Penalty Who Must Pay the Underpayment Part I Required Instructions for Form 2210 Internal Revenue ServiceInstructions for Form 2 2020

Understanding the Delaware Underpayment Form

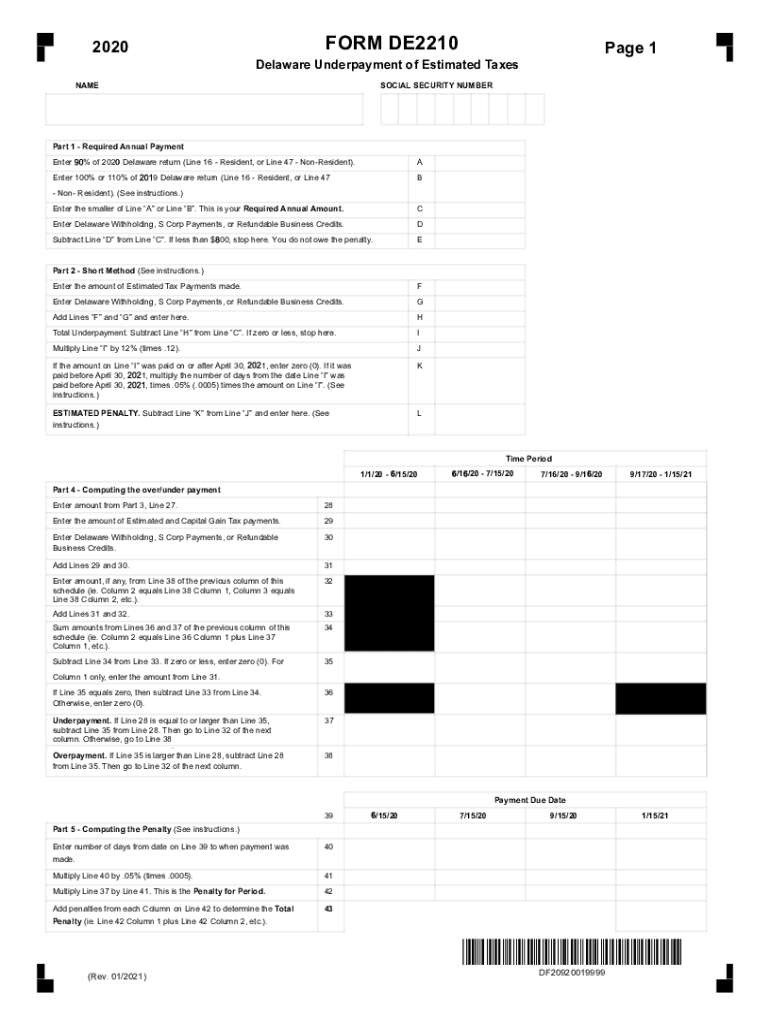

The Delaware underpayment form, often referred to as the DE2210, is essential for taxpayers who may not have paid enough estimated tax throughout the year. This form helps calculate any penalties for underpayment and ensures compliance with state tax regulations. It is particularly relevant for individuals and businesses that have fluctuating income or those who do not have sufficient tax withheld from their paychecks.

Steps to Complete the Delaware Underpayment Form

Filling out the Delaware underpayment form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather your income information, including W-2s and 1099s.

- Calculate your total tax liability for the year.

- Determine the amount of tax you have already paid through withholding and estimated payments.

- Use the DE2210 to calculate any underpayment penalties based on your total tax liability and payments made.

- Complete the form by filling in all required fields accurately.

- Review the form for errors before submission.

Filing Deadlines for the Delaware Underpayment Form

It is crucial to be aware of the filing deadlines associated with the Delaware underpayment form. Typically, the form must be filed by the same deadline as your state income tax return. For most taxpayers, this means submitting the DE2210 by April 30 of the following year. If you miss this deadline, you may incur additional penalties.

Penalties for Non-Compliance

Failure to file the Delaware underpayment form or underpayment of estimated tax can result in penalties. The state may impose a penalty based on the amount of underpayment and the duration of the underpayment period. Understanding these penalties can help taxpayers avoid unexpected costs and ensure compliance with state tax laws.

Who Issues the Delaware Underpayment Form

The Delaware underpayment form is issued by the Delaware Division of Revenue. This agency is responsible for administering state tax laws and ensuring compliance among taxpayers. It is important to refer to the official resources provided by the Division of Revenue for the most current version of the form and any updates to tax regulations.

Digital vs. Paper Version of the Delaware Underpayment Form

Taxpayers have the option to fill out the Delaware underpayment form either digitally or on paper. The digital version allows for easier completion and submission, often providing instant feedback on potential errors. Conversely, the paper version can be filled out manually and mailed to the appropriate tax office. Choosing the right format depends on individual preferences and access to technology.

Eligibility Criteria for Using the Delaware Underpayment Form

To use the Delaware underpayment form, taxpayers must meet specific eligibility criteria. Generally, this form is applicable to individuals and entities that expect to owe tax of $1,000 or more when filing their return. Additionally, those who have had insufficient withholding or estimated payments throughout the year should consider filing the DE2210 to avoid penalties.

Quick guide on how to complete penalty who must pay the underpayment part i required instructions for form 2210 2019internal revenue serviceinstructions for

Effortlessly Prepare Penalty Who Must Pay The Underpayment Part I Required Instructions For Form 2210 Internal Revenue ServiceInstructions For Form 2 on Any Device

Managing documents online has become increasingly popular among corporations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without delays. Handle Penalty Who Must Pay The Underpayment Part I Required Instructions For Form 2210 Internal Revenue ServiceInstructions For Form 2 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Alter and Electronically Sign Penalty Who Must Pay The Underpayment Part I Required Instructions For Form 2210 Internal Revenue ServiceInstructions For Form 2 with Ease

- Obtain Penalty Who Must Pay The Underpayment Part I Required Instructions For Form 2210 Internal Revenue ServiceInstructions For Form 2 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and electronically sign Penalty Who Must Pay The Underpayment Part I Required Instructions For Form 2210 Internal Revenue ServiceInstructions For Form 2 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct penalty who must pay the underpayment part i required instructions for form 2210 2019internal revenue serviceinstructions for

Create this form in 5 minutes!

How to create an eSignature for the penalty who must pay the underpayment part i required instructions for form 2210 2019internal revenue serviceinstructions for

The best way to create an eSignature for a PDF in the online mode

The best way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the Delaware underpayment form?

The Delaware underpayment form is a tax document used to report underpayment of estimated taxes by individuals or businesses. It's essential for ensuring compliance with state tax regulations in Delaware. If you're unsure about your obligations, completing the Delaware underpayment form correctly will help you avoid penalties.

-

How does airSlate SignNow assist with the Delaware underpayment form?

airSlate SignNow provides a seamless platform for completing and signing the Delaware underpayment form online. With our intuitive interface, you can fill out the form easily, ensuring all necessary information is included. This reduces the chances of errors and helps expedite the submission process.

-

What features does airSlate SignNow offer for processing the Delaware underpayment form?

With airSlate SignNow, you can eSign the Delaware underpayment form securely and manage your documents efficiently. Features like templates, customizable workflows, and cloud storage help streamline the process. Additionally, our platform allows for easy sharing and collaboration on the document.

-

Is there a cost associated with using airSlate SignNow for the Delaware underpayment form?

airSlate SignNow offers competitive pricing plans that cater to different business needs, making it a cost-effective option for processing the Delaware underpayment form. You can choose from various subscription tiers based on your usage. Consider starting with a free trial to explore its features without commitment.

-

Can I integrate airSlate SignNow with other tools to manage the Delaware underpayment form?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to manage the Delaware underpayment form alongside your other business tools. Whether it's CRM systems, cloud storage services, or accounting software, our integrations enhance your workflow efficiency. This makes it easier to keep track of your documents.

-

What are the benefits of using airSlate SignNow for tax-related documents like the Delaware underpayment form?

Using airSlate SignNow for documents such as the Delaware underpayment form simplifies the signing process and increases accuracy. The platform improves turnaround time and offers secure storage for your sensitive information. Additionally, the digital nature of our service ensures you can access your forms anytime, anywhere.

-

How can I ensure my Delaware underpayment form is submitted on time with airSlate SignNow?

To ensure timely submission of the Delaware underpayment form using airSlate SignNow, utilize our reminder features and automated workflows. Set deadlines for signing and sending to keep all parties accountable. This proactive approach helps you avoid late fees and ensure compliance with Delaware tax regulations.

Get more for Penalty Who Must Pay The Underpayment Part I Required Instructions For Form 2210 Internal Revenue ServiceInstructions For Form 2

Find out other Penalty Who Must Pay The Underpayment Part I Required Instructions For Form 2210 Internal Revenue ServiceInstructions For Form 2

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online