Form Indiana Department of Revenue Estimated Tax Payment 2020

What is the Indiana Department of Revenue Estimated Tax Payment Form?

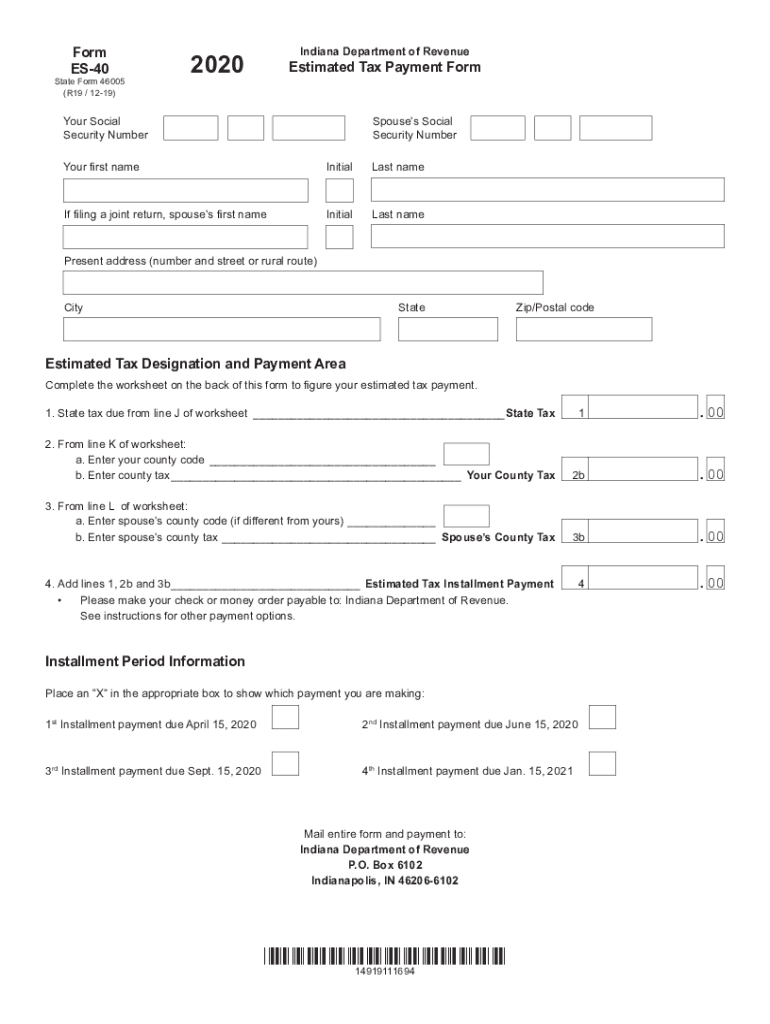

The Indiana Department of Revenue Estimated Tax Payment Form, commonly referred to as the es40 form, is a document used by individuals and businesses to report and pay estimated income taxes throughout the year. This form is essential for taxpayers who expect to owe a certain amount of tax when they file their annual returns. By submitting estimated payments using the es40 form, taxpayers can avoid penalties and interest that may arise from underpayment of taxes. It is particularly relevant for self-employed individuals, freelancers, and those with significant non-wage income.

Steps to Complete the Indiana Department of Revenue Estimated Tax Payment Form

Completing the es40 form involves several key steps to ensure accuracy and compliance with state regulations. Follow these guidelines:

- Gather necessary financial information, including your expected income and deductions for the year.

- Calculate your estimated tax liability based on your income projections. Use the Indiana tax rates applicable to your income bracket.

- Fill out the es40 form with your personal information, including your name, address, and Social Security number or Employer Identification Number (EIN).

- Input your estimated tax payment amount for the current quarter.

- Review the form for any errors or omissions before submission.

- Choose your payment method—options typically include online payment, mail, or in-person submission.

Legal Use of the Indiana Department of Revenue Estimated Tax Payment Form

The es40 form is legally recognized as a valid method for reporting and paying estimated taxes in Indiana. To ensure its legal standing, it must be filled out accurately and submitted by the due dates established by the Indiana Department of Revenue. Compliance with the state's tax laws is crucial, as failure to submit the es40 form or make timely payments can result in penalties. Utilizing a trusted electronic signature platform, such as signNow, can enhance the legal validity of your submissions by providing secure digital signatures and maintaining compliance with relevant eSignature laws.

Obtaining the Indiana Department of Revenue Estimated Tax Payment Form

The es40 form can be obtained through several convenient methods. Taxpayers can download a printable version directly from the Indiana Department of Revenue's website. Additionally, many tax preparation software programs include the form and can assist in filling it out. For those who prefer a physical copy, the form is also available at local tax offices and public libraries throughout Indiana. Ensuring you have the correct version of the form is essential, especially if you are filing for a specific tax year.

Filing Deadlines for the Indiana Department of Revenue Estimated Tax Payment Form

Timely submission of the es40 form is crucial to avoid penalties. Estimated tax payments are typically due on a quarterly basis, with deadlines falling on the 15th of April, June, September, and January of the following year. It is important to mark these dates on your calendar and prepare your payments in advance to ensure compliance. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Keeping track of these deadlines can help you manage your tax obligations effectively.

Penalties for Non-Compliance with the Indiana Department of Revenue Estimated Tax Payment Form

Failure to submit the es40 form or make required estimated tax payments can result in significant penalties. The Indiana Department of Revenue imposes penalties for underpayment, which can accumulate over time. Additionally, interest may accrue on any unpaid tax balance. Taxpayers who do not meet their estimated payment obligations may also face difficulties when filing their annual returns. It is advisable to stay informed about your payment requirements and maintain accurate records to avoid these consequences.

Quick guide on how to complete form 2020 indiana department of revenue estimated tax payment

Complete Form Indiana Department Of Revenue Estimated Tax Payment effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form Indiana Department Of Revenue Estimated Tax Payment on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form Indiana Department Of Revenue Estimated Tax Payment with ease

- Obtain Form Indiana Department Of Revenue Estimated Tax Payment and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for this task.

- Generate your eSignature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign Form Indiana Department Of Revenue Estimated Tax Payment and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2020 indiana department of revenue estimated tax payment

Create this form in 5 minutes!

How to create an eSignature for the form 2020 indiana department of revenue estimated tax payment

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is the es40 form and why is it important?

The es40 form is a crucial document for businesses looking to streamline their electronic signing process. It allows users to capture signatures with legal validity, ensuring that agreements are upheld in court. Understanding how to utilize the es40 form can enhance your organization's efficiency and compliance.

-

How can airSlate SignNow help me with the es40 form?

airSlate SignNow provides an intuitive platform that makes it easy to create, send, and eSign the es40 form. With its user-friendly interface, you can quickly prepare your documents, gather signatures, and track their status in real-time. This saves time and boosts productivity for your business.

-

Is there a cost associated with using the es40 form in airSlate SignNow?

Yes, there is a cost associated with using the es40 form in airSlate SignNow, but it offers flexible pricing plans tailored to different business needs. The platform's cost-effective solution provides excellent value by reducing paper waste and administrative tasks. Review the pricing options on our website to find the best fit for your organization.

-

What features does airSlate SignNow offer for managing the es40 form?

airSlate SignNow includes various features to enhance your experience with the es40 form, such as customizable templates, automated reminders, and secure cloud storage. These features ensure that your documents are organized, accessible, and legally binding. Enjoy seamless integration with other tools to optimize your workflow.

-

Can I integrate the es40 form with other software using airSlate SignNow?

Absolutely! airSlate SignNow allows integration with numerous applications, making it easy to incorporate the es40 form into your existing workflows. Whether you're using CRM systems, document management tools, or project management platforms, our solution adapts to your business processes effortlessly.

-

What are the benefits of using airSlate SignNow for the es40 form?

Using airSlate SignNow for the es40 form streamlines your document signing process, saving time and improving efficiency. The electronic signatures provided are secure and legally binding, ensuring compliance with regulations. Additionally, the platform helps reduce paper usage and related costs.

-

Is it easy to track the status of the es40 form with airSlate SignNow?

Yes, tracking the status of the es40 form is simple with airSlate SignNow. You can easily see which documents are pending, signed, or completed in real-time. This transparency helps you manage your tasks efficiently and ensures that agreements are executed promptly.

Get more for Form Indiana Department Of Revenue Estimated Tax Payment

- Fort bend county farm bureau achievement and academic form

- Water tank cleaning checklist pdf form

- Drain cleaner restricted registrant verification of training affidavit answers form

- Reserve an appointment harris county clerks office form

- Pdf texas hazlewood act exemption application for continued form

- Daily building and grounds checklist form

- Fillable online duke clacs form to approve courses for

- Harris county appraisal district form 21mh 082011 hcad

Find out other Form Indiana Department Of Revenue Estimated Tax Payment

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now