New York Form it 59 Tax Forgiveness for Victims of the

What is the New York Form IT 59 Tax Forgiveness For Victims Of The

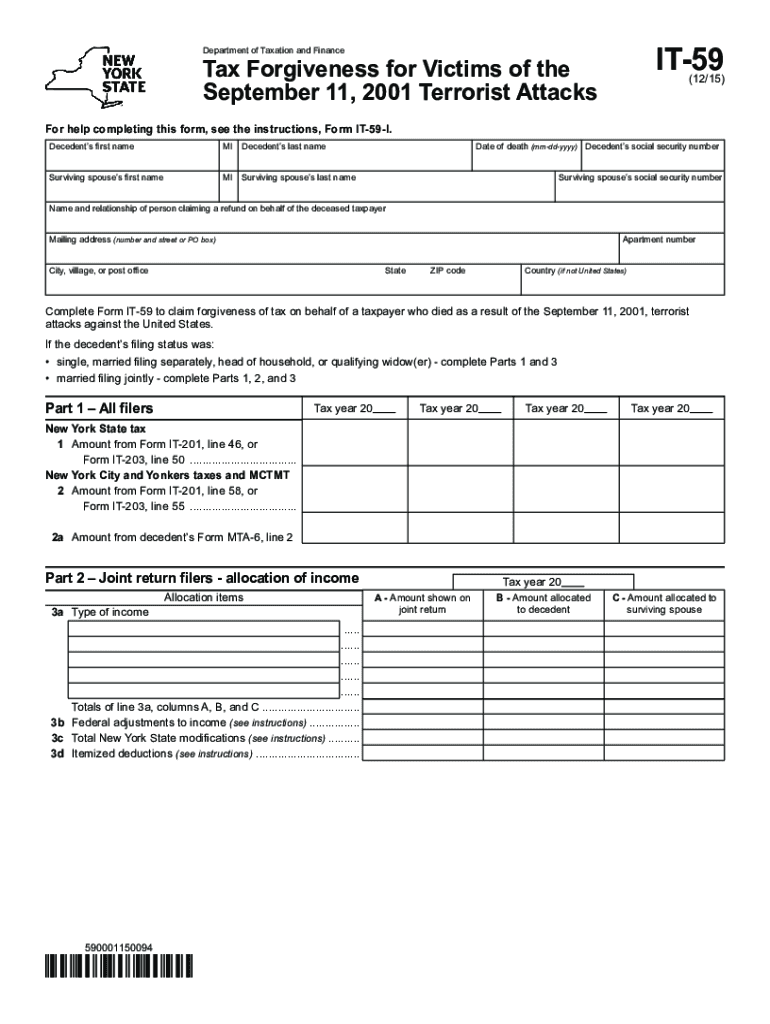

The New York Form IT 59 is designed to provide tax forgiveness for individuals who have been victims of specific disasters. This form allows eligible taxpayers to claim a refund of state income tax that was withheld as a result of the disaster. The purpose of this form is to alleviate some of the financial burdens that victims face in the aftermath of such events. It is important for applicants to understand the specific criteria that qualify them for this tax forgiveness, ensuring they can take full advantage of the benefits available to them.

Eligibility Criteria

To qualify for the New York Form IT 59 tax forgiveness, individuals must meet certain eligibility requirements. These include being a resident of New York State and having suffered financial loss due to a declared disaster. The form is typically available for those who experienced losses during specific tax years following the disaster declaration. It is crucial for applicants to review the official guidelines to confirm their eligibility before proceeding with the application.

Steps to Complete the New York Form IT 59 Tax Forgiveness For Victims Of The

Completing the New York Form IT 59 involves several key steps. First, individuals should gather all necessary documentation, including proof of residency and evidence of the disaster-related losses. Next, they should fill out the form accurately, ensuring that all required fields are completed. After completing the form, applicants must review it for accuracy before submitting it. Finally, the form can be submitted online, by mail, or in person, depending on the preferred method of submission.

Required Documents

When applying for tax forgiveness using the New York Form IT 59, certain documents are required to support the application. These may include:

- Proof of residency in New York State

- Documentation of losses incurred due to the disaster

- Previous tax returns to verify income

- Any other relevant financial statements

Having these documents ready will streamline the application process and help ensure that the form is processed without delays.

Form Submission Methods

The New York Form IT 59 can be submitted through various methods, providing flexibility for applicants. The available submission methods include:

- Online submission through the New York State Department of Taxation and Finance website

- Mailing the completed form to the designated address

- In-person submission at local tax offices

Choosing the right submission method can depend on personal preference and the urgency of the request.

Legal Use of the New York Form IT 59 Tax Forgiveness For Victims Of The

The New York Form IT 59 is legally recognized as a valid means for victims of disasters to seek tax forgiveness. To ensure that the form is legally binding, it must be completed in accordance with state regulations. This includes providing accurate information and adhering to deadlines for submission. By following the legal requirements, applicants can secure their rights to the tax benefits intended for disaster victims.

Quick guide on how to complete new york form it 59 tax forgiveness for victims of the

Manage New York Form IT 59 Tax Forgiveness For Victims Of The easily on any device

Digital document administration has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct template and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle New York Form IT 59 Tax Forgiveness For Victims Of The on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign New York Form IT 59 Tax Forgiveness For Victims Of The effortlessly

- Obtain New York Form IT 59 Tax Forgiveness For Victims Of The and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize necessary sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Edit and electronically sign New York Form IT 59 Tax Forgiveness For Victims Of The and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new york form it 59 tax forgiveness for victims of the

The best way to generate an electronic signature for your PDF file online

The best way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is it 59 and how does it work with airSlate SignNow?

It 59 refers to the industry standard for electronic signatures and document management. airSlate SignNow utilizes this standard to ensure that your eSignatures are legally binding and secure, allowing businesses to streamline their document workflow seamlessly.

-

What are the pricing options for airSlate SignNow's features supporting it 59?

airSlate SignNow offers flexible pricing plans that cater to various user needs. Each plan provides access to features that comply with it 59, ensuring businesses of all sizes can utilize a cost-effective solution for their eSigning and document management requirements.

-

Does airSlate SignNow support integrations with other software while adhering to it 59?

Yes, airSlate SignNow supports a wide range of integrations with popular applications like Salesforce, Google Drive, and Slack, while maintaining compliance with it 59 standards. This enables businesses to enhance their existing workflows without sacrificing functionality or security.

-

What benefits does airSlate SignNow offer in relation to it 59 compliance?

By using airSlate SignNow, businesses benefit from seamless eSigning, enhanced document security, and compliance with it 59 regulations. This not only improves operational efficiency but also ensures that all signatures are legitimate and verifiable, which is crucial for legal documents.

-

How does airSlate SignNow facilitate an easy transition to using it 59?

airSlate SignNow provides an intuitive user interface that simplifies the transition for new users adopting it 59 standards. With helpful onboarding tools and customer support, businesses can quickly integrate eSigning into their routine without extensive training or disruption.

-

Can airSlate SignNow handle high volumes of documents while complying with it 59?

Absolutely! airSlate SignNow is designed to manage high-volume document workflows efficiently while adhering to it 59 compliance. Whether you are sending dozens or thousands of documents, our solution maintains speed and reliability.

-

Is airSlate SignNow mobile-friendly for it 59 eSigning?

Yes, airSlate SignNow offers a fully responsive mobile application that allows users to eSign documents anywhere, anytime, while complying with it 59 standards. This mobility ensures that you can manage your documents on the go without compromising security or functionality.

Get more for New York Form IT 59 Tax Forgiveness For Victims Of The

Find out other New York Form IT 59 Tax Forgiveness For Victims Of The

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online