DELAWARE 2021

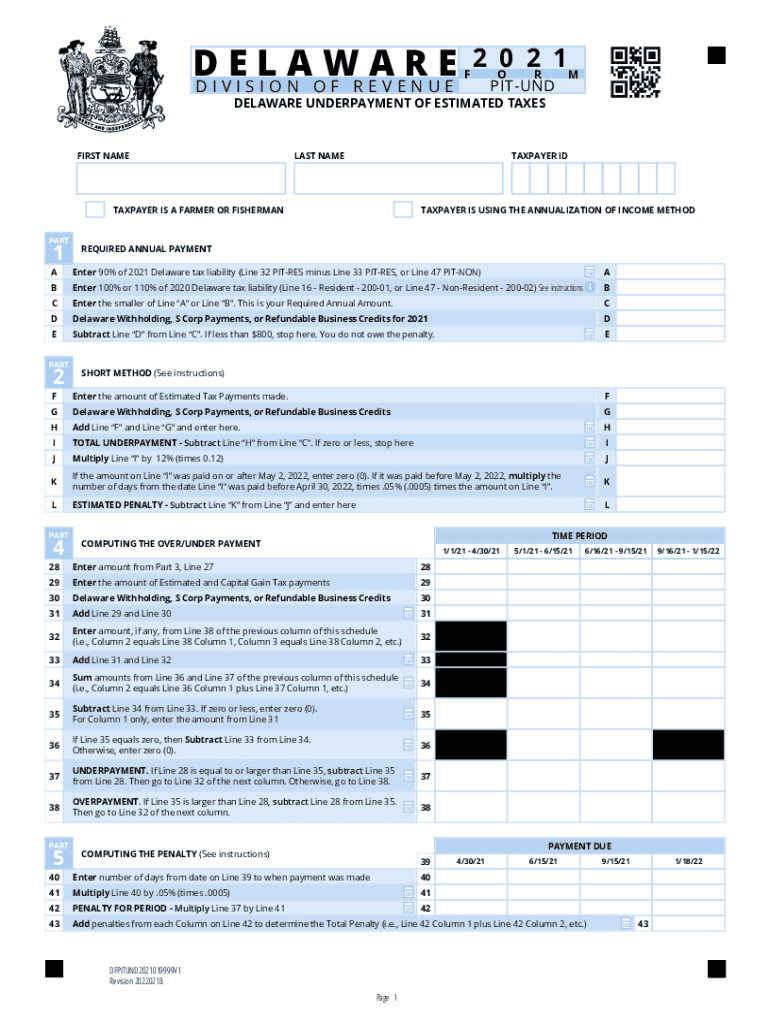

What is the DE2210?

The DE2210 is a form used in Delaware for reporting the estimated tax liability of individuals and businesses. This form is essential for taxpayers who expect to owe a certain amount in taxes and want to avoid penalties for underpayment. By submitting the DE2210, taxpayers can calculate and pay their estimated tax obligations throughout the year, ensuring compliance with state tax laws.

How to use the DE2210

Using the DE2210 involves several steps. First, gather all necessary financial information, including income, deductions, and credits. Next, complete the form by accurately entering your estimated income and calculating the tax owed. It is important to ensure that all figures are correct to avoid penalties. Once completed, submit the form according to the specified methods, either online or by mail.

Steps to complete the DE2210

Completing the DE2210 requires careful attention to detail. Follow these steps:

- Gather your financial documents, including previous tax returns and income statements.

- Calculate your estimated income for the current tax year.

- Determine applicable deductions and credits.

- Fill out the DE2210 form with the calculated figures.

- Review the form for accuracy before submission.

- Submit the form by the due date to avoid penalties.

Legal use of the DE2210

The DE2210 must be used in accordance with Delaware tax laws. It is legally binding when filled out correctly and submitted on time. Failure to comply with the submission requirements can result in penalties and interest on unpaid taxes. It is crucial for taxpayers to understand their obligations under state law to ensure that they are using the DE2210 appropriately.

Filing Deadlines / Important Dates

Timely filing of the DE2210 is essential to avoid penalties. The deadlines for submitting estimated tax payments typically align with quarterly due dates. For most taxpayers, these deadlines are April 15, June 15, September 15, and January 15 of the following year. It is important to stay informed about any changes to these dates to ensure compliance.

Required Documents

To complete the DE2210, you will need several documents, including:

- Previous year’s tax return for reference.

- Income statements such as W-2s or 1099s.

- Documentation of any deductions or credits you plan to claim.

Having these documents on hand will streamline the completion process and help ensure accuracy.

Who Issues the Form

The DE2210 is issued by the Delaware Division of Revenue. This state agency is responsible for collecting taxes and ensuring compliance with tax laws. Taxpayers can obtain the form directly from their website or through authorized tax professionals.

Quick guide on how to complete delaware 613381459

Effortlessly Prepare DELAWARE on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage DELAWARE on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and eSign DELAWARE with Ease

- Find DELAWARE and then click Get Form to initiate.

- Utilize the features we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the issues of lost or misfiled documents, tedious form searches, and errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Edit and eSign DELAWARE and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct delaware 613381459

Create this form in 5 minutes!

People also ask

-

What is the de2210 form and how can airSlate SignNow help?

The de2210 form is used by taxpayers to report estimated tax payments. airSlate SignNow enables users to easily send, receive, and eSign the de2210 document, making the process more streamlined and efficient for individuals and businesses alike.

-

How does airSlate SignNow ensure the security of my de2210 documents?

airSlate SignNow prioritizes security by employing advanced encryption protocols to protect your de2210 documents. Additionally, it complies with industry regulations, ensuring that your sensitive information remains confidential during the eSigning process.

-

Is there a free trial available for airSlate SignNow when using de2210?

Yes, airSlate SignNow offers a free trial that allows prospective users to explore its features when working with the de2210 form. This trial provides access to all key functionalities, enabling users to understand how it can enhance their document management experience.

-

What pricing plans does airSlate SignNow offer for eSigning de2210?

airSlate SignNow offers several pricing plans designed to cater to different business needs, including options specifically for handling forms like de2210. Each plan provides flexibility, allowing businesses to choose a setup that best meets their volume and feature requirements.

-

Can I integrate airSlate SignNow with other software when managing de2210 forms?

Absolutely! airSlate SignNow seamlessly integrates with various platforms, enhancing your experience when managing the de2210 form. Popular integrations include CRM systems, document storage services, and accounting software, facilitating a comprehensive workflow.

-

What are the primary benefits of using airSlate SignNow for my de2210 eSignatures?

Using airSlate SignNow for your de2210 eSignatures offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced tracking capabilities. This user-friendly platform simplifies managing documents, allowing for quicker turnaround times and improved productivity.

-

How can I track the status of my eSigned de2210 documents?

airSlate SignNow provides real-time tracking for your eSigned de2210 documents, giving you visibility into their status throughout the signing process. This feature ensures that you can easily monitor when documents are signed and who has completed the signing steps.

Get more for DELAWARE

- Essential legal life documents for newlyweds mississippi form

- Essential legal life documents for military personnel mississippi form

- Essential legal life documents for new parents mississippi form

- Power of attorney for care and custody of child or children mississippi form

- Mississippi business form

- Company employment policies and procedures package mississippi form

- Revocation of power of attorney for care and custody of child or children mississippi form

- Newly divorced individuals package mississippi form

Find out other DELAWARE

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist