Formulario 399 Tributum

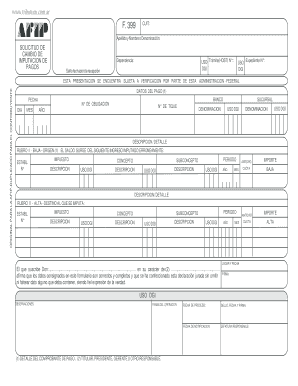

What is the Formulario 399 Tributum

The Formulario 399 Tributum is a tax-related document used primarily for reporting specific financial information to the tax authorities. This form is essential for individuals and businesses to ensure compliance with tax regulations. It serves as a declaration of income, deductions, and credits, allowing the government to assess tax liabilities accurately. Understanding its purpose is crucial for effective tax planning and reporting.

How to use the Formulario 399 Tributum

To use the Formulario 399 Tributum effectively, follow these steps:

- Gather all necessary financial documents, including income statements, expense receipts, and previous tax returns.

- Access the interactive version of the form, which allows for easy completion and digital signing.

- Fill in the required fields accurately, ensuring that all information reflects your financial situation.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference and the requirements set by the tax authority.

Steps to complete the Formulario 399 Tributum

Completing the Formulario 399 Tributum involves several key steps:

- Open the interactive form on your device.

- Input your personal information, including your name, address, and taxpayer identification number.

- Detail your income sources, including wages, interest, and dividends.

- List any deductions or credits you are eligible for, ensuring you have documentation to support these claims.

- Double-check all entries for accuracy and completeness.

- Sign the form electronically to validate your submission.

Legal use of the Formulario 399 Tributum

The legal use of the Formulario 399 Tributum is governed by specific regulations that ensure its validity as a tax document. To be considered legally binding, the form must be filled out accurately and submitted within the designated deadlines. Utilizing a reputable electronic signature platform enhances the legal standing of the form, as it complies with regulations such as ESIGN and UETA. This ensures that the form is recognized by tax authorities and can withstand scrutiny in case of audits.

Filing Deadlines / Important Dates

Filing deadlines for the Formulario 399 Tributum are critical to avoid penalties. Typically, the form must be submitted by a specific date each year, often coinciding with the general tax filing deadline. It is essential to stay informed about these dates, as late submissions can lead to fines or additional interest on unpaid taxes. Mark your calendar with important dates to ensure timely compliance.

Required Documents

When completing the Formulario 399 Tributum, certain documents are required to support your claims. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Previous year’s tax return for reference

- Any relevant documentation for tax credits

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in your reporting.

Quick guide on how to complete formulario 399 tributum

Complete Formulario 399 Tributum effortlessly on any device

Online document administration has grown increasingly favored by businesses and individuals alike. It offers a perfect green alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly and without delays. Manage Formulario 399 Tributum on any platform using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The easiest way to modify and electronically sign Formulario 399 Tributum effortlessly

- Locate Formulario 399 Tributum and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you prefer to send your form: via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Formulario 399 Tributum to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 399 tributum

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is f399 excel and how does it work with airSlate SignNow?

The f399 excel is a versatile form designed for electronic signatures within Excel documents. With airSlate SignNow, users can easily upload their f399 excel, allowing for seamless document signing and management. This tool enhances the efficiency of handling important documents without the need for printing or scanning.

-

How can I integrate f399 excel with airSlate SignNow?

Integrating f399 excel with airSlate SignNow is straightforward. You simply need to upload your f399 excel file into the airSlate SignNow platform, where you can add signature fields and send it for eSigning. This integration simplifies the signing process and enhances workflow efficiency.

-

What are the pricing options for using airSlate SignNow with f399 excel?

airSlate SignNow offers competitive pricing tailored to businesses of all sizes using f399 excel. Plans begin with a free trial that allows access to essential features, including eSigning f399 excel documents, and scale up based on additional needs such as advanced integrations and user support.

-

What features does airSlate SignNow offer for managing f399 excel documents?

When it comes to managing f399 excel documents, airSlate SignNow provides features such as customizable templates, real-time tracking, and secure storage. Users can create workflows that automate the signing process, ensuring that their f399 excel documents are processed quickly and securely.

-

What are the main benefits of using airSlate SignNow for f399 excel?

Using airSlate SignNow for f399 excel offers several benefits, including increased efficiency, reduced turnaround times, and enhanced security. The platform enables users to digitally sign their f399 excel documents, eliminating the hassles associated with paper-based processes and improving overall productivity.

-

Can f399 excel be signed on mobile devices with airSlate SignNow?

Yes, f399 excel documents can be easily signed on mobile devices using airSlate SignNow's mobile app. This feature allows users to remain productive and obtain signatures on the go, ensuring that important documents are signed and submitted promptly, regardless of location.

-

Is it secure to use airSlate SignNow for f399 excel document signing?

Absolutely! AirSlate SignNow employs industry-standard security measures to protect your f399 excel documents during the signing process. Features such as encryption, audit trails, and secure cloud storage ensure that your confidential information remains safe and compliant with regulatory standards.

Get more for Formulario 399 Tributum

Find out other Formulario 399 Tributum

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile