Minnesota Form M1M Income Additions and Subtractions 2020

What is the Minnesota Form M1M Income Additions and Subtractions

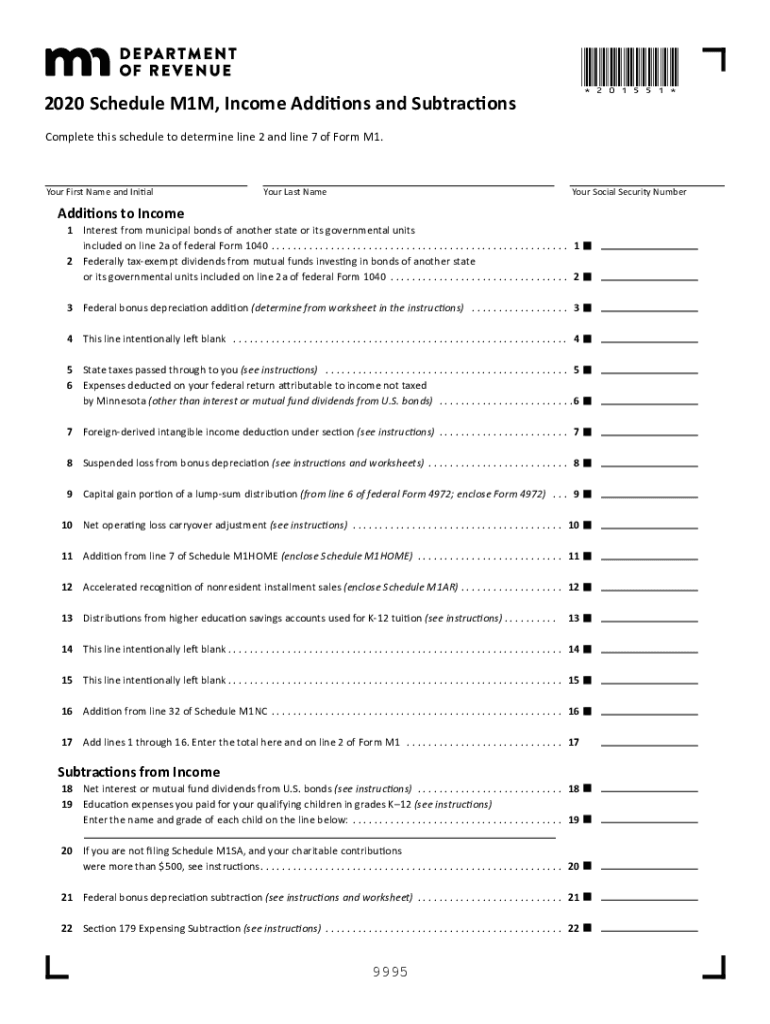

The Minnesota Form M1M is designed to help taxpayers report specific income additions and subtractions when filing their state income tax returns. This form is essential for individuals who need to adjust their federal adjusted gross income to determine their Minnesota taxable income. The M1M allows taxpayers to account for various income sources and deductions that may not be reflected in their federal return, ensuring compliance with state tax regulations.

How to Use the Minnesota Form M1M Income Additions and Subtractions

Using the Minnesota M1M involves several steps to ensure accurate reporting. Taxpayers should first gather all necessary documentation related to income and deductions. It is important to identify any additions, such as interest from non-Minnesota state bonds, as well as subtractions, like certain retirement benefits. Once the relevant information is collected, taxpayers can fill out the form, detailing each addition and subtraction clearly. This process helps in calculating the correct Minnesota taxable income.

Steps to Complete the Minnesota Form M1M Income Additions and Subtractions

Completing the Minnesota M1M requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Identify any income additions that need to be reported, such as interest from out-of-state bonds.

- Determine any allowable subtractions, such as contributions to certain retirement accounts.

- Fill out the M1M form, ensuring that each addition and subtraction is accurately recorded.

- Double-check all calculations and ensure that the form is complete before submission.

Legal Use of the Minnesota Form M1M Income Additions and Subtractions

The Minnesota M1M is legally recognized as a valid document for reporting income adjustments. To ensure compliance, taxpayers must follow state guidelines regarding what constitutes an addition or subtraction. The form must be completed accurately and submitted by the designated filing deadline. Failure to properly use the form can result in penalties or delays in processing tax returns.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines related to the Minnesota M1M. Typically, the form must be filed by the same deadline as the Minnesota income tax return, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to stay informed about any changes to filing deadlines to avoid potential penalties.

Required Documents

To complete the Minnesota M1M, taxpayers will need several documents, including:

- Federal tax return (Form 1040 or 1040-SR)

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for any additions or subtractions claimed

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Examples of Using the Minnesota Form M1M Income Additions and Subtractions

Examples of situations where the Minnesota M1M may be used include:

- A taxpayer who received interest income from bonds issued by states other than Minnesota may need to report this as an addition.

- Individuals who have received pension benefits may be eligible to subtract a portion of this income when calculating their Minnesota taxable income.

These examples illustrate how the M1M can be utilized to accurately reflect a taxpayer's financial situation in Minnesota.

Quick guide on how to complete minnesota form m1m income additions and subtractions

Complete Minnesota Form M1M Income Additions And Subtractions effortlessly on any device

Digital document management has become prevalent among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without interruptions. Handle Minnesota Form M1M Income Additions And Subtractions on any device using the airSlate SignNow Android or iOS applications and simplify any document-centric task today.

How to modify and eSign Minnesota Form M1M Income Additions And Subtractions effortlessly

- Find Minnesota Form M1M Income Additions And Subtractions and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal significance as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, either via email, text message (SMS), or invite link, or download it onto your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Minnesota Form M1M Income Additions And Subtractions to ensure outstanding communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota form m1m income additions and subtractions

Create this form in 5 minutes!

How to create an eSignature for the minnesota form m1m income additions and subtractions

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is m1m and how does it relate to airSlate SignNow?

m1m is a powerful feature within airSlate SignNow that simplifies the process of sending and eSigning documents. It empowers businesses to manage their document workflows efficiently and securely, ensuring that all signing parties can complete transactions quickly.

-

How much does airSlate SignNow's m1m feature cost?

The pricing for airSlate SignNow, including the m1m feature, varies based on your subscription plan. We offer different tiers that cater to various business sizes and needs, ensuring you only pay for what you require in your document management solutions.

-

What are the key features of the m1m solution?

The m1m solution in airSlate SignNow includes features such as document tracking, customizable templates, and multi-party eSigning. These tools are designed to enhance productivity, streamline workflows, and reduce the time spent on paperwork.

-

Can m1m integrate with other software applications?

Yes, airSlate SignNow's m1m feature supports integrations with popular applications like Salesforce, Google Drive, and Dropbox. This seamless integration enables users to manage their documents across various platforms without hassle.

-

What benefits does using m1m offer for my business?

Using m1m within airSlate SignNow offers numerous benefits, including improved efficiency, expedited document turnaround times, and enhanced security. Businesses can achieve faster transactions, freeing up resources to focus on growth and customer satisfaction.

-

Is m1m suitable for small businesses?

Absolutely! The m1m feature is designed to be user-friendly and cost-effective, making it ideal for small businesses looking to streamline their document processes. It allows you to manage eSigning easily, regardless of your technical expertise.

-

How secure is the m1m solution?

The m1m feature in airSlate SignNow employs advanced security protocols, including encryption and robust authentication methods. This ensures that your documents are protected at all times, giving you peace of mind as you send and eSign important paperwork.

Get more for Minnesota Form M1M Income Additions And Subtractions

- Income withholding order support form

- Ics 213 rr form

- New webtrader tutorial form

- Form fda 1571 investigational new drug application ind

- Form 565 report of accountable personal property

- Npi application printable form

- Mothers worksheet form

- Information and instructions for completing statement of 380688153

Find out other Minnesota Form M1M Income Additions And Subtractions

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later