Form it 602 Claim for EZ Capital Tax Credit Tax Year 2024-2026

Understanding the Form IT 602 Claim for EZ Capital Tax Credit

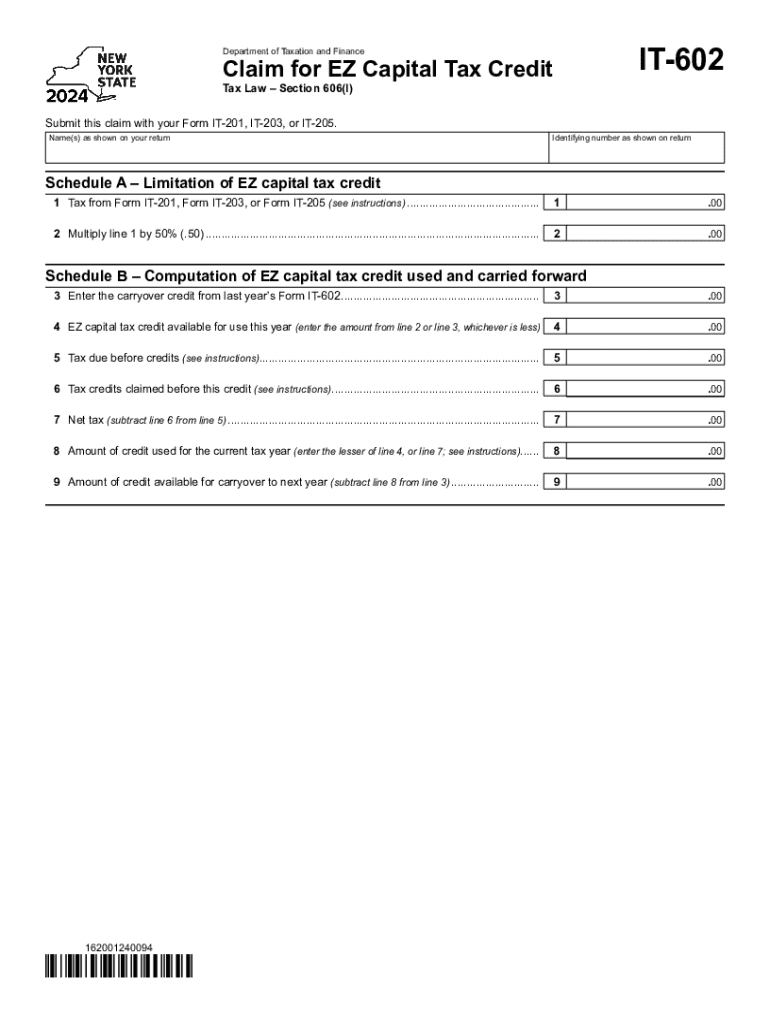

The Form IT 602 is specifically designed for claiming the EZ Capital Tax Credit in the United States. This tax credit is aimed at supporting businesses that invest in eligible capital assets. By completing this form, businesses can reduce their tax liability, promoting growth and investment in the local economy. The form outlines the necessary information that the taxpayer must provide to substantiate their claim for the credit.

Step-by-Step Instructions for Completing the Form IT 602

Completing the Form IT 602 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including financial statements and records of capital investments. Next, fill out the form by providing detailed information about your business and the specific investments made. Be sure to double-check all entries for accuracy, as errors can lead to delays or rejections. Finally, submit the form according to the specified guidelines, ensuring that you meet all deadlines.

Eligibility Criteria for the EZ Capital Tax Credit

To qualify for the EZ Capital Tax Credit, businesses must meet specific eligibility criteria. Generally, the business must be located in a designated zone and must have made qualifying capital investments within the tax year for which the credit is claimed. Additionally, the business must maintain compliance with all relevant tax regulations and reporting requirements. Understanding these criteria is essential for businesses to successfully claim the credit.

Required Documents for Filing the Form IT 602

When filing the Form IT 602, businesses must provide several key documents to support their claim. These typically include proof of capital investments, such as receipts or invoices, financial statements, and any other documentation that demonstrates eligibility for the credit. Ensuring that all required documents are included can help streamline the filing process and reduce the likelihood of issues arising during review.

Filing Deadlines for the Form IT 602

It is crucial for businesses to be aware of the filing deadlines associated with the Form IT 602. Generally, the form must be submitted by the tax return due date, including any extensions. Missing the deadline can result in the loss of the tax credit, so businesses should mark their calendars and prepare their submissions in advance to avoid any last-minute complications.

Common Scenarios for Claiming the EZ Capital Tax Credit

Various taxpayer scenarios can affect the claiming of the EZ Capital Tax Credit. For instance, self-employed individuals may have different considerations compared to corporations or partnerships. Understanding how different business structures impact eligibility and documentation requirements is essential for accurate filing. Each scenario may present unique challenges, so it is important to tailor the approach based on the specific business context.

Create this form in 5 minutes or less

Find and fill out the correct form it 602 claim for ez capital tax credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 602 claim for ez capital tax credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ez capital and how does it relate to airSlate SignNow?

Ez capital refers to the financial resources that businesses can leverage to enhance their operations. With airSlate SignNow, companies can utilize ez capital to streamline their document signing processes, making transactions faster and more efficient.

-

How much does airSlate SignNow cost for businesses looking to utilize ez capital?

The pricing for airSlate SignNow is competitive and designed to fit various business needs. By investing in this solution, businesses can maximize their ez capital by reducing costs associated with traditional document signing methods.

-

What features does airSlate SignNow offer that support ez capital utilization?

AirSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning. These tools help businesses effectively manage their ez capital by ensuring that document processes are efficient and compliant.

-

How can airSlate SignNow benefit my business's ez capital strategy?

By using airSlate SignNow, businesses can enhance their ez capital strategy through improved cash flow management and reduced operational costs. The platform allows for quicker turnaround times on contracts and agreements, which can lead to faster revenue generation.

-

Does airSlate SignNow integrate with other tools to enhance ez capital management?

Yes, airSlate SignNow integrates seamlessly with various business applications such as CRM systems and cloud storage solutions. These integrations help businesses optimize their ez capital by ensuring that all document-related processes are interconnected and efficient.

-

Is airSlate SignNow secure for handling sensitive documents related to ez capital?

Absolutely, airSlate SignNow prioritizes security with features like encryption and secure access controls. This ensures that all documents related to ez capital are protected, giving businesses peace of mind while managing their sensitive information.

-

Can airSlate SignNow help in reducing the time spent on document signing, thus optimizing ez capital?

Yes, airSlate SignNow signNowly reduces the time spent on document signing through its user-friendly interface and automated processes. This efficiency allows businesses to allocate their ez capital more effectively, focusing on growth and innovation.

Get more for Form IT 602 Claim For EZ Capital Tax Credit Tax Year

- Vocabulary note taking template form

- How to fill out a trade reference form

- Section 27 4 mollusks answer key form

- Endorsement identification form

- Thyatis form

- Orbital diagram ws kirkwoodk12mous form

- Needs assessment questionnaire naq tool utah dspd dspd utah form

- Certification of training and orientation of skilled nursing facility staff to hospice snf certificate of training utahhospice form

Find out other Form IT 602 Claim For EZ Capital Tax Credit Tax Year

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document