Form 8867 Paid Preparer's Due Diligence ChecklistSupportpreparer Due DiligenceEarned Income Tax Creditpreparer Due DiligenceEarn 2020

What is Form 8867?

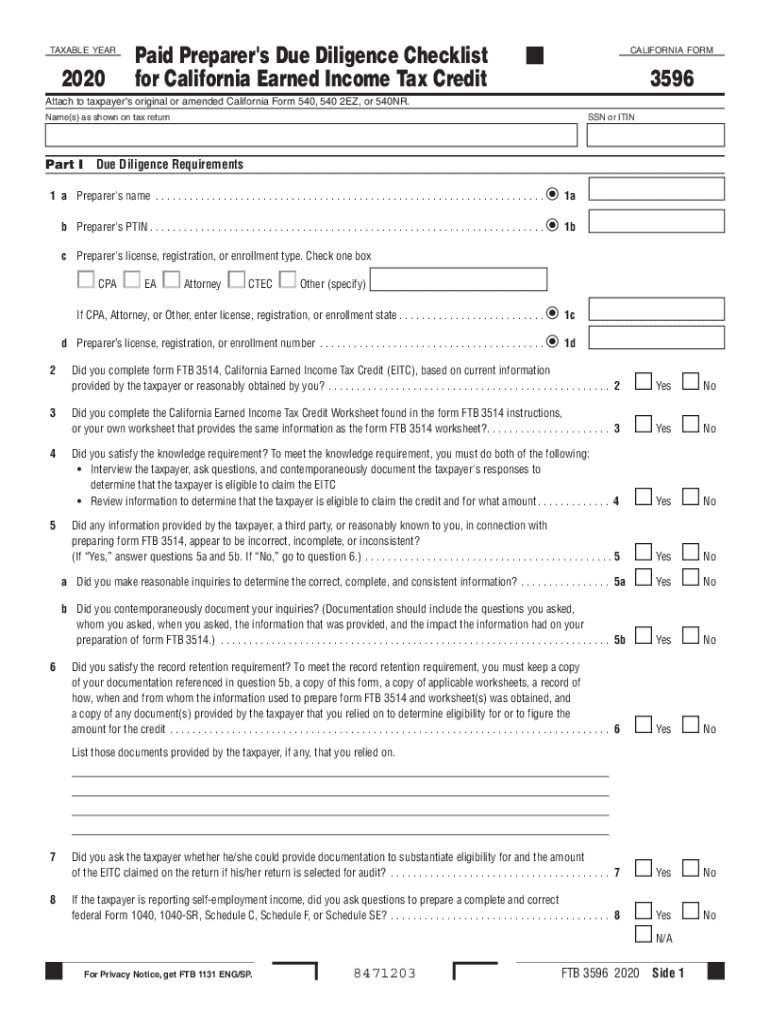

The Form 8867, known as the Paid Preparer's Due Diligence Checklist, is a document required by the Internal Revenue Service (IRS) to ensure that tax preparers fulfill their due diligence obligations when preparing tax returns claiming the Earned Income Tax Credit (EITC) and other tax credits. This form is essential for tax professionals to demonstrate compliance with IRS guidelines and to protect themselves from potential penalties associated with improper claims.

Tax preparers must complete this checklist for each client who claims the EITC, ensuring that all necessary information and documentation are reviewed. The form helps maintain the integrity of the tax system by promoting accurate reporting and preventing fraudulent claims.

Steps to Complete Form 8867

Completing Form 8867 involves several key steps to ensure accuracy and compliance. Here’s a breakdown of the process:

- Gather necessary documentation from the taxpayer, including income statements, Social Security numbers, and any relevant identification.

- Review the eligibility criteria for the Earned Income Tax Credit to confirm that the taxpayer qualifies.

- Complete each section of the Form 8867, ensuring that all questions are answered accurately.

- Sign and date the form, confirming that due diligence has been performed and all information is correct.

- Attach the completed Form 8867 to the taxpayer's return when filing.

Following these steps helps ensure that tax preparers meet their obligations and reduces the risk of penalties for non-compliance.

Legal Use of Form 8867

The legal use of Form 8867 is crucial for tax preparers in the United States. By completing this form, preparers demonstrate that they have taken the necessary steps to verify a taxpayer's eligibility for the Earned Income Tax Credit. This form is not merely a formality; it serves as a legal safeguard against potential penalties that may arise from incorrect claims.

Tax preparers who fail to complete Form 8867 when required may face substantial penalties, including fines and the possibility of losing their ability to prepare tax returns. Therefore, understanding the legal implications of using this form is vital for compliance and professional integrity.

Key Elements of Form 8867

Form 8867 includes several key elements that tax preparers must pay attention to when completing the document. These elements include:

- Taxpayer Information: Basic details about the taxpayer, including name, address, and Social Security number.

- Eligibility Questions: Specific questions that help determine if the taxpayer qualifies for the EITC and other credits.

- Due Diligence Requirements: A checklist of actions that the preparer must take to ensure compliance with IRS regulations.

- Signature Section: A declaration that the preparer has fulfilled their due diligence obligations.

Understanding these key elements ensures that tax preparers can accurately complete the form and adhere to IRS guidelines.

Filing Deadlines for Form 8867

Filing deadlines for Form 8867 align with the overall tax filing deadlines in the United States. Generally, tax returns must be filed by April 15 of each year. However, if the taxpayer is eligible for an extension, the deadline may be extended to October 15. It is important for tax preparers to be aware of these deadlines to ensure timely submission of the form along with the tax return.

Failure to file Form 8867 by the deadline can result in penalties for the tax preparer, highlighting the importance of adhering to these timelines.

Examples of Using Form 8867

Form 8867 is utilized in various scenarios where taxpayers claim the Earned Income Tax Credit. Here are a few examples:

- A single parent with two children claiming the EITC must provide documentation of income and residency to the tax preparer.

- A married couple filing jointly who both work and have qualifying children needs to ensure that all eligibility criteria are met before claiming the credit.

- A taxpayer who is self-employed and claims the EITC must provide additional documentation regarding their income and expenses.

In each case, the tax preparer must complete Form 8867 to document due diligence and verify the taxpayer's eligibility for the credit.

Quick guide on how to complete form 8867 paid preparers due diligence checklistsupportpreparer due diligenceearned income tax creditpreparer due

Complete Form 8867 Paid Preparer's Due Diligence ChecklistSupportpreparer Due DiligenceEarned Income Tax Creditpreparer Due DiligenceEarn effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form 8867 Paid Preparer's Due Diligence ChecklistSupportpreparer Due DiligenceEarned Income Tax Creditpreparer Due DiligenceEarn on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 8867 Paid Preparer's Due Diligence ChecklistSupportpreparer Due DiligenceEarned Income Tax Creditpreparer Due DiligenceEarn with ease

- Locate Form 8867 Paid Preparer's Due Diligence ChecklistSupportpreparer Due DiligenceEarned Income Tax Creditpreparer Due DiligenceEarn and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you select. Modify and eSign Form 8867 Paid Preparer's Due Diligence ChecklistSupportpreparer Due DiligenceEarned Income Tax Creditpreparer Due DiligenceEarn to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8867 paid preparers due diligence checklistsupportpreparer due diligenceearned income tax creditpreparer due

Create this form in 5 minutes!

How to create an eSignature for the form 8867 paid preparers due diligence checklistsupportpreparer due diligenceearned income tax creditpreparer due

How to make an eSignature for a PDF document in the online mode

How to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is form 8867 and why is it important?

Form 8867 is used by tax preparers to signNow that they have completed due diligence when claiming the Earned Income Tax Credit (EITC). It is crucial for ensuring compliance with IRS regulations and avoiding penalties. By using airSlate SignNow, you can easily prepare and send form 8867 to your clients efficiently.

-

How does airSlate SignNow help with form 8867 preparation?

airSlate SignNow simplifies the preparation of form 8867 by providing templates and electronic signatures. This allows you to complete the form quickly and securely, ensuring that all necessary information is included. Our user-friendly interface makes the process seamless for both tax preparers and clients.

-

Is there a cost associated with using airSlate SignNow for form 8867?

Yes, airSlate SignNow offers various pricing plans to accommodate different business sizes and needs. Each plan includes features that assist with document preparation, including form 8867. Explore our pricing options to find the best fit for your tax preparation services.

-

What features does airSlate SignNow offer for managing form 8867?

airSlate SignNow provides a variety of features for managing form 8867, such as customizable templates, electronic signing, and document tracking. These tools help streamline the process and ensure that clients can easily access and sign the form securely. Additionally, our integration capabilities allow for improved workflow within your business.

-

Can I integrate airSlate SignNow with my tax software for form 8867?

Absolutely! airSlate SignNow offers integrations with popular tax software to facilitate the easy import and export of form 8867. This integration saves time and reduces errors, enhancing your overall efficiency when preparing tax documents.

-

What are the benefits of using airSlate SignNow for form 8867?

Using airSlate SignNow for form 8867 offers many benefits, including increased efficiency, secure document handling, and ease of client access. You can also minimize paper usage and streamline approval processes, making your tax preparation services more eco-friendly and effective.

-

Is it secure to send form 8867 using airSlate SignNow?

Yes, airSlate SignNow ensures the security of your documents, including form 8867, with advanced encryption and compliance with industry standards. Your clients' sensitive information is protected throughout the signing process, giving you and your clients peace of mind.

Get more for Form 8867 Paid Preparer's Due Diligence ChecklistSupportpreparer Due DiligenceEarned Income Tax Creditpreparer Due DiligenceEarn

Find out other Form 8867 Paid Preparer's Due Diligence ChecklistSupportpreparer Due DiligenceEarned Income Tax Creditpreparer Due DiligenceEarn

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document