Background Screening in the Financial Services Industry BIG 2019-2026

Understanding the Background Screening in the Financial Services Industry

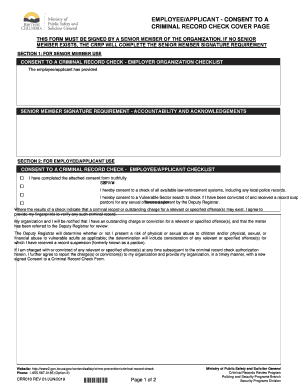

The Background Screening in the Financial Services Industry is a critical process that ensures organizations verify the credentials and history of potential employees or partners. This form is essential for maintaining trust and compliance within the financial sector. It typically includes checks on criminal history, credit reports, and employment verification to assess the suitability of individuals for sensitive roles. The integrity of this process is vital, as it directly impacts the security and reliability of financial institutions.

Steps to Complete the Background Screening in the Financial Services Industry

Completing the Background Screening in the Financial Services Industry involves several key steps:

- Gather necessary personal information, including full name, date of birth, and Social Security number.

- Obtain consent from the individual being screened, as required by law.

- Submit the completed form through a secure online platform, ensuring compliance with relevant regulations.

- Review the results of the background check for any discrepancies or issues.

- Make informed decisions based on the findings, adhering to fair hiring practices.

Legal Use of the Background Screening in the Financial Services Industry

The legal use of the Background Screening in the Financial Services Industry is governed by various federal and state laws, including the Fair Credit Reporting Act (FCRA). Organizations must ensure that they comply with these regulations to avoid legal repercussions. This includes obtaining written consent from the individual being screened and providing them with a copy of the report if adverse action is taken based on the findings. Understanding these legal requirements is essential for maintaining compliance and protecting the rights of individuals.

Key Elements of the Background Screening in the Financial Services Industry

Several key elements are integral to the Background Screening in the Financial Services Industry:

- Identity Verification: Confirming the individual's identity through official documents.

- Criminal History Check: Reviewing any past criminal offenses that may affect employment suitability.

- Credit Report Analysis: Assessing financial responsibility and stability.

- Employment Verification: Checking previous employment history and references.

- Education Verification: Confirming educational qualifications and credentials.

State-Specific Rules for the Background Screening in the Financial Services Industry

Each state may have specific rules and regulations governing background screenings in the financial services sector. Organizations must stay informed about these variations to ensure compliance. For instance, some states may have restrictions on the types of information that can be considered or require additional disclosures to candidates. Understanding these state-specific rules is crucial for organizations to navigate the legal landscape effectively.

Examples of Using the Background Screening in the Financial Services Industry

Background screenings are commonly utilized in various scenarios within the financial services industry:

- Hiring for Sensitive Positions: Financial institutions often require thorough screenings for roles involving access to sensitive financial data.

- Partnership Assessments: Organizations may conduct screenings on potential partners to ensure they align with compliance standards.

- Regulatory Compliance: Regular screenings help organizations adhere to industry regulations and maintain operational integrity.

Quick guide on how to complete background screening in the financial services industry big

Effortlessly prepare Background Screening In The Financial Services Industry BIG on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Background Screening In The Financial Services Industry BIG on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to modify and electronically sign Background Screening In The Financial Services Industry BIG with ease

- Locate Background Screening In The Financial Services Industry BIG and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with specialized tools that airSlate SignNow offers for that specific purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Background Screening In The Financial Services Industry BIG while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct background screening in the financial services industry big

Create this form in 5 minutes!

How to create an eSignature for the background screening in the financial services industry big

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is the cr010 feature in airSlate SignNow?

The cr010 feature in airSlate SignNow allows users to securely send and eSign documents with ease. This functionality streamlines the signing process, providing a user-friendly experience that ensures all parties can efficiently complete their tasks.

-

How does airSlate SignNow pricing work for crr010 users?

airSlate SignNow offers flexible pricing plans tailored to various business needs. For crr010 users, competitive rates apply, making it a cost-effective solution for managing document workflows and eSignatures.

-

What are the key benefits of using airSlate SignNow with crr010?

Using airSlate SignNow with crr010 delivers numerous benefits, including increased efficiency and reduced turnaround times for document signing. Additionally, the platform enhances security and compliance, giving users peace of mind while handling sensitive documents.

-

Can I integrate airSlate SignNow with other software while using crr010?

Yes, airSlate SignNow supports integrations with many popular software applications. This capability allows crr010 users to seamlessly incorporate eSignature functionalities into their existing systems, enhancing productivity and collaboration.

-

Is airSlate SignNow mobile-friendly for crr010 users?

Absolutely! airSlate SignNow is optimized for mobile devices, enabling crr010 users to send and sign documents on-the-go. This flexibility ensures that important agreements can be executed anytime, anywhere, without compromising security.

-

What types of businesses can benefit from crr010 in airSlate SignNow?

Businesses of all sizes and industries can benefit from crr010 in airSlate SignNow. Whether you’re a startup, a mid-sized company, or an enterprise, the platform streamlines document processes and enhances workflow efficiency.

-

What security measures does airSlate SignNow provide for crr010 users?

airSlate SignNow implements robust security measures, including data encryption and secure user authentication for crr010 users. These features ensure that all documents are protected and compliant with industry standards.

Get more for Background Screening In The Financial Services Industry BIG

- Real id faqslinks to state by state guides dmvorg form

- State of montana montana department of transportation driveway approach application permit form

- Driving record montana form

- Pdf release of driving records personal info express consent forms

- Vehiclevessel chattel lien sale affidavit form

- Wd ago form 53 55

- Form k uniform

- Abandoned vehicle affidavit of sale registered tow truck operators only form

Find out other Background Screening In The Financial Services Industry BIG

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF