Minnesota Form M1M Income Additions and Subtractions TaxFormFinder 2022

What is the Minnesota Form M1M Income Additions and Subtractions?

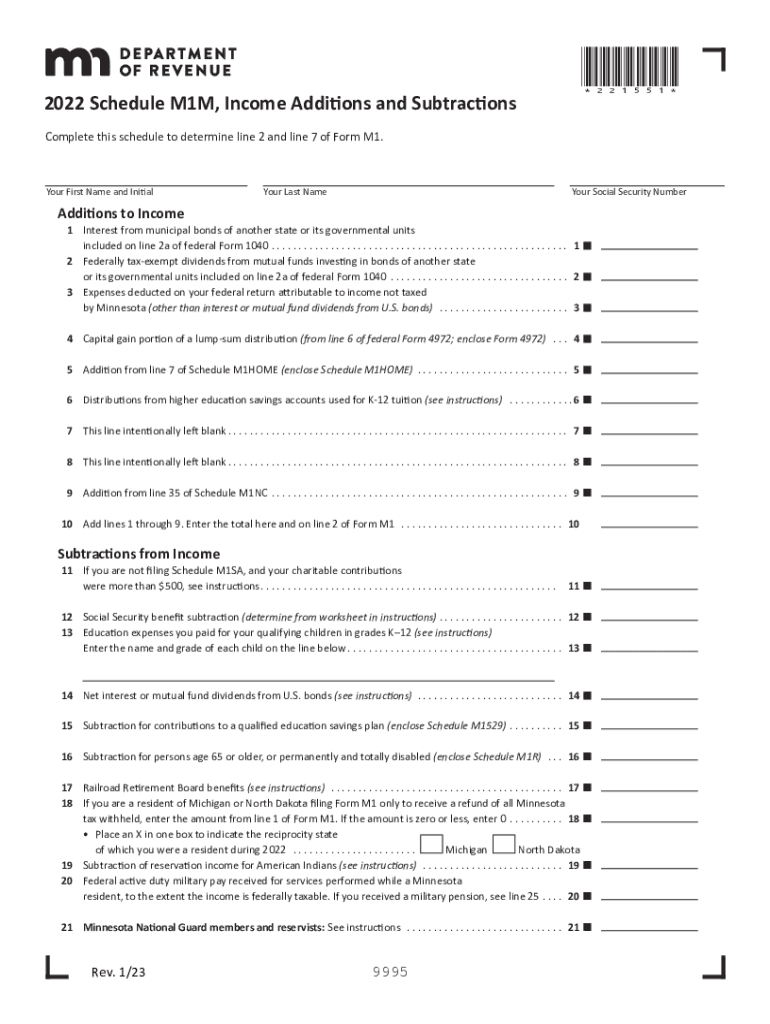

The Minnesota Form M1M is a tax document used by residents to report income additions and subtractions when filing their state income tax return. This form allows taxpayers to adjust their federal adjusted gross income to determine their Minnesota taxable income. It includes various categories of income that may need to be added or subtracted, such as interest from municipal bonds, certain retirement contributions, and other specific adjustments mandated by Minnesota tax law.

Steps to Complete the Minnesota Form M1M Income Additions and Subtractions

Completing the Minnesota Form M1M involves several key steps:

- Gather necessary documentation, including your federal tax return and any relevant financial statements.

- Identify income additions and subtractions applicable to your situation, such as state-specific deductions or credits.

- Fill out the form by entering your federal adjusted gross income and making the necessary adjustments based on your findings.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form along with your Minnesota tax return by the designated filing deadline.

Legal Use of the Minnesota Form M1M Income Additions and Subtractions

The Minnesota Form M1M is legally recognized by the state of Minnesota for tax reporting purposes. To ensure compliance, taxpayers must follow the specific guidelines outlined by the Minnesota Department of Revenue. Proper use of this form is essential for accurately reporting income and avoiding potential penalties. Taxpayers should be aware that any misreporting or failure to include required information could lead to audits or adjustments by the state.

Key Elements of the Minnesota Form M1M Income Additions and Subtractions

Key elements of the Minnesota Form M1M include:

- Income Additions: Items that increase your taxable income, such as certain types of interest and contributions to retirement accounts.

- Income Subtractions: Deductions that reduce your taxable income, including specific exemptions and credits.

- Calculation Section: A designated area for calculating your adjusted gross income after accounting for additions and subtractions.

- Signature Line: A section where the taxpayer must sign and date the form, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines for the Minnesota Form M1M to avoid penalties. Typically, the deadline aligns with the federal tax return due date, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to check the Minnesota Department of Revenue website for any updates regarding filing dates and potential extensions.

Examples of Using the Minnesota Form M1M Income Additions and Subtractions

Examples of when to use the Minnesota Form M1M include:

- If you received interest from municipal bonds, you would report this as an addition to your income.

- Taxpayers who made contributions to a traditional IRA may subtract these amounts from their income.

- Individuals claiming certain deductions for student loan interest or tuition may also need to adjust their income using this form.

Quick guide on how to complete minnesota form m1m income additions and subtractions taxformfinder

Complete Minnesota Form M1M Income Additions And Subtractions TaxFormFinder seamlessly on any device

Digital document management has become favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Minnesota Form M1M Income Additions And Subtractions TaxFormFinder on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Minnesota Form M1M Income Additions And Subtractions TaxFormFinder effortlessly

- Obtain Minnesota Form M1M Income Additions And Subtractions TaxFormFinder and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Minnesota Form M1M Income Additions And Subtractions TaxFormFinder and ensure exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota form m1m income additions and subtractions taxformfinder

Create this form in 5 minutes!

People also ask

-

What is the process to schedule m1m using airSlate SignNow?

To schedule m1m with airSlate SignNow, simply log into your account, select the document you wish to send, and choose the scheduling option. You can specify precise times for when the document needs to be signed, ensuring seamless workflow management. This feature allows you to automate and streamline your document signing process effectively.

-

Are there any costs associated with scheduling m1m?

airSlate SignNow offers various pricing plans, which include the ability to schedule m1m for your documents. The costs depend on the plan you select, which can accommodate diverse business needs. Check out our pricing page for detailed information and choose a plan that best fits your budget.

-

What features does airSlate SignNow provide for scheduling m1m?

airSlate SignNow includes robust features for scheduling m1m, such as document templates, notifications, and reminders. It enables users to keep their signing process organized and timely. Additional features include integration with various platforms for easy document management and tracking.

-

How can scheduling m1m improve my business efficiency?

By using airSlate SignNow to schedule m1m, businesses can reduce the time spent on manual follow-ups and streamline operations. This automation minimizes errors and enhances the overall productivity of your team. Consequently, you can focus more on core business activities rather than administrative tasks.

-

Can I integrate other tools with airSlate SignNow when scheduling m1m?

Yes, airSlate SignNow offers integrations with various software tools like CRM systems and project management applications, allowing you to schedule m1m more efficiently. This integration enhances collaboration and data accuracy across your business. You can create a more seamless workflow by combining functionalities of different platforms.

-

What are the benefits of using airSlate SignNow for scheduling m1m?

Using airSlate SignNow for scheduling m1m provides numerous benefits, including automatic reminders for recipients and real-time tracking of document status. This transparency improves customer satisfaction as signers are informed throughout the signing process. Additionally, the secure nature of airSlate SignNow ensures your documents are protected.

-

Is there a free trial available for scheduling m1m with airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore its features, including the scheduling of m1m. This trial gives you the opportunity to experience the platform's capabilities and determine its fit for your business before committing to a subscription. Sign up today to get started without any obligations.

Get more for Minnesota Form M1M Income Additions And Subtractions TaxFormFinder

- Letter from tenant to landlord about insufficient notice to terminate rental agreement nebraska form

- Letter from tenant to landlord about insufficient notice of change in rental agreement for other than rent increase nebraska form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants nebraska form

- Utility shut off notice form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat nebraska form

- Notice of assignment of lien corporation or llc nebraska form

- Nebraska notice commencement form

- Ne notice form

Find out other Minnesota Form M1M Income Additions And Subtractions TaxFormFinder

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement