE on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents promptly and without delays. Manage DIVISION OF CORPORATIONS FEE SCHEDULE across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign DIVISION OF CORPORATIONS FEE SCHEDULE With Ease

- Locate DIVISION OF CORPORATIONS FEE SCHEDULE and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign DIVISION OF CORPORATIONS FEE SCHEDULE to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct division of corporations fee schedule

Create this form in 5 minutes!

How to create an eSignature for the division of corporations fee schedule

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the DIVISION OF CORPORATIONS FEE SCHEDULE?

The DIVISION OF CORPORATIONS FEE SCHEDULE outlines the fees associated with registering and maintaining corporate entities. This schedule can vary based on the type of entity and services required. Understanding these fees is essential for compliance and financial planning for your business.

-

How can airSlate SignNow assist with managing the DIVISION OF CORPORATIONS FEE SCHEDULE?

airSlate SignNow simplifies the process of accessing and executing necessary documents related to the DIVISION OF CORPORATIONS FEE SCHEDULE. Our platform allows for efficient online document management, ensuring that you adhere to the fee schedule while saving time and reducing costs.

-

Are there any optional services related to the DIVISION OF CORPORATIONS FEE SCHEDULE?

Yes, there may be additional services related to the DIVISION OF CORPORATIONS FEE SCHEDULE, such as expedited processing or registered agent services. These services can enhance your business's compliance and operational efficiency. You can select these options based on your specific needs.

-

What features does airSlate SignNow offer that relate to the DIVISION OF CORPORATIONS FEE SCHEDULE?

airSlate SignNow provides features such as document templates and secure eSigning, which are invaluable when handling documents related to the DIVISION OF CORPORATIONS FEE SCHEDULE. These features ensure that your documents are correctly filled out and legally binding, streamlining compliance.

-

How does the pricing of airSlate SignNow compare to the DIVISION OF CORPORATIONS FEE SCHEDULE?

The pricing of airSlate SignNow is designed to be cost-effective and transparent, complementing the expenses outlined in the DIVISION OF CORPORATIONS FEE SCHEDULE. By using our service, businesses can save money on document management and signing processes, making it a smart investment.

-

Can I integrate airSlate SignNow with other accounting tools to manage the DIVISION OF CORPORATIONS FEE SCHEDULE?

Absolutely! airSlate SignNow offers integration capabilities with various accounting and business management tools. This integration helps simplify the management of the DIVISION OF CORPORATIONS FEE SCHEDULE, allowing for better tracking and organization of your fees and documents.

-

What benefits does airSlate SignNow provide when addressing the DIVISION OF CORPORATIONS FEE SCHEDULE?

Using airSlate SignNow when navigating the DIVISION OF CORPORATIONS FEE SCHEDULE offers numerous benefits, including increased efficiency, improved compliance, and enhanced security for your documents. Our platform ensures that you can manage your corporate obligations seamlessly and stress-free.

Get more for DIVISION OF CORPORATIONS FEE SCHEDULE

- 2014 battle of the books journal forms academy at the lakes

- Fbi release form

- Immunology amp allergy gleneagles hospital hong kong form

- Risk management 4th edition pdf form

- Dnv welding certificate issuing center form

- Covenant security claims form

- Subcontractor prequalification form corporation

- Service dog application form

Find out other DIVISION OF CORPORATIONS FEE SCHEDULE

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself