Printable New York Form it 602 Claim for EZ Capital Tax Credit 2020

What is the Printable New York Form IT 602 Claim For EZ Capital Tax Credit

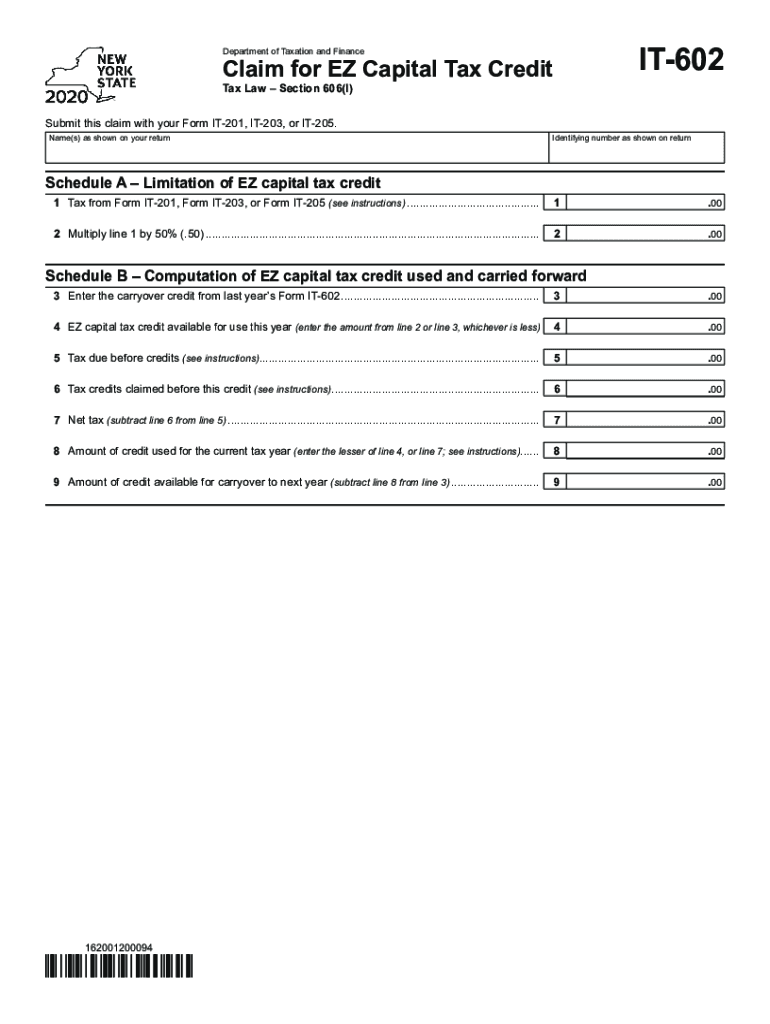

The Printable New York Form IT 602 Claim For EZ Capital Tax Credit is a tax form used by eligible businesses in New York State to claim a tax credit for investments in qualified capital assets. This form is specifically designed for businesses that meet certain criteria and have made eligible investments, allowing them to reduce their tax liability. The EZ Capital Tax Credit aims to encourage economic growth by incentivizing businesses to invest in their operations and create jobs within the state.

How to use the Printable New York Form IT 602 Claim For EZ Capital Tax Credit

To use the Printable New York Form IT 602 Claim For EZ Capital Tax Credit, businesses must first ensure they meet the eligibility requirements. Once confirmed, the form should be filled out with accurate information regarding the business and the capital investments made. After completing the form, it can be submitted as part of the annual tax return. It is important to retain copies of all relevant documentation to support the claims made on the form.

Steps to complete the Printable New York Form IT 602 Claim For EZ Capital Tax Credit

Completing the Printable New York Form IT 602 involves several key steps:

- Gather necessary documentation, including proof of capital investments and business identification details.

- Fill out the form with accurate information about the business and the specific investments made.

- Calculate the tax credit based on the eligible investments as outlined in the form instructions.

- Review the completed form for accuracy and completeness.

- Submit the form along with the annual tax return, ensuring that all supporting documents are included.

Eligibility Criteria

To qualify for the EZ Capital Tax Credit, businesses must meet specific eligibility criteria set by the New York State Department of Taxation and Finance. Generally, eligible businesses include those that have made qualified capital investments in tangible property used in their trade or business. Additionally, businesses must be located within New York State and comply with all relevant tax laws. It is essential to review the criteria carefully to ensure compliance before submitting the form.

Form Submission Methods

The Printable New York Form IT 602 can be submitted through various methods, depending on the preferences of the business. Businesses may choose to file the form electronically as part of their online tax return submission. Alternatively, the form can be printed and mailed to the appropriate tax authority. In-person submissions are also an option for those who prefer direct interaction with tax officials. Each method has its own guidelines and requirements, so it is important to follow the instructions provided with the form.

Key elements of the Printable New York Form IT 602 Claim For EZ Capital Tax Credit

The key elements of the Printable New York Form IT 602 include sections for business identification, details of the capital investments made, and calculations for the tax credit being claimed. Additionally, the form requires the signature of an authorized representative of the business, affirming that the information provided is accurate and complete. Each section must be filled out carefully to ensure that the claim is processed smoothly.

Quick guide on how to complete printable 2020 new york form it 602 claim for ez capital tax credit

Complete Printable New York Form IT 602 Claim For EZ Capital Tax Credit effortlessly on any device

Online document management has become increasingly popular with businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Printable New York Form IT 602 Claim For EZ Capital Tax Credit on any device with airSlate SignNow's Android or iOS applications, and streamline your document-related tasks today.

How to modify and electronically sign Printable New York Form IT 602 Claim For EZ Capital Tax Credit with ease

- Find Printable New York Form IT 602 Claim For EZ Capital Tax Credit and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive details with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Printable New York Form IT 602 Claim For EZ Capital Tax Credit and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 new york form it 602 claim for ez capital tax credit

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 new york form it 602 claim for ez capital tax credit

The best way to generate an eSignature for a PDF file online

The best way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is the Printable New York Form IT 602 Claim For EZ Capital Tax Credit?

The Printable New York Form IT 602 Claim For EZ Capital Tax Credit is a tax form used to claim credits for investments in qualified businesses in New York State. This form allows taxpayers to reduce their tax liability and is essential for maximizing tax credits. Completing this form accurately can lead to signNow financial benefits.

-

How can I obtain the Printable New York Form IT 602 Claim For EZ Capital Tax Credit?

You can easily obtain the Printable New York Form IT 602 Claim For EZ Capital Tax Credit through airSlate SignNow by accessing our document library. We provide a straightforward way to download and print the form. Simply visit our website, and you’ll find all the necessary resources.

-

Is there a cost associated with the Printable New York Form IT 602 Claim For EZ Capital Tax Credit?

The Printable New York Form IT 602 Claim For EZ Capital Tax Credit is available for free on our platform. While there are no charges for accessing the form, using airSlate SignNow for eSigning and document management may involve subscription fees, which are competitively priced to suit various business needs.

-

What features does airSlate SignNow offer for the Printable New York Form IT 602 Claim For EZ Capital Tax Credit?

AirSlate SignNow offers numerous features for the Printable New York Form IT 602 Claim For EZ Capital Tax Credit, including easy document editing, eSigning capabilities, and secure storage. Users can seamlessly collaborate on forms and automate workflows, enhancing efficiency during tax season. Our platform is designed to simplify the entire process.

-

What are the benefits of using airSlate SignNow for the Printable New York Form IT 602 Claim For EZ Capital Tax Credit?

Using airSlate SignNow for the Printable New York Form IT 602 Claim For EZ Capital Tax Credit streamlines the entire submission process. You benefit from reduced paperwork, faster processing times, and increased accuracy in your submissions. Additionally, our eSignature feature ensures legal compliance while enhancing document security.

-

Can I integrate other tools with airSlate SignNow when using the Printable New York Form IT 602 Claim For EZ Capital Tax Credit?

Yes, airSlate SignNow offers integrations with several third-party applications, facilitating a more efficient tax filing process with the Printable New York Form IT 602 Claim For EZ Capital Tax Credit. You can connect with popular tools like Google Drive, Dropbox, and many CRMs. This allows for a seamless workflow, simplifying document management and sharing.

-

How secure is my information when using airSlate SignNow for the Printable New York Form IT 602 Claim For EZ Capital Tax Credit?

AirSlate SignNow prioritizes security and compliance to protect your information when using the Printable New York Form IT 602 Claim For EZ Capital Tax Credit. Our platform employs advanced encryption protocols and adheres to industry regulations, ensuring that your documents remain confidential and secure during the entire process.

Get more for Printable New York Form IT 602 Claim For EZ Capital Tax Credit

Find out other Printable New York Form IT 602 Claim For EZ Capital Tax Credit

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF