Form 2210 Underpayment of Estimated Tax by Individuals, Estates and Trusts 2022

What is the Form 2210 Underpayment Of Estimated Tax By Individuals, Estates And Trusts

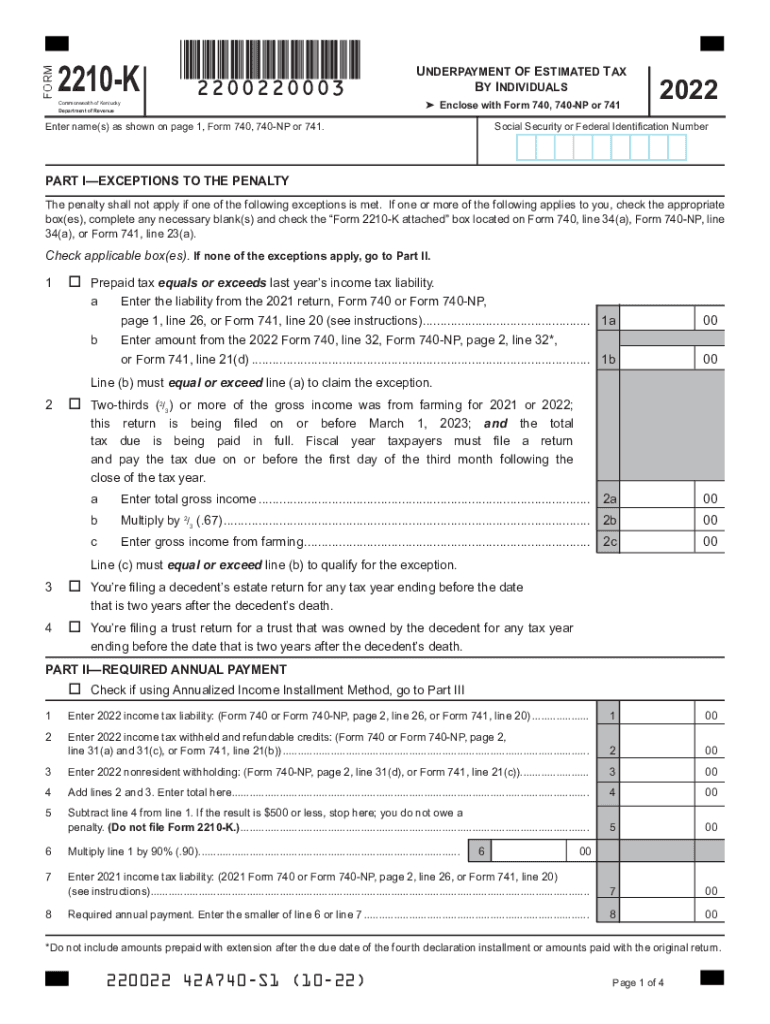

The 2210 k tax form is designed for individuals, estates, and trusts to report underpayment of estimated taxes. This form is essential for taxpayers who did not pay enough tax throughout the year, either through withholding or estimated tax payments. It helps in calculating any penalties for underpayment and determining the correct amount owed to the state. Understanding this form is crucial for compliance with tax obligations and avoiding unnecessary penalties.

How to use the Form 2210 Underpayment Of Estimated Tax By Individuals, Estates And Trusts

Using the 2210 k tax form involves several steps. First, gather all necessary financial information, including income and tax payments made throughout the year. Next, determine if you owe any underpayment penalties by comparing your total tax liability with the amount paid. The form provides a detailed calculation to help you assess your situation. Once completed, you can submit the form along with your tax return to the appropriate tax authority.

Steps to complete the Form 2210 Underpayment Of Estimated Tax By Individuals, Estates And Trusts

Completing the 2210 k tax form requires careful attention to detail. Follow these steps:

- Start by entering your personal information, including your name and Social Security number.

- Calculate your total tax liability for the year.

- Document any estimated tax payments made throughout the year.

- Determine if you meet the safe harbor provisions to avoid penalties.

- Complete the penalty calculation section if applicable.

- Review your form for accuracy before submission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the 2210 k tax form. Generally, the form must be submitted by the tax return due date, which is typically April 15 for individuals. If you are filing for an extension, ensure that the 2210 k is submitted along with your extended return. Keeping track of these dates helps in avoiding late penalties and interest charges.

Penalties for Non-Compliance

Failing to file the 2210 k tax form or underpaying estimated taxes can result in penalties. The IRS imposes a penalty based on the amount of underpayment and the period it remains unpaid. Understanding these penalties is crucial for taxpayers to ensure compliance and avoid unnecessary financial burdens. It is advisable to consult with a tax professional if you are unsure about your obligations.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 2210 k tax form. These guidelines outline eligibility criteria, calculation methods, and documentation requirements. Familiarizing yourself with these guidelines ensures that you fill out the form correctly and meet all necessary compliance standards. It is recommended to refer to the latest IRS publications for detailed instructions.

Quick guide on how to complete form 2210 underpayment of estimated tax by individuals estates and trusts

Complete Form 2210 Underpayment Of Estimated Tax By Individuals, Estates And Trusts effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 2210 Underpayment Of Estimated Tax By Individuals, Estates And Trusts on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and eSign Form 2210 Underpayment Of Estimated Tax By Individuals, Estates And Trusts with ease

- Obtain Form 2210 Underpayment Of Estimated Tax By Individuals, Estates And Trusts and click Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that task.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and hit the Done button to save your changes.

- Select how you want to share your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 2210 Underpayment Of Estimated Tax By Individuals, Estates And Trusts and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2210 underpayment of estimated tax by individuals estates and trusts

Create this form in 5 minutes!

People also ask

-

What is the 2210 k tax form, and why is it important?

The 2210 k tax form is a crucial document for taxpayers who need to report their underpayment of estimated taxes. Understanding this form helps you avoid penalties and ensures compliance with the IRS guidelines. airSlate SignNow can help you eSign and send this form effortlessly.

-

How can airSlate SignNow assist with completing the 2210 k tax form?

airSlate SignNow offers a user-friendly platform to easily fill out and eSign the 2210 k tax form. With its intuitive interface, you can complete your tax documents swiftly, ensuring accuracy and efficiency in your submissions. Our tool simplifies the process of managing your tax forms.

-

What features does airSlate SignNow offer for managing the 2210 k tax form?

With airSlate SignNow, you gain access to features like customizable templates, electronic signatures, and document storage for your 2210 k tax form. These features streamline your workflow, reduce paperwork, and provide you with a secure way to manage your tax documents. Efficiency is at the forefront of our platform.

-

Is there a cost associated with using airSlate SignNow for the 2210 k tax form?

Yes, airSlate SignNow provides various pricing plans to cater to different business needs while ensuring a cost-effective solution for managing your 2210 k tax form. You can choose a plan that aligns with your usage and budget requirements. We also offer a free trial to help you explore our features.

-

Can I integrate airSlate SignNow with other applications for handling the 2210 k tax form?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive and Microsoft Office, making it easier to manage your 2210 k tax form alongside other documents. This means you can streamline your workflow and enhance productivity with our powerful integrations.

-

What are the benefits of using airSlate SignNow for tax forms like the 2210 k?

Using airSlate SignNow for the 2210 k tax form saves you time and reduces the risk of errors. Our platform ensures your documents are securely stored and easily accessible, facilitating quick revisions and compliance. With electronic signatures, you can expedite the submission process and improve overall efficiency.

-

How secure is my data when I use airSlate SignNow to complete the 2210 k tax form?

Data security is a priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your sensitive information when completing the 2210 k tax form. You can confidently manage your tax documents, knowing that your data is safeguarded.

Get more for Form 2210 Underpayment Of Estimated Tax By Individuals, Estates And Trusts

Find out other Form 2210 Underpayment Of Estimated Tax By Individuals, Estates And Trusts

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself