IA 2440 Disability Income Exclusion, 41 127 Tax Iowa Gov 2021

What is the Iowa Disability Income Exclusion?

The Iowa Disability Income Exclusion is a tax provision that allows qualifying individuals to exclude a portion of their disability income from state income taxes. This exclusion is designed to provide financial relief to those who are unable to work due to a disability. The specific amount that can be excluded may vary based on the individual's circumstances and the type of disability income received. Understanding this exclusion is essential for individuals who rely on disability benefits as it can significantly impact their overall tax liability.

Eligibility Criteria for the Iowa Disability Income Exclusion

To qualify for the Iowa Disability Income Exclusion, individuals must meet specific criteria. Generally, applicants must be residents of Iowa and receive disability income from a qualifying source, such as Social Security Disability Insurance (SSDI) or private disability insurance. Additionally, the individual must provide documentation proving their disability status. It is important to review the eligibility requirements carefully to ensure compliance and maximize the benefits of the exclusion.

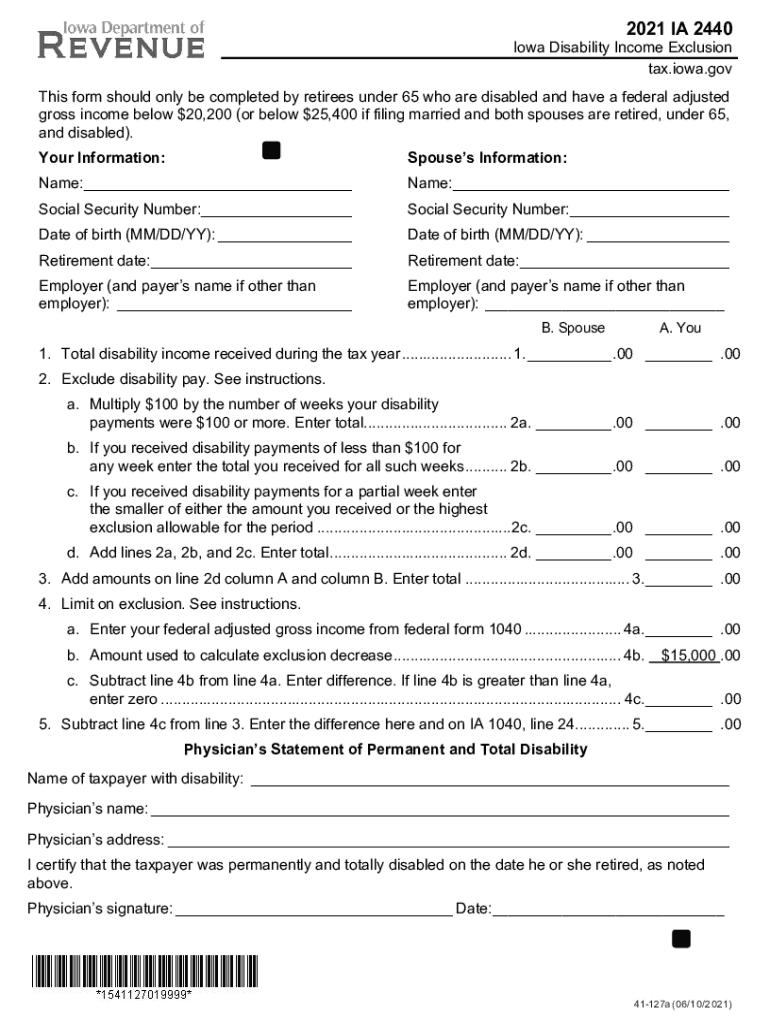

Steps to Complete the Iowa Disability Income Exclusion Form

Completing the Iowa Disability Income Exclusion form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of disability and income statements. Next, fill out the IA 2440 form accurately, ensuring that all required fields are completed. After completing the form, review it for any errors or omissions. Finally, submit the form to the appropriate state tax authority by the designated deadline. Properly following these steps can help avoid delays or issues with tax processing.

Required Documents for the Iowa Disability Income Exclusion

When applying for the Iowa Disability Income Exclusion, individuals must provide certain documentation to support their application. Key documents typically include:

- Proof of disability status, such as a Social Security award letter or medical documentation.

- Income statements detailing the amount of disability income received.

- Completed IA 2440 form with all required information filled out.

Having these documents ready can facilitate a smoother application process and ensure that all necessary information is available for review.

Legal Use of the Iowa Disability Income Exclusion

The Iowa Disability Income Exclusion is legally recognized under state tax law, allowing eligible individuals to benefit from this provision. It is crucial for applicants to understand the legal framework surrounding this exclusion to ensure compliance with all regulations. Misrepresentation or failure to provide accurate information can lead to penalties or denial of the exclusion. Therefore, individuals should take care to follow all legal guidelines when applying for and using this exclusion.

Filing Deadlines for the Iowa Disability Income Exclusion

Filing deadlines for the Iowa Disability Income Exclusion are important to note to avoid penalties. Typically, individuals must submit their tax returns, including the IA 2440 form, by the state’s income tax deadline, which is usually April 30th of each year. However, if additional time is needed, individuals may request an extension. It is advisable to stay informed about any changes to deadlines to ensure timely submission and compliance with state tax laws.

Quick guide on how to complete ia 2440 disability income exclusion 41 127 taxiowagov

Easily Prepare IA 2440 Disability Income Exclusion, 41 127 Tax iowa gov on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage IA 2440 Disability Income Exclusion, 41 127 Tax iowa gov on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Effortlessly Edit and eSign IA 2440 Disability Income Exclusion, 41 127 Tax iowa gov

- Locate IA 2440 Disability Income Exclusion, 41 127 Tax iowa gov and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method for sharing your form—by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign IA 2440 Disability Income Exclusion, 41 127 Tax iowa gov to ensure excellent communication throughout the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ia 2440 disability income exclusion 41 127 taxiowagov

Create this form in 5 minutes!

How to create an eSignature for the ia 2440 disability income exclusion 41 127 taxiowagov

The way to generate an e-signature for a PDF online

The way to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The way to generate an e-signature right from your smartphone

The way to create an e-signature for a PDF on iOS

The way to generate an e-signature for a PDF on Android

People also ask

-

What is the Iowa disability income exclusion?

The Iowa disability income exclusion refers to specific tax benefits available to individuals with disabilities in Iowa. This exclusion allows eligible taxpayers to exclude a portion of their disability income from state income taxes, effectively reducing their overall tax liability. Understanding how this works can help you maximize your benefits and savings.

-

Who qualifies for the Iowa disability income exclusion?

To qualify for the Iowa disability income exclusion, individuals must have a disability that meets Iowa's legal definition and be receiving qualifying disability income. This often includes Social Security disability benefits or other defined income sources recognized by the state. It's important to verify your eligibility to take full advantage of this exclusion.

-

How can airSlate SignNow assist with documents related to the Iowa disability income exclusion?

airSlate SignNow provides a user-friendly platform for efficiently sending and eSigning documents that may be necessary for the Iowa disability income exclusion process. Whether submitting applications or supporting documents, our solution streamlines the workflow, ensuring a secure and timely completion. This makes managing your paperwork easier and more efficient.

-

Are there any fees associated with using airSlate SignNow for the Iowa disability income exclusion documents?

airSlate SignNow offers a variety of pricing plans, ensuring flexibility for all users. Whether you are a solo user or part of a larger organization handling Iowa disability income exclusion documentation, you can find a plan that fits your budget. Additionally, our cost-effective solution includes features that justify the investment.

-

What features does airSlate SignNow offer that are beneficial for Iowa disability claims?

With airSlate SignNow, you can enjoy features such as customizable templates, reminders, and a secure signing process, which are particularly beneficial for managing Iowa disability claims. These tools ensure that your documents are accurately completed and submitted on time, optimizing the process for any disability income exclusion needs. Enhanced automation and tracking further streamline the experience.

-

Can airSlate SignNow integrate with other platforms to support Iowa disability income exclusion needs?

Yes, airSlate SignNow integrates with a range of platforms and applications, enhancing your ability to manage documents related to the Iowa disability income exclusion. Whether it's syncing with your email, storage systems, or other tools you use, our integrations make it easy to connect your workflow and access all necessary resources. This can signNowly enhance efficiency.

-

What are the benefits of using electronic signatures for the Iowa disability income exclusion process?

Using electronic signatures for the Iowa disability income exclusion process offers numerous benefits, including increased efficiency and security. Electronic signatures streamline the submission of necessary documents, reducing processing time compared to traditional methods. Additionally, they provide a secure way to sign sensitive documents, ensuring the integrity of your claims.

Get more for IA 2440 Disability Income Exclusion, 41 127 Tax iowa gov

- Guardian ad litem 497314364 form

- Undivided interest property form

- Undivided interest property 497314366 form

- Motion to remove conservator and to set aside conservatorship or in the alternative to have another named as conservator form

- Petition funds 497314368 form

- Order to allow the withdrawal of funds mississippi form

- Advance healthcare directive mississippi form

- Complaint mississippi 497314371 form

Find out other IA 2440 Disability Income Exclusion, 41 127 Tax iowa gov

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document