Form 3596 Paid Preparer's Due Diligence Checklist for California Earned Income Tax Credit 2022-2026

What is the Form 3596 Paid Preparer's Due Diligence Checklist?

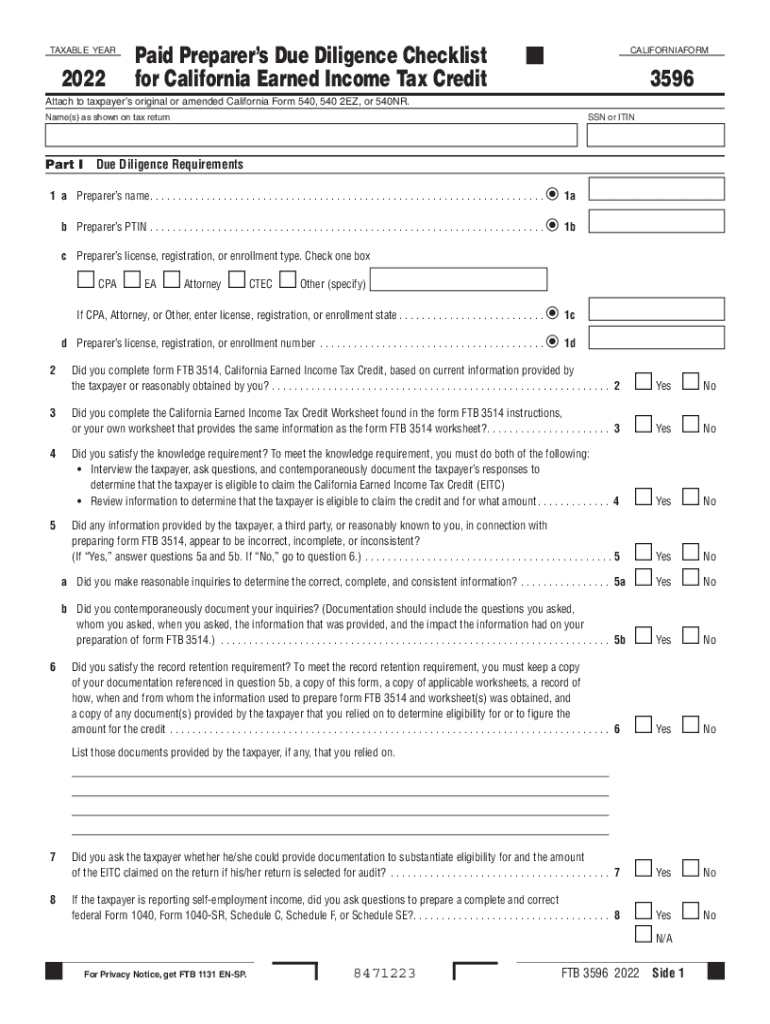

The Form 3596, known as the Paid Preparer's Due Diligence Checklist, is essential for tax preparers in California when assisting clients with the Earned Income Tax Credit (EITC). This form ensures that tax preparers meet their due diligence requirements by documenting the steps taken to determine a taxpayer's eligibility for the EITC. The checklist helps maintain compliance with state regulations and protects both the taxpayer and the preparer from potential penalties associated with improper claims.

Steps to Complete the Form 3596 Paid Preparer's Due Diligence Checklist

Completing the Form 3596 involves a series of methodical steps that tax preparers must follow to ensure accuracy and compliance. The following steps outline the process:

- Gather necessary documentation from the taxpayer, including income statements, identification, and any relevant tax documents.

- Review the eligibility criteria for the EITC to confirm that the taxpayer qualifies based on their income and family situation.

- Complete each section of the Form 3596, ensuring that all required information is accurately filled out.

- Maintain copies of the completed checklist and supporting documents for your records, as these may be necessary for audits or reviews.

Legal Use of the Form 3596 Paid Preparer's Due Diligence Checklist

The legal use of the Form 3596 is crucial for tax preparers to avoid penalties and ensure compliance with California tax laws. Tax preparers must use this form to document their due diligence efforts when preparing returns that claim the EITC. Failure to complete the checklist properly can result in fines or disqualification from claiming the credit. The form serves as a protective measure for both the taxpayer and the preparer, ensuring that all claims are legitimate and well-supported.

IRS Guidelines for the Form 3596

The IRS provides specific guidelines regarding the use of the Form 3596. These guidelines emphasize the importance of thorough documentation and adherence to due diligence requirements. Tax preparers are encouraged to familiarize themselves with these guidelines to ensure they are taking the necessary steps to verify taxpayer eligibility for the EITC. Understanding these requirements helps preparers avoid common pitfalls and ensures that they are acting in accordance with federal and state regulations.

Required Documents for the Form 3596

When completing the Form 3596, tax preparers must collect several key documents from their clients to support the EITC claim. These documents typically include:

- Proof of income, such as W-2 forms or 1099 statements.

- Social Security numbers for all qualifying children and the taxpayer.

- Identification documents, such as a driver's license or state ID.

- Any other documentation that supports the taxpayer's claim for the EITC.

Penalties for Non-Compliance with the Form 3596

Non-compliance with the requirements associated with the Form 3596 can lead to significant penalties for tax preparers. These penalties may include fines, disqualification from preparing EITC claims, or even legal action in severe cases. It is essential for tax preparers to understand the implications of failing to complete the form correctly and to ensure that they are following all necessary procedures to protect themselves and their clients.

Quick guide on how to complete 2022 form 3596 paid preparers due diligence checklist for california earned income tax credit

Effortlessly Prepare Form 3596 Paid Preparer's Due Diligence Checklist For California Earned Income Tax Credit on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with every tool you need to swiftly create, edit, and eSign your documents without delay. Handle Form 3596 Paid Preparer's Due Diligence Checklist For California Earned Income Tax Credit on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-driven task today.

Steps to Modify and eSign Form 3596 Paid Preparer's Due Diligence Checklist For California Earned Income Tax Credit with Ease

- Obtain Form 3596 Paid Preparer's Due Diligence Checklist For California Earned Income Tax Credit and click on Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize important sections of the documents or obscure sensitive details using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your edits.

- Choose your preferred method to share your form, whether via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Modify and eSign Form 3596 Paid Preparer's Due Diligence Checklist For California Earned Income Tax Credit to ensure seamless communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 3596 paid preparers due diligence checklist for california earned income tax credit

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 3596 paid preparers due diligence checklist for california earned income tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8867, and why is it important?

Form 8867 is a tax form used to determine a taxpayer's eligibility for the Earned Income Tax Credit. It's essential because accurate completion can help taxpayers maximize their refund and ensure compliance with IRS requirements. By using airSlate SignNow, you can easily eSign and send your Form 8867 securely.

-

How can airSlate SignNow help with Form 8867?

airSlate SignNow simplifies the process of managing Form 8867 by allowing users to electronically sign and send the form with ease. Our platform ensures that your documents are secure, compliant, and accessible. You can quickly share your Form 8867 with clients or colleagues, streamlining your workflow.

-

What features does airSlate SignNow offer for handling Form 8867?

airSlate SignNow offers features like customizable templates, bulk sending, and real-time tracking for your Form 8867. Additionally, you can integrate with various applications to automate your document workflows, ensuring that your tax forms are processed efficiently and accurately.

-

Is there a cost associated with using airSlate SignNow for Form 8867?

Yes, airSlate SignNow offers various pricing plans depending on your needs, starting from affordable options for individuals to comprehensive solutions for businesses. The investment in our platform can save you time and streamline your processes, ultimately making handling your Form 8867 much easier.

-

Can I use airSlate SignNow on mobile devices for Form 8867?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to complete and eSign Form 8867 on the go. Whether you're in the office or working remotely, you can access your documents and manage your eSignatures from anywhere.

-

Are there integrations available with airSlate SignNow for Form 8867?

Yes, airSlate SignNow integrates seamlessly with various applications, such as Google Drive, Dropbox, and CRM systems. These integrations allow for easy document management and sharing, making the handling of Form 8867 more efficient and organized.

-

What benefits does airSlate SignNow provide for users handling Form 8867?

Using airSlate SignNow for your Form 8867 provides benefits like increased efficiency, enhanced security, and compliance with tax regulations. The easy-to-use platform helps you get documents signed faster, which can lead to quicker tax processing and increased satisfaction for you and your clients.

Get more for Form 3596 Paid Preparer's Due Diligence Checklist For California Earned Income Tax Credit

- Mutual wills or last will and testaments for man and woman living together not married with minor children south dakota form

- Non marital cohabitation living together agreement south dakota form

- Paternity law and procedure handbook south dakota form

- Bill of sale in connection with sale of business by individual or corporate seller south dakota form

- Office lease agreement south dakota form

- South dakota service form

- Notice of entry of judgment and decree of divorce south dakota form

- Commercial sublease south dakota form

Find out other Form 3596 Paid Preparer's Due Diligence Checklist For California Earned Income Tax Credit

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT