This Form Must Be Received by the 15th of the Month for Your Monthly Benefit Payment to Be Directly Deposited into 2018-2026

Understanding the tcdrs Form Submission Deadline

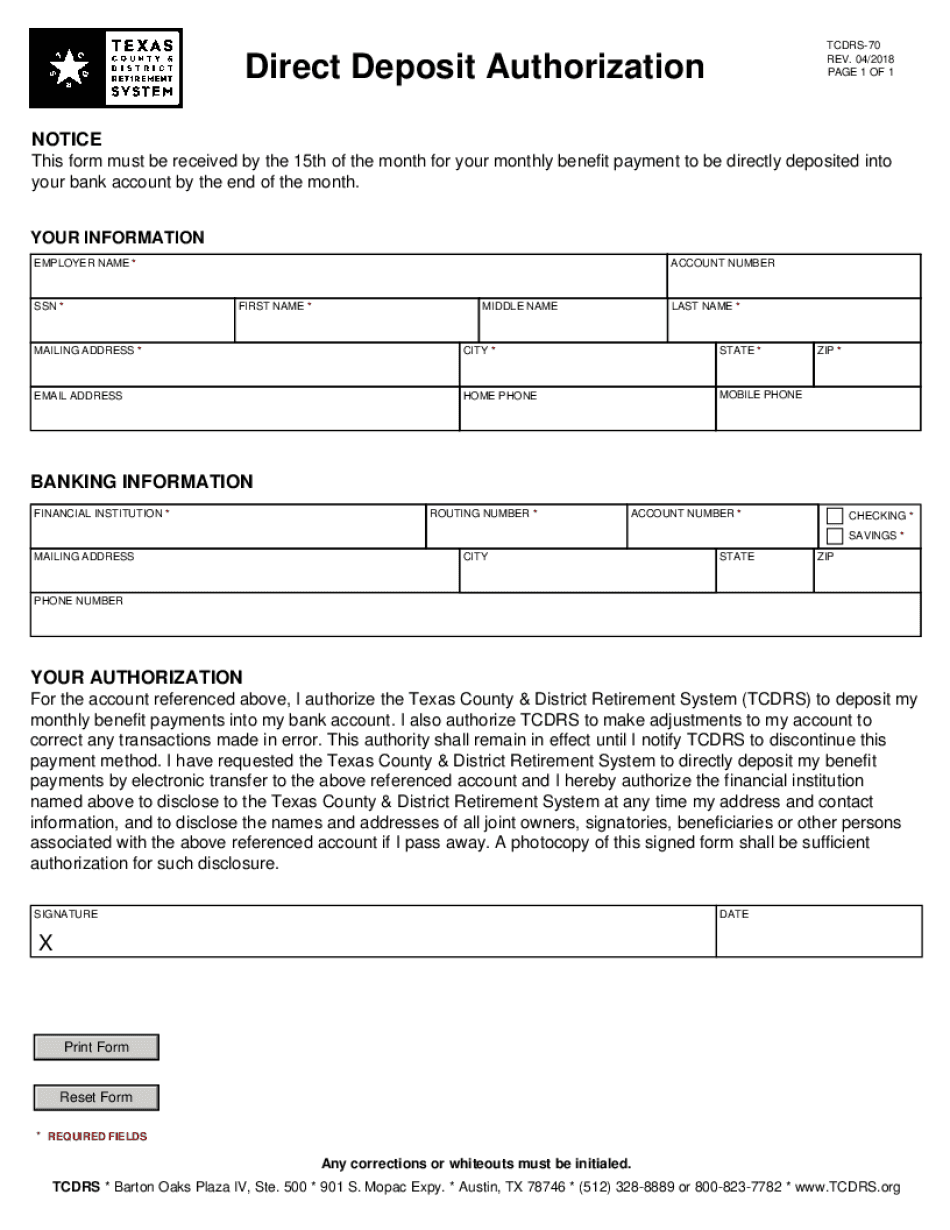

The tcdrs form must be received by the 15th of the month to ensure that your monthly benefit payment is directly deposited into your account. This deadline is crucial for timely processing and to avoid any delays in receiving your funds. If the form is submitted after this date, the payment may be postponed until the following month.

Steps to Complete the tcdrs Form for Direct Deposit

Completing the tcdrs form accurately is essential for setting up direct deposit. Follow these steps to ensure a smooth process:

- Gather required information, including your bank account details and personal identification.

- Fill out the form clearly, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the form electronically through a secure platform or mail it to the appropriate address.

Legal Use of the tcdrs Form

The tcdrs form is legally binding when completed correctly and submitted on time. It serves as an official request for direct deposit of your benefits, and compliance with submission guidelines is essential. Ensure that you understand the legal implications of your submission, as it affects your financial transactions with the Texas retirement system.

Required Documents for tcdrs Submission

To complete the tcdrs form, you may need to provide supporting documentation. Commonly required documents include:

- Proof of identity, such as a driver's license or Social Security card.

- Bank account information, including routing and account numbers.

- Any previous correspondence related to your retirement benefits.

Form Submission Methods for tcdrs

You can submit the tcdrs form through various methods to ensure it reaches the appropriate department. Options include:

- Online submission via a secure e-signature platform.

- Mailing the completed form to the designated address.

- In-person delivery at a local retirement office.

Penalties for Non-Compliance with tcdrs Submission

Failing to submit the tcdrs form by the deadline can result in penalties, such as delayed benefit payments. It is important to adhere to the submission guidelines to avoid any disruptions in your financial planning.

Quick guide on how to complete this form must be received by the 15th of the month for your monthly benefit payment to be directly deposited into

Effortlessly manage This Form Must Be Received By The 15th Of The Month For Your Monthly Benefit Payment To Be Directly Deposited Into on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the required forms and securely store them online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle This Form Must Be Received By The 15th Of The Month For Your Monthly Benefit Payment To Be Directly Deposited Into on any device with the airSlate SignNow applications for Android or iOS and enhance any document-based process today.

The simplest way to update and eSign This Form Must Be Received By The 15th Of The Month For Your Monthly Benefit Payment To Be Directly Deposited Into with ease

- Obtain This Form Must Be Received By The 15th Of The Month For Your Monthly Benefit Payment To Be Directly Deposited Into and click on Get Form to begin.

- Use the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form hunts, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Update and eSign This Form Must Be Received By The 15th Of The Month For Your Monthly Benefit Payment To Be Directly Deposited Into to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct this form must be received by the 15th of the month for your monthly benefit payment to be directly deposited into

Create this form in 5 minutes!

How to create an eSignature for the this form must be received by the 15th of the month for your monthly benefit payment to be directly deposited into

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What are tcdrs and how do they work with airSlate SignNow?

TCdrs, or Transactional Click-Through Document Retrieval Services, allow users to retrieve and manage documents seamlessly. With airSlate SignNow, you can integrate tcdrs to streamline document workflows and enhance efficiency, ensuring that your documents are readily accessible.

-

How much does airSlate SignNow cost for tcdrs integration?

Pricing for airSlate SignNow varies based on the features and integrations you choose, including tcdrs. We offer flexible plans that accommodate different business sizes, ensuring you get great value while harnessing tcdrs for your document needs.

-

What features does airSlate SignNow offer for managing tcdrs?

airSlate SignNow includes features like document sharing, electronic signatures, and tcdrs integration that enhances document accessibility. These features help you manage your tcdrs efficiently, making it easy to oversee transactions and maintain compliance.

-

Can I automate my workflows with tcdrs using airSlate SignNow?

Yes, airSlate SignNow allows you to automate workflows that incorporate tcdrs, thereby reducing manual tasks. Automation helps streamline your document processes, allowing you to focus on your core business activities while tcdrs handles the logistics of document management.

-

What are the benefits of using airSlate SignNow with tcdrs?

Using airSlate SignNow with tcdrs offers numerous benefits, including enhanced document security, improved workflow efficiency, and cost savings. By leveraging tcdrs within airSlate SignNow, businesses can facilitate smoother transactions and ensure that documents are easily retrievable.

-

Are there any integrations available for tcdrs with airSlate SignNow?

Absolutely! airSlate SignNow provides various integrations that support tcdrs, enabling you to connect with other tools you already use. This integration enhances your document workflow and ensures that tcdrs operate efficiently with your existing software solutions.

-

How does airSlate SignNow ensure the security of tcdrs?

airSlate SignNow prioritizes security by employing advanced encryption methods to protect your tcdrs. With robust security practices in place, you can trust that your documents are safe from unauthorized access, giving you peace of mind when handling sensitive information.

Get more for This Form Must Be Received By The 15th Of The Month For Your Monthly Benefit Payment To Be Directly Deposited Into

Find out other This Form Must Be Received By The 15th Of The Month For Your Monthly Benefit Payment To Be Directly Deposited Into

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later