Form it 602 Claim for EZ Capital Tax Credit Tax Year 2022

What is the Form IT 602 Claim For EZ Capital Tax Credit Tax Year

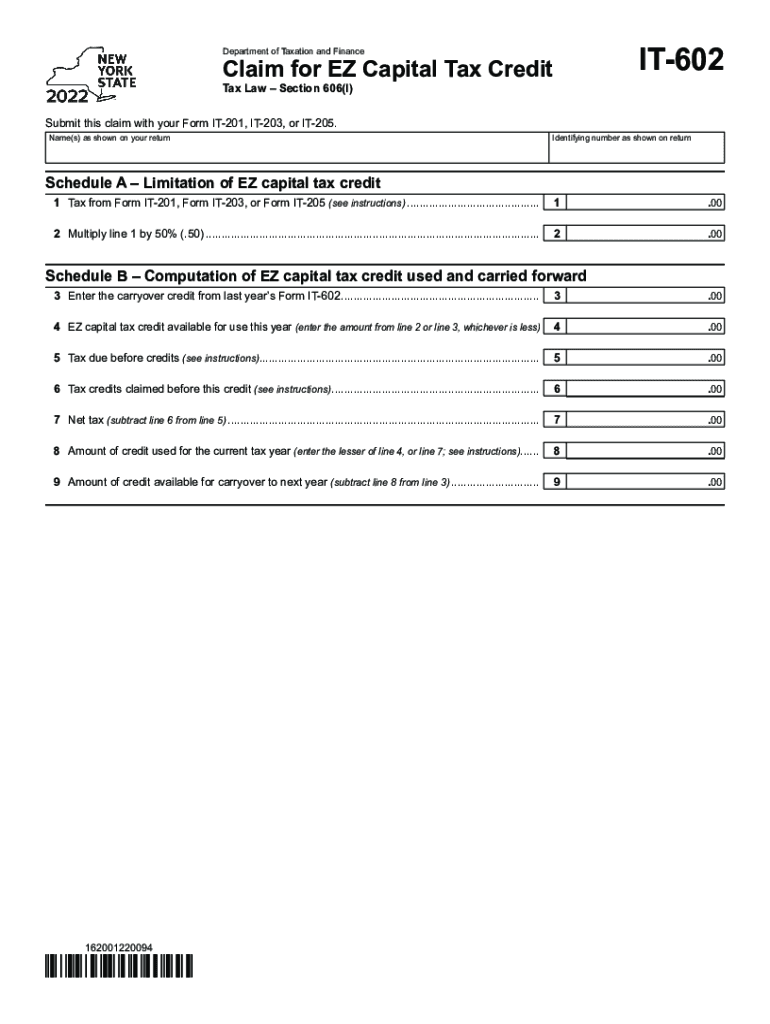

The Form IT 602 Claim For EZ Capital Tax Credit Tax Year is a tax document utilized by businesses in the United States to claim a tax credit for investments in certain qualified property. This form is specifically designed for entities that have made eligible capital investments, allowing them to reduce their overall tax liability. The EZ Capital Tax Credit aims to encourage economic development by providing financial incentives to businesses that invest in their operations.

How to use the Form IT 602 Claim For EZ Capital Tax Credit Tax Year

To use the Form IT 602 Claim For EZ Capital Tax Credit Tax Year, businesses must first ensure they meet the eligibility criteria outlined by the relevant tax authorities. Once eligibility is confirmed, the form must be accurately filled out, detailing the qualifying investments made during the tax year. It is essential to provide all required information and documentation to support the claim. After completing the form, it can be submitted electronically or via mail, depending on the specific guidelines provided by the state tax agency.

Steps to complete the Form IT 602 Claim For EZ Capital Tax Credit Tax Year

Completing the Form IT 602 Claim For EZ Capital Tax Credit Tax Year involves several key steps:

- Gather all necessary documentation related to your capital investments.

- Review the eligibility criteria to ensure compliance.

- Fill out the form accurately, providing details about the investments.

- Double-check all entries for accuracy and completeness.

- Submit the form through the appropriate channels, either online or by mail.

Legal use of the Form IT 602 Claim For EZ Capital Tax Credit Tax Year

The legal use of the Form IT 602 Claim For EZ Capital Tax Credit Tax Year is governed by federal and state tax laws. To ensure that the form is legally binding, it must be completed in accordance with these regulations. This includes providing truthful information and maintaining compliance with any applicable deadlines. Additionally, using a reliable electronic signature platform can enhance the legal validity of the submitted form.

Eligibility Criteria

To qualify for the EZ Capital Tax Credit, businesses must meet specific eligibility criteria. Generally, these criteria include:

- Being a registered business entity in the United States.

- Making qualified capital investments in eligible property.

- Meeting any additional state-specific requirements as outlined by local tax authorities.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 602 Claim For EZ Capital Tax Credit Tax Year can be submitted through various methods, depending on the guidelines set by the state tax agency. Common submission methods include:

- Online submission via the state tax agency's website.

- Mailing a printed copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete form it 602 claim for ez capital tax credit tax year 2022

Prepare Form IT 602 Claim For EZ Capital Tax Credit Tax Year effortlessly on any device

The management of online documents has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Form IT 602 Claim For EZ Capital Tax Credit Tax Year on any device with the airSlate SignNow applications for Android or iOS, and simplify your document-related tasks today.

The easiest way to alter and electronically sign Form IT 602 Claim For EZ Capital Tax Credit Tax Year with ease

- Find Form IT 602 Claim For EZ Capital Tax Credit Tax Year and click on Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Alter and electronically sign Form IT 602 Claim For EZ Capital Tax Credit Tax Year to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 602 claim for ez capital tax credit tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form it 602 claim for ez capital tax credit tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 602 Claim For EZ Capital Tax Credit Tax Year?

Form IT 602 Claim For EZ Capital Tax Credit Tax Year is a document that allows eligible businesses to apply for tax credits associated with EZ Capital investments. This form is specifically designed to help businesses maximize their benefits while navigating tax-related processes efficiently.

-

How can airSlate SignNow help with the Form IT 602 Claim For EZ Capital Tax Credit Tax Year?

airSlate SignNow simplifies the process of filling out and submitting the Form IT 602 Claim For EZ Capital Tax Credit Tax Year. With features such as eSigning and document tracking, businesses can ensure their claims are submitted accurately and on time, reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Form IT 602 Claim submissions?

Yes, airSlate SignNow provides various pricing tiers that cater to different needs. Customers can choose a plan that best fits their budget while leveraging the platform's capabilities to enhance their experience with Form IT 602 Claim For EZ Capital Tax Credit Tax Year submissions.

-

What features does airSlate SignNow offer for managing documents like Form IT 602?

airSlate SignNow offers a wide range of features including customizable templates, secure eSigning, and robust document management tools. These features allow businesses to efficiently manage their Form IT 602 Claim For EZ Capital Tax Credit Tax Year and streamline their overall document workflow.

-

Are there integrations available for processing Form IT 602 Claim For EZ Capital Tax Credit Tax Year?

Yes, airSlate SignNow integrates seamlessly with popular business applications and cloud storage solutions. This means users can easily upload, manage, and send their Form IT 602 Claim For EZ Capital Tax Credit Tax Year documents directly from their preferred platforms.

-

What are the benefits of using airSlate SignNow for my Form IT 602 Claim?

Using airSlate SignNow provides numerous benefits such as increased efficiency, enhanced accuracy, and reduced processing time. By utilizing the platform for the Form IT 602 Claim For EZ Capital Tax Credit Tax Year, businesses can focus more on growth while relying on reliable document management.

-

Can I track the status of my Form IT 602 Claim using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Form IT 602 Claim For EZ Capital Tax Credit Tax Year in real-time. This transparency ensures that you are always informed about your document's progress and can act quickly if needed.

Get more for Form IT 602 Claim For EZ Capital Tax Credit Tax Year

Find out other Form IT 602 Claim For EZ Capital Tax Credit Tax Year

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer