Us Dept of Education Approving Tax Offset Hardship Form

Understanding the Us Dept Of Education Approving Tax Offset Hardship

The Us Department of Education may approve a tax offset hardship for individuals facing financial difficulties. This approval allows borrowers to request a temporary suspension of tax refund offsets that would otherwise be applied to their student loan debts. The hardship determination is based on specific criteria, including income levels, family size, and other financial obligations. Understanding the eligibility requirements is crucial for those seeking relief from tax offsets due to financial status hardship.

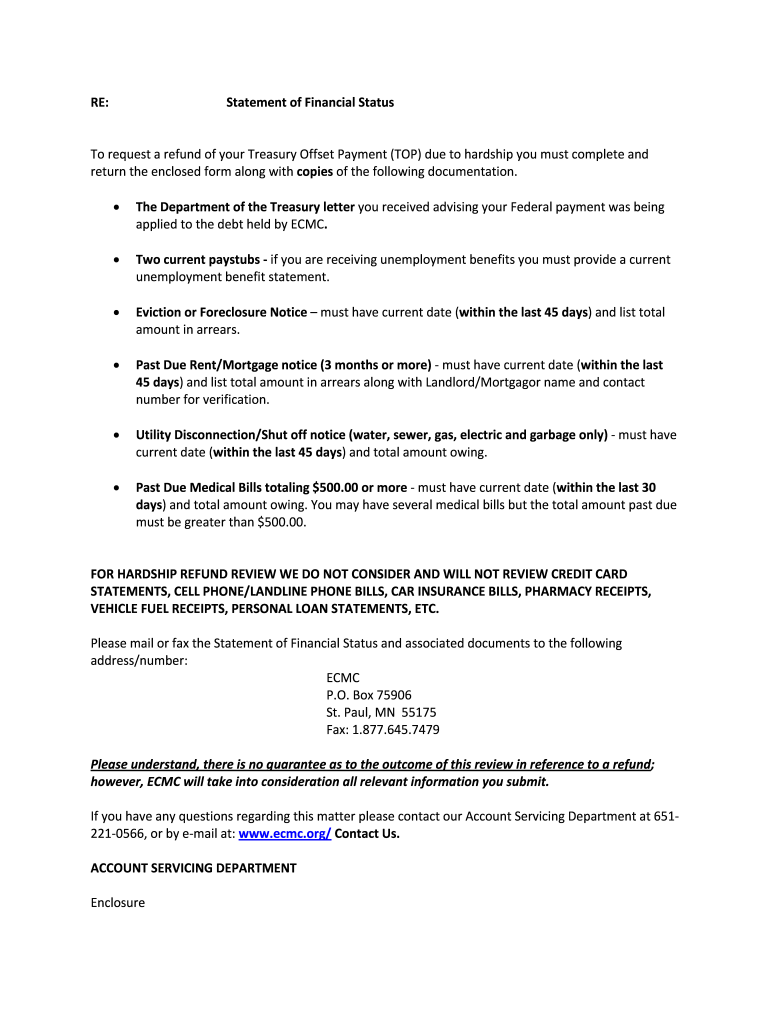

Steps to Complete the Us Dept Of Education Approving Tax Offset Hardship

Completing the process for obtaining approval for a tax offset hardship involves several key steps:

- Gather necessary documentation, including proof of income, tax returns, and any relevant financial statements.

- Fill out the financial status hardship form accurately, ensuring all information is current and complete.

- Submit the completed form along with supporting documents to the appropriate department within the Us Department of Education.

- Monitor the status of your application to ensure it is processed in a timely manner.

Eligibility Criteria for Tax Offset Hardship Approval

To qualify for tax offset hardship approval, applicants must meet specific eligibility criteria. These may include:

- Demonstrating a significant drop in income due to job loss, medical expenses, or other unforeseen circumstances.

- Providing evidence of financial obligations that exceed income, such as mortgage payments, medical bills, or childcare costs.

- Meeting income thresholds set by the Us Department of Education, which may vary based on family size and location.

Required Documents for Tax Offset Hardship Application

When applying for a tax offset hardship, it is essential to include the following documents:

- Current pay stubs or proof of income.

- Tax returns from the previous year.

- Documentation of any additional financial obligations, such as bills or loan statements.

- A completed financial status hardship form, which outlines your financial situation in detail.

Legal Use of the Us Dept Of Education Approving Tax Offset Hardship

The legal framework surrounding the tax offset hardship approval process ensures that individuals have the right to seek relief when facing financial distress. Borrowers must adhere to the guidelines set forth by the Us Department of Education, ensuring that all information provided is truthful and accurate. Misrepresentation or failure to comply with the application process may result in penalties or denial of the hardship request.

Form Submission Methods for Tax Offset Hardship

Applicants can submit their tax offset hardship forms through various methods, including:

- Online submission via the Us Department of Education's official website, which may offer a streamlined process for electronic applications.

- Mailing the completed form and supporting documents to the designated address provided by the department.

- In-person submission at local education offices, where applicants can receive assistance with the process.

Quick guide on how to complete financial status form

The simplest method to obtain and endorse Us Dept Of Education Approving Tax Offset Hardship

At the magnitude of a complete organization, ineffective workflows concerning document approval can consume a signNow amount of productive time. Endorsing documents such as Us Dept Of Education Approving Tax Offset Hardship is an inherent aspect of operations across all sectors, which is why the effectiveness of each contract’s lifecycle signNowly impacts the organization’s overall efficiency. With airSlate SignNow, endorsing your Us Dept Of Education Approving Tax Offset Hardship can be as straightforward and prompt as possible. You will discover on this platform the latest version of virtually any form. Even better, you can endorse it instantly without needing to install external software on your computer or printing physical copies.

Steps to obtain and endorse your Us Dept Of Education Approving Tax Offset Hardship

- Browse our collection by category or utilize the search bar to locate the form you require.

- View the form preview by clicking Learn more to confirm it is the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and include any required details using the toolbar.

- Once completed, click the Sign tool to endorse your Us Dept Of Education Approving Tax Offset Hardship.

- Select the signature method that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finish editing and move on to document-sharing options as necessary.

With airSlate SignNow, you possess everything required to manage your documents effectively. You can search, complete, modify, and even send your Us Dept Of Education Approving Tax Offset Hardship in one tab effortlessly. Enhance your methods by employing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How much does it cost to start a 501(c)3 in NYC?

According to the Department of State, Division of Corporations, State Records, and UCC for New York, you must pay the statutory filing fee of $75 (as of July 2017) along with a small fee to check name availability.Filling out your non-profit forms accurately is very, very important. Ultimately, what you put in your documents may affect whether you are (or will remain) tax-exempt. Now, with that being said, your state documents aren’t the only documents you must complete. You must also fill out an Application for Recognition of Exemption with the IRS. Some non-profits are eligible to fill out a streamlined version, but you should talk with an attorney or tax professional to determine which one you should complete.You may also be required to obtain certain permits or licenses in New York (at either the city or the state level). This depends on what your non-profit will do or sell in order to raise money. Without the right permits or licenses, your non-profit could be shut down.You also need to write bylaws and appoint directors to the non-profit. Directors are important and should be chosen with care. They make important business and financial decisions for your non-profit. They will also officially adopt the bylaws at the first board meeting. The bylaws explain how the non-profit will be ran.Because non-profits must remain in compliance with state and federal law, it’s a good idea to first speak with an attorney and maybe even consider allowing the attorney to fill out the documents. It’s really worth the price since the tax-exempt status of the non-profit can be affected by a mistake. If you’d like to speak with an experienced attorney, check out LawTrades. Our legal marketplace has helped connect many entrepreneurs with experienced, non-profit attorneys to get them up and running. Hope you give us a try!

-

How do I transfer an H1B visa to an F1?

So, you have three questions here. I am going to answer them in this order: how to do the change of status, whether you have to return to your country, and whether you’d be eligible to get an H-1B in the future.Change of status from H-1B to F-1For future readers, an H-1B is an employment visa. An employer sponsors someone who has (at least) a four-year degree to fill a position that the employer has open and cannot find an American citizen who has the right qualifications. An F-1 visa is a student visa.To change your status, you must file Form I-539. The thing to keep in mind here is that when you’re here on an F-1, you must have enough existing funds to support yourself during your stay. USCIS only allows extremely limited work options. In order for the USCIS to examine your financial ability to support yourself (and examine your petition), it’s going to take some time.Returning to your country and difficulty of changing statusNo, you do not have to return to your home country. Changing your status can take some time. You may have to do an interview. Your financial status will be examined. Your current H-1B would be void upon receiving the status change. So, based on the time it would take and what you would need to do to show your ability to self-support during your Master’s program, one could certainly consider that difficult. It is easier to do with the help of an immigration attorney.Getting another H-1B at the end of your studiesWhen you finish your Master’s program and if you can find an employer willing to sponsor you, yes you can get a second H-1B to finish out the time that you have left on your current H-1B.If you’d like to get help with your status transfer, consider LawTrades. Our legal marketplace has high-quality, vetted attorneys available to assist you. We offer things like affordable, transparent flat-fee pricing, end-to-end customer support and all projects are backed by a satisfaction guarantee. Hope you give us a visit!

-

How does one prove they cannot afford an attorney in seeking a public defender?

This is one where the respective Office of the Public Defender will state it’s policies regarding whether they will represent you or not. Do keep in mind that in many states you can use them even if you could ‘afford’ a private attorney (in reality, for most people, the legal fees are financially crushing, but then again, so is jail or prison and a criminal record), but you may be charged for their services. There’s nothing wrong with consulting with a private attorney (typically the initial interview is free or the fee is modest) to discuss the facts and what manner of representation is best for you.

-

How many people are in favour of ending the reservation quota system in india?

Dr. Babasaheb Ambedkar proposed reservation for a limited period for upliftment of lower caste community in India. Who knew then that this reservation policy will become a big tool of vote bank politics of 21st century.Who knew the upper caste who used to treat lower caste people as untouchables then, would one day fight for lower caste status.Yes i am against resrvation and let me explain in sequence of my life experience why i am against it.For more than 10 years all we school mates were good friends and none of us knew one of our freind ( infact my best friend) is a SC until we had to fill our SSC form where they specifically asked for Caste. It didnt change anything between us but why there was a need to seperate him out on the basis of caste.Then we passed 12th and then i realised the true colours of reservation. There were many friends of mine who scored above 90% in PCM and didnt get admission in Engineering and my SC friend got admission in best Engineering college by scoring around 70% in PCM. One of the brightest guy in our group was so dejected that he joined Merchant navy. How many great minds like him have we lost due to this idiotic reservation policiy? I propose let make it mandatory that all Political Leaders gets treated in India by SC/ST practitioners. Its not that i am questioning capabilities of an SC/ST practitioner but this move will expose these hypocrites who play caste politics.Lets remove the caste based vote bank policy once and for all. Remove caste column from all forms.Give financial aid and scholarship to all people below BPL.Ensure every tribal area has good schools atleast till 10th.This will give far better result within 10 years compared to what Reservation has given till now.

-

Why does Western Union hold funds?

There are several reasons for Western Union to hold funds:The first reason is because either the sender or receiver is on the “Specially Designated Nationals List” or SDN List the Department of Treasury and FBI maintain. They get put on this list for having ties to organized crime, terrorism, narcotics trade, fraud, perpetuating scams, etc. You can see the list here: Specially Designated Nationals List (SDN). If the sender or receiver is on the list, Western Union will hold the funds and are prohibited from paying it out and will refund the sender’s money. Don’t try using a different spelling of the name because if it comes close, they will block it and they also track where the person picks the money up too and sending it to another country to avoid the system won’t work.The second reason the money could be placed on hold is because of the amount of money being sent. Anything over $1,000 will be put on hold until the sender answers additional questions required by federal law to make sure the person isn’t being defrauded, scammed, or committing some sort of wire fraud or money laundering.Another reason the money can be placed on hold is if they suspect a sender or receiver of fraud or money laundering or some sort of financial crime. Agents will call in the suspected person to Western Union and put a block on the transaction and this will kick back the funds to whoever sent the money and they will put both the sender and receiver into the system, so having someone else sending the money won’t work.Western Union will also hold transactions when they see people sending or receiving multiple transactions to the same or different people trying to avoid filling out the 8300 form the IRS needs for senders or receivers to fill out when the transactions hit $10,000. A lot of people don’t want to fill that form out and once that happens, Western Union gets notified about that and so do a lot of the agents within that area that there is a customer going around possibly doing something criminal by doing small transactions to avoid filling out that form. The penalties for a person who refuses to fill this out is a fine of $250 or 10% of what they sent if they do not go back to the business and fill it out (plus the money will be held until it is filled out), a SARS report that will be filled out on both the sender and receiver, and/or jail time for both.The agent must have called the Western Union hotline on the individuals suspecting that there is something going on with the person (even though they could have declined the transaction).These are some of the reasons why Western Union will hold transactions.

-

How do you qualify for disability benefits?

In the US there are two forms of disability insurance I’m aware of.Private disability coverage from your employer either short or long term (STD or LTD)SSDI Social Security Disability IncomeFor private coverage the policies I’ve seen in 40+ years the requirement for LTD is that you can no longer perform your job and requires lots of documentation. STD has different rules that probably vary employer to employer and from state to state.SUGGESTION: If your firm offers you LTD make sure you pay the monthly fee which will result in any payments being non-taxable, if your employer pays it the payments will be taxed.If you are referring to SSDI - Social Security Disability Income the requirement is that you can’t perform any job. Yes - any job - it doesn’t matter if you are a highly skilled professional or uneducated: If you can perform a legal paying job, you’re not eligible.I know it sounds pretty difficult to meet this requirement but there are some additional considerations I’ve learnt about that may not be on SSA’s web site.All rely on having well documented problems in your doctors’ records. A former co-worker did not document his many issues at each doctor visit and was turned down by the private disability insurer despite hiring a more than competent advocate for his appeal.A fellow I know was at his doctor’s office every four weeks over several years and every time accurately wrote on his intake form “headaches, vision problems, pain from intense cramping, urinary urgency, can’t concentrate” and probably one or two more if they had occurred since his last visit.When the latter fellow applied for LTD (long term disability) from his employer, despite submitting about 200 pages of records, he was initially turned down. He luckily found (I’m not sure how) a former insurance firm employee who went over his records, noted the problems, called the insurer, and won coverage.At some point he applied for SSDI, spoke with a sympathetic staffer, and qualified for SSDI on his first try.If you apply for SSDI and get turned down, there are numerous attorneys who specialize in appealing SSA’s decision. Their fees are limited by law to some percentage of what they win.I am not a lawyer and the information I’ve provided is about 7 years old, things may have changed.

Create this form in 5 minutes!

How to create an eSignature for the financial status form

How to generate an electronic signature for your Financial Status Form online

How to generate an eSignature for the Financial Status Form in Chrome

How to create an eSignature for signing the Financial Status Form in Gmail

How to make an electronic signature for the Financial Status Form straight from your mobile device

How to make an electronic signature for the Financial Status Form on iOS

How to make an eSignature for the Financial Status Form on Android

People also ask

-

What is financial status hardship and how can airSlate SignNow assist?

Financial status hardship refers to situations where individuals or businesses face difficulties in meeting financial obligations. airSlate SignNow offers a cost-effective solution that simplifies document signing and management, making it easier to navigate financial challenges.

-

How does airSlate SignNow help in managing financial status hardship?

With airSlate SignNow, users can streamline their document workflows and automate repetitive tasks, which is crucial during times of financial status hardship. This allows businesses to save time and reduce costs, helping them focus on overcoming their financial challenges.

-

What pricing plans are available for airSlate SignNow, especially for those experiencing financial status hardship?

airSlate SignNow offers various pricing plans designed to fit different budgets, making it accessible even for those experiencing financial status hardship. You can choose a plan that suits your needs and try it free for 7 days to see how it can aid your business.

-

Are there any features in airSlate SignNow tailored for businesses facing financial status hardship?

Yes, airSlate SignNow includes features like bulk sending and in-person signing that are particularly beneficial for businesses facing financial status hardship. These features can signNowly speed up the process of getting documents signed and ease cash flow management.

-

Can airSlate SignNow integrate with other financial tools to manage status hardship better?

Absolutely! airSlate SignNow offers integrations with popular financial tools, allowing businesses to manage their documents and finances seamlessly. This integration can enhance efficiency, especially for those in financial status hardship, ensuring that all documentation is easily accessible.

-

How secure is airSlate SignNow for handling sensitive documents related to financial status hardship?

Security is a top priority for airSlate SignNow, employing advanced encryption and compliance standards to protect sensitive documents. This ensures that any financial status hardship-related documents remain confidential and secure throughout the signing process.

-

What customer support options are available for businesses dealing with financial status hardship?

airSlate SignNow provides extensive customer support options, including live chat and email assistance, tailored to help businesses navigate their challenges during financial status hardship. Our support team is ready to assist you in maximizing the platform to address your specific needs.

Get more for Us Dept Of Education Approving Tax Offset Hardship

Find out other Us Dept Of Education Approving Tax Offset Hardship

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy