Iowa Form IA 2440 Disability Income Exclusion 41 127 2020

What is the Iowa Form IA 2440 Disability Income Exclusion 41 127

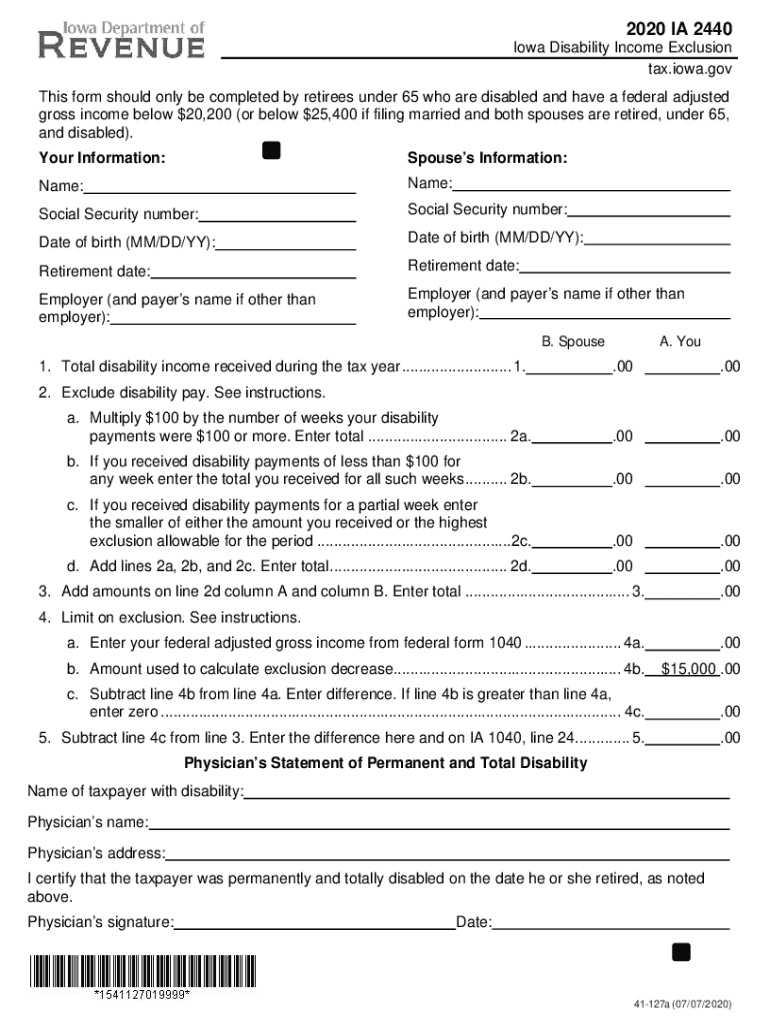

The Iowa Form IA 2440 Disability Income Exclusion 41 127 is a state tax form designed for individuals who receive disability income. This form allows eligible taxpayers to exclude a portion of their disability income from state taxation, thereby reducing their overall taxable income. The exclusion is particularly beneficial for those who rely on disability benefits as their primary source of income, providing financial relief and ensuring that individuals are not overly burdened by state taxes.

How to use the Iowa Form IA 2440 Disability Income Exclusion 41 127

Using the Iowa Form IA 2440 involves several straightforward steps. First, ensure that you meet the eligibility criteria for the disability income exclusion. Next, gather all necessary documentation related to your disability income, including any relevant statements or benefit letters. Complete the form by accurately entering your personal information, the amount of disability income received, and any other required details. Finally, submit the form according to the instructions provided, ensuring that you keep a copy for your records.

Steps to complete the Iowa Form IA 2440 Disability Income Exclusion 41 127

Completing the Iowa Form IA 2440 requires careful attention to detail. Begin by downloading the form from the appropriate state resources. Fill in your name, address, and Social Security number at the top of the form. Next, report your total disability income for the year in the designated section. Be sure to include any supporting documentation that verifies your income. Finally, review the completed form for accuracy and sign it before submission. It is advisable to keep a copy of the form and any attachments for your records.

Eligibility Criteria

To qualify for the Iowa Form IA 2440 Disability Income Exclusion, individuals must meet specific eligibility criteria. Generally, the taxpayer must be receiving disability income from a qualifying source, such as Social Security Disability Insurance (SSDI) or other state-sponsored disability programs. Additionally, the taxpayer must be a resident of Iowa and must not have exceeded the income limits set by the state for the exclusion to apply. It is important to review the latest guidelines to ensure compliance with the eligibility requirements.

Legal use of the Iowa Form IA 2440 Disability Income Exclusion 41 127

The Iowa Form IA 2440 is legally recognized as a valid document for tax purposes when filled out correctly. To ensure legal compliance, it is essential to follow all instructions provided by the Iowa Department of Revenue. The form must be submitted within the designated filing periods to avoid penalties. Additionally, using a reliable electronic signature service can enhance the legitimacy of the submission, ensuring that all signatures are valid and compliant with state eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Iowa Form IA 2440 Disability Income Exclusion are typically aligned with the state income tax return deadlines. Taxpayers should be aware of the annual tax filing deadline, which is usually April 30 for individual income tax returns. It is advisable to check for any updates or changes to deadlines each tax year, as these can affect the timely submission of the form and the eligibility for the exclusion.

Quick guide on how to complete iowa form ia 2440 disability income exclusion 41 127

Effortlessly Prepare Iowa Form IA 2440 Disability Income Exclusion 41 127 on Any Device

Managing documents online has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow offers all the tools you need to create, edit, and electronically sign your documents swiftly without any delays. Handle Iowa Form IA 2440 Disability Income Exclusion 41 127 on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related tasks today.

The Simplest Way to Edit and eSign Iowa Form IA 2440 Disability Income Exclusion 41 127 with Ease

- Obtain Iowa Form IA 2440 Disability Income Exclusion 41 127 and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with the tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the information and click on the Done button to preserve your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or via an invitation link, or download it to your computer.

Put an end to lost or mislaid files, tedious form searching, and the errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign Iowa Form IA 2440 Disability Income Exclusion 41 127 while ensuring excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iowa form ia 2440 disability income exclusion 41 127

Create this form in 5 minutes!

How to create an eSignature for the iowa form ia 2440 disability income exclusion 41 127

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is Iowa Form IA 2440 Disability Income Exclusion 41 127?

Iowa Form IA 2440 Disability Income Exclusion 41 127 is a form used by residents of Iowa to claim an exclusion for certain disability income on their state tax return. This form allows eligible individuals to reduce their taxable income, leading to potential savings. It’s essential for taxpayers to understand this form to maximize their benefits.

-

Who needs to file Iowa Form IA 2440 Disability Income Exclusion 41 127?

Individuals receiving disability benefits in Iowa may need to file Iowa Form IA 2440 Disability Income Exclusion 41 127. Specifically, those who wish to claim an exclusion on their state income tax should consider this form. Filing correctly is crucial for ensuring eligible benefits are not missed.

-

How do I complete Iowa Form IA 2440 Disability Income Exclusion 41 127?

Completing Iowa Form IA 2440 Disability Income Exclusion 41 127 involves gathering your disability income information and filling out the required sections of the form accurately. It's essential to follow the instructions provided to ensure your claim is processed efficiently. For additional assistance, consulting a tax professional can be beneficial.

-

What types of income are excluded under Iowa Form IA 2440 Disability Income Exclusion 41 127?

Under Iowa Form IA 2440 Disability Income Exclusion 41 127, specific disability-related income is excluded, such as Social Security Disability benefits and long-term disability insurance. Knowing which types of income qualify can help taxpayers maximize their exclusions and reduce their overall tax burden in Iowa.

-

What are the benefits of using airSlate SignNow for documents related to Iowa Form IA 2440 Disability Income Exclusion 41 127?

Using airSlate SignNow allows users to efficiently manage and eSign documents related to Iowa Form IA 2440 Disability Income Exclusion 41 127. The platform streamlines the document workflow, making it easy to send, sign, and store important tax forms securely. This convenience is especially helpful during tax season.

-

Is there a cost associated with filing Iowa Form IA 2440 Disability Income Exclusion 41 127?

Filing Iowa Form IA 2440 Disability Income Exclusion 41 127 itself does not involve a direct fee, but potential costs may arise from tax preparation services. Utilizing airSlate SignNow may incur fees based on the subscription chosen, but it provides a cost-effective solution for managing all your document needs diligently and securely.

-

Can Iowa Form IA 2440 Disability Income Exclusion 41 127 be submitted electronically?

Yes, Iowa Form IA 2440 Disability Income Exclusion 41 127 can be submitted electronically, depending on the tax software used. Many taxpayers choose to file their Iowa forms through electronic means for convenience. Integrating airSlate SignNow can facilitate the electronic signing and submission processes, making tax filing straightforward.

Get more for Iowa Form IA 2440 Disability Income Exclusion 41 127

Find out other Iowa Form IA 2440 Disability Income Exclusion 41 127

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word