KY Form 2210 K Fill and Sign Printable Template 2023-2026

What is the KY Form 2210 K Fill And Sign Printable Template

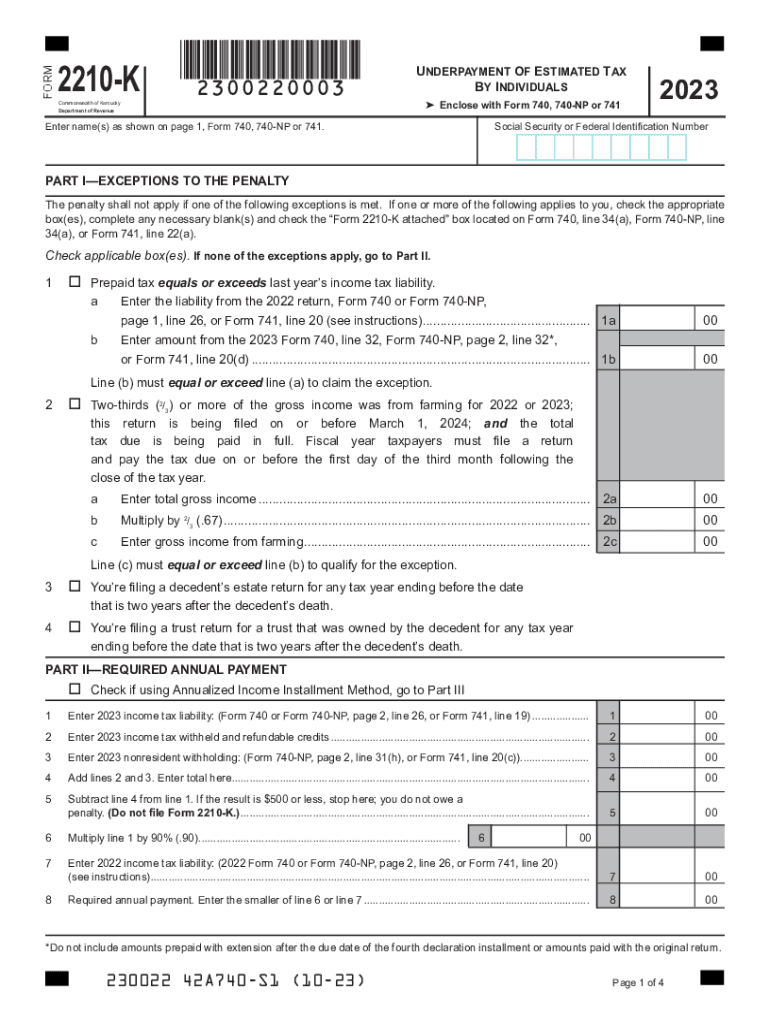

The KY Form 2210 K is a tax form used by Kentucky residents to calculate underpayment penalties for state income taxes. This form is essential for individuals who did not pay enough tax throughout the year, either through withholding or estimated payments. It helps determine if a penalty applies and the amount owed. The fillable and printable template allows taxpayers to complete the form digitally, ensuring accuracy and ease of submission.

How to use the KY Form 2210 K Fill And Sign Printable Template

Using the KY Form 2210 K template involves several straightforward steps. First, download the fillable PDF from a reliable source. Open the document in a PDF reader that supports form filling. Enter your personal information, including your name, address, and Social Security number. Next, input your income details and any tax payments made during the year. The form will automatically calculate any penalties based on the information provided. Once completed, you can sign the document electronically, ensuring it is ready for submission.

Steps to complete the KY Form 2210 K Fill And Sign Printable Template

Completing the KY Form 2210 K involves a series of steps:

- Download the form from a trusted source.

- Open the form in a compatible PDF reader.

- Fill in your personal details, including your name and Social Security number.

- Provide your total income and any estimated tax payments made.

- Review the calculated penalties, if applicable.

- Sign the form electronically or print it for a handwritten signature.

- Submit the completed form to the Kentucky Department of Revenue.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the KY Form 2210 K. Generally, the form must be submitted by the same deadline as your state income tax return, which is typically April 15 for most taxpayers. If you are unable to file by this date, you may apply for an extension, but any taxes owed must still be paid by the original deadline to avoid additional penalties.

Penalties for Non-Compliance

Failure to file the KY Form 2210 K when required can result in penalties imposed by the Kentucky Department of Revenue. These penalties may include fines based on the amount of underpayment and the duration of the underpayment period. It is essential to accurately complete and submit the form to avoid these financial repercussions. Understanding the implications of non-compliance can help taxpayers manage their tax obligations effectively.

Examples of using the KY Form 2210 K Fill And Sign Printable Template

There are various scenarios where the KY Form 2210 K may be applicable. For instance, a self-employed individual who did not make sufficient estimated tax payments throughout the year may need to file this form to calculate any penalties. Similarly, a taxpayer who received a significant bonus or other income that was not subject to withholding might also find this form necessary to determine if they owe any penalties for underpayment. Each situation requires careful consideration of income and tax payments made to ensure compliance.

Quick guide on how to complete ky form 2210 k fill and sign printable template

Effortlessly prepare KY Form 2210 K Fill And Sign Printable Template on any gadget

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed files, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the resources required to generate, modify, and eSign your documents quickly without delays. Handle KY Form 2210 K Fill And Sign Printable Template on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to adjust and eSign KY Form 2210 K Fill And Sign Printable Template effortlessly

- Find KY Form 2210 K Fill And Sign Printable Template and click Get Form to initiate.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specially designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to preserve your changes.

- Select your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign KY Form 2210 K Fill And Sign Printable Template and guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ky form 2210 k fill and sign printable template

Create this form in 5 minutes!

How to create an eSignature for the ky form 2210 k fill and sign printable template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 2210 worksheet, and who needs it?

The form 2210 worksheet is a tool used by taxpayers to determine if they owe a penalty for underpayment of estimated taxes. It's essential for individuals whose income fluctuates signNowly throughout the year, to ensure they meet their tax obligations without incurring penalties.

-

How do I access the form 2210 worksheet?

You can access the form 2210 worksheet through the IRS website or various tax preparation software that includes digital forms. Additionally, airSlate SignNow offers a seamless experience for filling out and eSigning the form 2210 worksheet electronically, making the process more efficient.

-

What features does airSlate SignNow offer for the form 2210 worksheet?

AirSlate SignNow provides a user-friendly interface that allows you to easily fill out, edit, and eSign the form 2210 worksheet. With features like cloud storage, secure sharing, and customizable templates, you can manage your tax documents effortlessly.

-

Is there a cost associated with using airSlate SignNow for the form 2210 worksheet?

Yes, airSlate SignNow offers various pricing plans tailored for different needs, which can include the use of the form 2210 worksheet. It's a cost-effective solution that caters to both individual users and businesses wishing to streamline their document management process.

-

Can I integrate airSlate SignNow with other software while working on my form 2210 worksheet?

Absolutely! AirSlate SignNow offers integrations with numerous applications, including popular accounting and tax software. This allows users to seamlessly incorporate the form 2210 worksheet into their existing workflow.

-

What are the benefits of using airSlate SignNow for my tax documents?

Using airSlate SignNow for your tax documents, including the form 2210 worksheet, provides enhanced security, ease of use, and quick document turnaround. The platform ensures your sensitive information is protected while allowing you to manage your taxes efficiently.

-

How secure is the airSlate SignNow platform for handling the form 2210 worksheet?

AirSlate SignNow prioritizes security with bank-level encryption and compliance with data protection regulations. This ensures that your form 2210 worksheet and other documents are kept safe from unauthorized access.

Get more for KY Form 2210 K Fill And Sign Printable Template

Find out other KY Form 2210 K Fill And Sign Printable Template

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself