Printable Kentucky Form 2210 K Underpayment of Estimated Tax by Individuals 2020

Understanding the Kentucky Form 2210 K for Underpayment of Estimated Tax

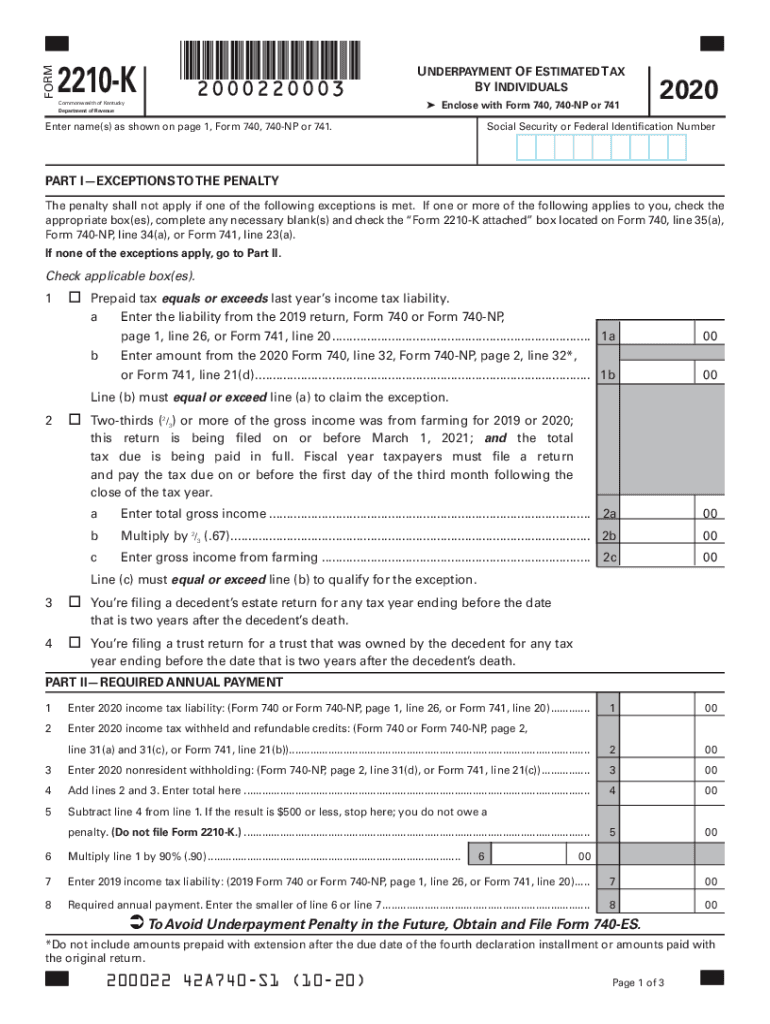

The Kentucky Form 2210 K is specifically designed for individuals who may not have paid enough estimated tax throughout the year. This form helps taxpayers determine if they owe a penalty for underpayment of estimated taxes. It is essential for individuals who have income that is not subject to withholding, such as self-employment income, rental income, or investment income. Understanding the purpose of this form is crucial for ensuring compliance with state tax laws and avoiding potential penalties.

Steps to Complete the Kentucky Form 2210 K

Completing the Kentucky Form 2210 K requires careful attention to detail. Here are the steps involved:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Calculate your total estimated tax liability for the year.

- Determine the amount of estimated tax you have already paid.

- Use the form's worksheet to calculate any potential penalty for underpayment.

- Complete the form by filling in your personal information and the calculated amounts.

- Review the form for accuracy before submission.

Legal Use of the Kentucky Form 2210 K

The Kentucky Form 2210 K is legally recognized for assessing penalties related to underpayment of estimated taxes. To ensure its legal validity, it must be completed accurately and submitted by the appropriate deadlines. Compliance with state tax regulations is vital, as failure to file or inaccuracies can result in penalties. Utilizing the form correctly helps maintain good standing with the Kentucky Department of Revenue.

Filing Deadlines for the Kentucky Form 2210 K

Timely filing of the Kentucky Form 2210 K is essential to avoid penalties. The form is generally due on the same date as your annual tax return, which is typically April 15. However, if you file for an extension, the deadline may be extended to October 15. It is important to stay informed about any changes to these deadlines to ensure compliance.

Obtaining the Kentucky Form 2210 K

The Kentucky Form 2210 K can be obtained through the Kentucky Department of Revenue's official website. It is available in a printable format, allowing taxpayers to easily access and complete the form. Additionally, many tax preparation software programs include the form, facilitating electronic filing options.

Key Elements of the Kentucky Form 2210 K

Several key elements are included in the Kentucky Form 2210 K, which are essential for accurate completion:

- Personal information, including name, address, and Social Security number.

- Details of estimated tax payments made during the year.

- Calculations related to the total tax liability and any penalties.

- Signature and date to certify the accuracy of the information provided.

Quick guide on how to complete printable 2020 kentucky form 2210 k underpayment of estimated tax by individuals

Finalize Printable Kentucky Form 2210 K Underpayment Of Estimated Tax By Individuals seamlessly on any device

Digital document management has become favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely archive it online. airSlate SignNow offers you all the tools required to generate, update, and electronically sign your documents swiftly without interruptions. Manage Printable Kentucky Form 2210 K Underpayment Of Estimated Tax By Individuals on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

Ways to modify and electronically sign Printable Kentucky Form 2210 K Underpayment Of Estimated Tax By Individuals effortlessly

- Obtain Printable Kentucky Form 2210 K Underpayment Of Estimated Tax By Individuals and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes moments and holds the same legal significance as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form: via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about missing or lost files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Printable Kentucky Form 2210 K Underpayment Of Estimated Tax By Individuals and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 kentucky form 2210 k underpayment of estimated tax by individuals

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 kentucky form 2210 k underpayment of estimated tax by individuals

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is form 2210 k and why is it important?

Form 2210 k is a crucial IRS form used by taxpayers to calculate any penalties for underpayment of estimated tax. Understanding this form is important for compliance with tax regulations and to avoid potential fines. It provides a way to determine if you owe additional taxes or if you're eligible for a penalty waiver.

-

How can airSlate SignNow assist with filling out form 2210 k?

airSlate SignNow simplifies the process of filling out form 2210 k by providing easy-to-use templates and electronic signature options. Users can efficiently complete and eSign the form, ensuring accuracy and facilitating timely submission. This streamlines the tax process, saving valuable time.

-

Is there a cost associated with using airSlate SignNow for form 2210 k?

airSlate SignNow offers a cost-effective solution for managing form 2210 k and other documents. Pricing plans are designed to cater to various business sizes and needs, ensuring affordability. You can try the service with a free trial before committing to a subscription.

-

What features does airSlate SignNow provide for form 2210 k management?

airSlate SignNow includes features such as document templates, automated workflows, and secure cloud storage specifically for form 2210 k. These features enhance organization and facilitate easy access and sharing of documents. Additionally, the platform's tracking capabilities provide insights into the signing process.

-

Can I integrate airSlate SignNow with other tools while working on form 2210 k?

Yes, airSlate SignNow supports seamless integrations with various third-party applications to enhance your workflow while managing form 2210 k. This includes integrations with popular accounting software, CRMs, and cloud storage solutions. These connections ensure you can efficiently align all your business processes.

-

How secure is my information when using airSlate SignNow for form 2210 k?

Security is a top priority at airSlate SignNow, particularly when handling sensitive information related to form 2210 k. The platform uses state-of-the-art encryption and complies with industry standards to protect your documents and data. Regular security audits also ensure robust protection for all users.

-

Can I access my form 2210 k documents from anywhere?

Absolutely! airSlate SignNow allows you to access your form 2210 k documents from any device with internet connectivity. This cloud-based solution ensures that you can manage your documents on-the-go, whether you're in the office or traveling. It promotes flexibility and efficiency in tracking your tax-related paperwork.

Get more for Printable Kentucky Form 2210 K Underpayment Of Estimated Tax By Individuals

Find out other Printable Kentucky Form 2210 K Underpayment Of Estimated Tax By Individuals

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure