it 1040X Ohio Amended Individual Income Tax Return Formytax Com 2014

What is the IT 1040X Ohio Amended Individual Income Tax Return Formytax com

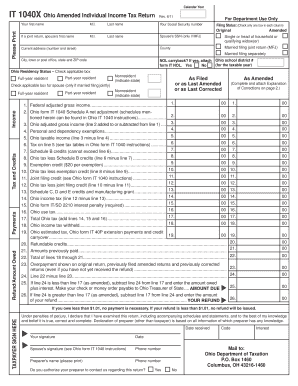

The IT 1040X Ohio Amended Individual Income Tax Return Formytax com is a specific tax form used by individuals in Ohio to amend their previously filed income tax returns. This form allows taxpayers to correct errors or make changes to their original filings, ensuring that their tax records accurately reflect their financial situations. It is essential for individuals who need to report additional income, claim overlooked deductions, or correct mistakes in their tax calculations.

Steps to complete the IT 1040X Ohio Amended Individual Income Tax Return Formytax com

Completing the IT 1040X involves several important steps:

- Gather necessary documents: Collect your original tax return, any supporting documents, and information related to the changes you are making.

- Fill out the form: Carefully complete the IT 1040X, ensuring that all changes are clearly indicated and that you provide accurate information.

- Explain your changes: Include a detailed explanation of why you are amending your return. This helps clarify your situation for the tax authorities.

- Review your form: Double-check all entries for accuracy and completeness before submission.

- Submit the form: Choose your preferred submission method, whether online or via mail, and ensure it is sent to the correct address.

How to obtain the IT 1040X Ohio Amended Individual Income Tax Return Formytax com

The IT 1040X can be obtained directly from the Ohio Department of Taxation website or through authorized tax preparation software. Many tax professionals also provide this form as part of their services. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Legal use of the IT 1040X Ohio Amended Individual Income Tax Return Formytax com

The IT 1040X is legally binding when completed and submitted according to Ohio tax laws. To ensure its validity, the form must be signed and dated by the taxpayer. Additionally, any electronic submissions must comply with the relevant eSignature laws, which recognize electronic signatures as legally valid when certain conditions are met.

Filing Deadlines / Important Dates

When filing the IT 1040X, it is crucial to be aware of the deadlines. Generally, amended returns must be filed within three years of the original due date or within one year of the tax payment date, whichever is later. Staying informed about these dates helps avoid penalties and ensures that your amendments are processed in a timely manner.

Form Submission Methods (Online / Mail / In-Person)

The IT 1040X can be submitted through various methods:

- Online: Many taxpayers choose to file electronically using tax preparation software that supports the IT 1040X.

- Mail: You can print the completed form and send it to the designated address provided by the Ohio Department of Taxation.

- In-Person: Some taxpayers may opt to deliver their amended returns directly to local tax offices, though this is less common.

Quick guide on how to complete it 1040x ohio amended individual income tax return formytaxcom

Effortlessly prepare IT 1040X Ohio Amended Individual Income Tax Return Formytax com on any device

The management of online documents has gained popularity among businesses and individuals alike. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Manage IT 1040X Ohio Amended Individual Income Tax Return Formytax com on any platform using airSlate SignNow Android or iOS applications and enhance any document-centered operation today.

The best approach to modify and electronically sign IT 1040X Ohio Amended Individual Income Tax Return Formytax com with ease

- Obtain IT 1040X Ohio Amended Individual Income Tax Return Formytax com and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools specifically available through airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign IT 1040X Ohio Amended Individual Income Tax Return Formytax com and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 1040x ohio amended individual income tax return formytaxcom

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the IT 1040X Ohio Amended Individual Income Tax Return Formytax com?

The IT 1040X Ohio Amended Individual Income Tax Return Formytax com is a tax form used to amend previously filed Ohio income tax returns. This form allows taxpayers to correct errors, change filing statuses, or update income details. It's specifically designed for residents of Ohio and is essential for ensuring compliance with state tax laws.

-

How do I fill out the IT 1040X Ohio Amended Individual Income Tax Return Formytax com?

Filling out the IT 1040X Ohio Amended Individual Income Tax Return Formytax com involves gathering your original tax return and identifying the changes you need to make. The form has clear sections for detailing your previous income data and the amendments being made. Be sure to follow the instructions carefully to avoid any mistakes.

-

What are the benefits of using the IT 1040X Ohio Amended Individual Income Tax Return Formytax com?

Using the IT 1040X Ohio Amended Individual Income Tax Return Formytax com helps individuals correct errors on their tax returns, potentially leading to refunds or reducing tax liabilities. It simplifies the amendment process and ensures that your tax records accurately reflect your financial situation. Additionally, it aids in maintaining good standing with the Ohio Department of Taxation.

-

Is there a deadline for submitting the IT 1040X Ohio Amended Individual Income Tax Return Formytax com?

Yes, the deadline for submitting the IT 1040X Ohio Amended Individual Income Tax Return Formytax com is typically three years from the original filing date or within one year after a final determination by the tax department. It’s crucial to meet these deadlines to ensure that any refunds or credits are processed in a timely manner.

-

How much does it cost to file the IT 1040X Ohio Amended Individual Income Tax Return Formytax com?

The cost to file the IT 1040X Ohio Amended Individual Income Tax Return Formytax com can vary depending on whether you choose to file it yourself or use a tax professional. Many online platforms offer affordable options for filing this amendment, often under $50. It's recommended to compare costs across different services to find the best deal.

-

Can I submit the IT 1040X Ohio Amended Individual Income Tax Return Formytax com online?

Yes, you can submit the IT 1040X Ohio Amended Individual Income Tax Return Formytax com online using various e-filing platforms that support Ohio tax forms. Online submission is fast and provides confirmation of your filing, which can be useful for tracking purposes. Ensure that you use a reputable service to guarantee the security of your personal information.

-

What information do I need to provide with the IT 1040X Ohio Amended Individual Income Tax Return Formytax com?

When filing the IT 1040X Ohio Amended Individual Income Tax Return Formytax com, you'll need your original tax return, identification information, and details of the changes being made. This includes new income data, deductions, and credits you wish to amend. Having all necessary documentation on hand will streamline the process and help prevent delays.

Get more for IT 1040X Ohio Amended Individual Income Tax Return Formytax com

- Additional order form

- Jd cv 86 form

- Multistate bar examination certification request form

- Request exclusion form

- Form 1e application

- Writ of habeas corpus ad testificandum form

- Application for referral of case to the individual jud ct form

- First order of notice upon attachment of estate of nonresident jud ct form

Find out other IT 1040X Ohio Amended Individual Income Tax Return Formytax com

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now