California Guidelines for Filing a Group Form 540 NR

What is the California Guidelines for Filing a Group Form 540 NR

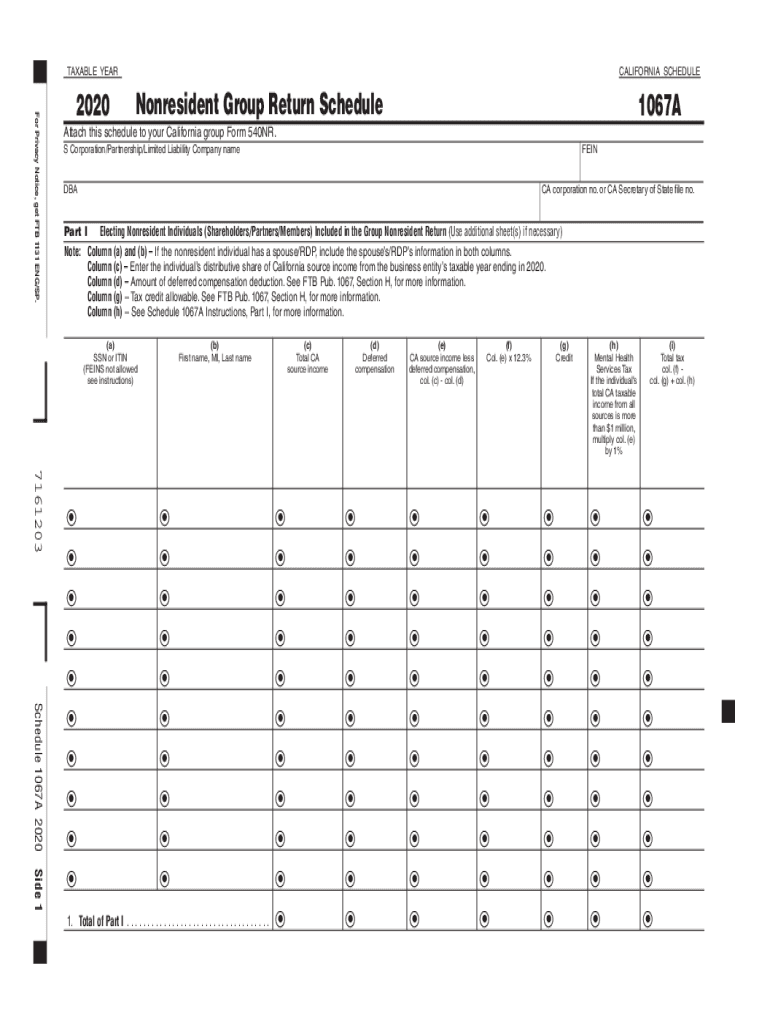

The California Guidelines for Filing a Group Form 540 NR provide essential instructions for individuals and entities filing their state tax returns. This form is specifically designed for non-residents who need to report income earned in California. Understanding these guidelines is crucial for ensuring compliance with state tax laws and for accurately reporting income, deductions, and credits. The guidelines outline the necessary steps, required documentation, and filing procedures to facilitate a smooth filing process.

Steps to Complete the California Guidelines for Filing a Group Form 540 NR

Completing the California Guidelines for Filing a Group Form 540 NR involves several key steps:

- Gather all necessary documents, including income statements, W-2 forms, and any other relevant financial records.

- Review the guidelines to understand the specific requirements for non-residents.

- Fill out the form accurately, ensuring that all income and deductions are reported correctly.

- Double-check the completed form for any errors or omissions.

- Submit the form either electronically or via mail, following the submission instructions provided in the guidelines.

Legal Use of the California Guidelines for Filing a Group Form 540 NR

The legal use of the California Guidelines for Filing a Group Form 540 NR is essential for compliance with California tax laws. Adhering to these guidelines ensures that taxpayers fulfill their obligations accurately and on time. The guidelines also provide clarity on the legal ramifications of incorrect filings, including potential penalties and interest on unpaid taxes. Understanding the legal framework surrounding this form helps taxpayers navigate the complexities of state tax regulations.

Required Documents for Filing a Group Form 540 NR

When filing a Group Form 540 NR, certain documents are required to substantiate the information provided. These include:

- W-2 forms from employers indicating wages earned.

- 1099 forms for any additional income received.

- Records of deductions and credits that may apply.

- Identification information, such as Social Security numbers for all filers.

Having these documents ready will streamline the filing process and help ensure accuracy.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the California Guidelines for Filing a Group Form 540 NR. Typically, the deadline for filing is April 15 of the year following the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and the implications of late filings.

Form Submission Methods

The California Guidelines for Filing a Group Form 540 NR can be submitted through various methods, including:

- Online submission via the California Franchise Tax Board's website.

- Mailing a paper form to the appropriate tax office.

- In-person submission at designated tax offices.

Choosing the right submission method can enhance the efficiency of the filing process and ensure timely processing of the tax return.

Quick guide on how to complete filing group

Prepare filing group effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without any delays. Manage publication 1067 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign filing group with minimal effort

- Obtain ca group and click Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize relevant sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your PC.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate new document printouts. airSlate SignNow manages all your document administration needs in just a few clicks from any device you choose. Modify and eSign publication 1067 while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ca group

Create this form in 5 minutes!

How to create an eSignature for the publication 1067

How to make an eSignature for your PDF document online

How to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask ca group

-

What is publication 1067 and how does it relate to airSlate SignNow?

Publication 1067 refers to guidelines that can help businesses understand the best practices for document management and eSignature solutions. airSlate SignNow aligns with these guidelines by providing a secure, efficient, and user-friendly platform for sending and signing documents, ensuring compliance with industry standards.

-

How much does airSlate SignNow cost for businesses looking to utilize publication 1067?

The pricing for airSlate SignNow is competitive and varies based on the plan you choose, catering to small and large businesses alike. By leveraging the features relevant to publication 1067, you can optimize expenses while maximizing document efficiency through tailored pricing options.

-

What features does airSlate SignNow offer in accordance with publication 1067?

AirSlate SignNow includes features such as unlimited document templates, advanced security measures, and customizable workflows, all designed to meet the standards outlined in publication 1067. These features empower businesses to streamline their document processes while remaining compliant with regulatory guidelines.

-

How can publication 1067 benefit my small business using airSlate SignNow?

By following the insights provided in publication 1067, small businesses can enhance their document workflow efficiency with airSlate SignNow. This leads to faster transaction times, reduced paper usage, and a more organized approach to document management, ultimately fostering better customer relationships.

-

Does airSlate SignNow integrate with other software to support publication 1067?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing businesses to create a cohesive ecosystem that supports the processes outlined in publication 1067. Popular integrations include CRM tools and cloud storage solutions, enhancing overall productivity and document management efficiency.

-

Is airSlate SignNow compliant with the regulations discussed in publication 1067?

Absolutely, airSlate SignNow takes compliance seriously and incorporates the necessary security measures to align with the regulations mentioned in publication 1067. This ensures that all electronic signatures and document transactions are legally binding and secure, reducing risk for your business.

-

What are the advantages of using airSlate SignNow over competitors when considering publication 1067?

AirSlate SignNow offers a user-friendly interface, robust features, and cost-effective pricing models that make it stand out among competitors in light of publication 1067. Its commitment to enhancing user experience while ensuring compliance and efficiency provides a signNow edge for businesses seeking an eSignature solution.

Get more for publication 1067

- Your guide to health care coverage employment security esd wa form

- Indiana family and social services administration state of indiana form

- A new approach to measuring residence status american form

- Consumer financial services application michigan form

- Jorge alejandro final order jorge alejandro final order dfi wa form

- Code of ethics fredericksburg area builders associations form

- Certification application amp guide pdf how it works netanational form

- Uniform sales amp use tax certificate independence medical

Find out other filing group

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking