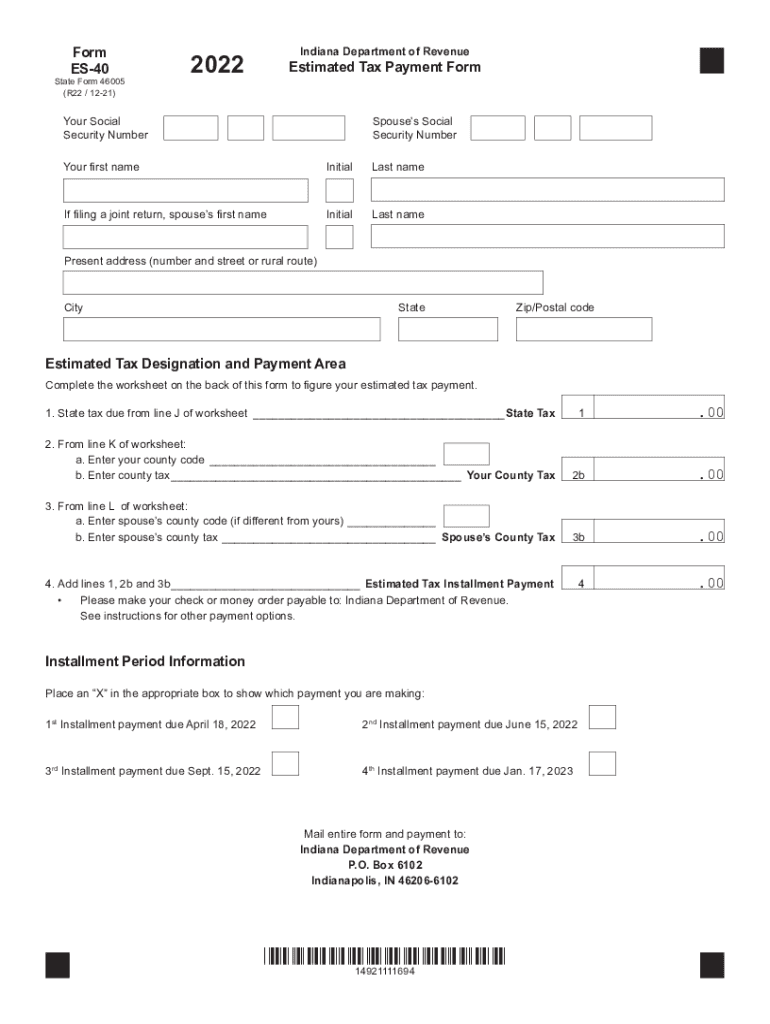

Form Indiana Department of Revenue Estimated Tax 2022

What is the Indiana Department Of Revenue Estimated Tax Form?

The Indiana Department of Revenue Estimated Tax Form, commonly referred to as the es40 form, is used by individuals and businesses to report and pay estimated taxes throughout the year. This form is essential for taxpayers who expect to owe a certain amount of tax when filing their annual returns. It allows them to make periodic payments to avoid penalties and interest for underpayment. The es40 form is particularly relevant for self-employed individuals, freelancers, and those with significant income not subject to withholding.

Steps to Complete the Indiana Department Of Revenue Estimated Tax Form

Completing the es40 form involves several key steps:

- Gather necessary financial information, including income, deductions, and credits.

- Calculate your estimated tax liability for the year based on your income projections.

- Determine the amount you need to pay each quarter to meet your estimated tax obligations.

- Fill out the es40 form accurately, ensuring all required fields are completed.

- Review your calculations and the completed form for accuracy.

- Submit the form either online or via mail, depending on your preference.

How to Obtain the Indiana Department Of Revenue Estimated Tax Form

The es40 form can be obtained directly from the Indiana Department of Revenue's official website. It is available in a printable format, allowing taxpayers to fill it out by hand or digitally. Additionally, the form may be accessible through various tax preparation software programs, which can simplify the process of completing and submitting the form.

Legal Use of the Indiana Department Of Revenue Estimated Tax Form

To ensure the legal validity of the es40 form, it must be filled out in compliance with Indiana tax laws. This includes adhering to deadlines for submission and making timely payments. The form serves as a legal document that reflects your estimated tax obligations, and failure to file or pay accurately can result in penalties. Utilizing a reliable eSigning platform ensures that your form is executed securely and meets all legal requirements.

Filing Deadlines / Important Dates

Timely submission of the es40 form is crucial to avoid penalties. Estimated tax payments are typically due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

It is essential to mark these dates on your calendar and ensure that your payments are made on time to maintain compliance with Indiana tax regulations.

Key Elements of the Indiana Department Of Revenue Estimated Tax Form

The es40 form includes several critical elements that taxpayers must complete:

- Personal Information: Name, address, and Social Security number or taxpayer identification number.

- Estimated Income: Projected income for the year, including wages, self-employment income, and other sources.

- Deductions and Credits: Any deductions or credits that may apply to reduce your tax liability.

- Payment Amount: The total estimated tax due and the amount to be paid each quarter.

Completing these sections accurately is crucial for ensuring that your estimated tax payments are correct and compliant with state regulations.

Quick guide on how to complete form 2015 indiana department of revenue estimated tax

Complete Form Indiana Department Of Revenue Estimated Tax effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Form Indiana Department Of Revenue Estimated Tax on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign Form Indiana Department Of Revenue Estimated Tax with ease

- Obtain Form Indiana Department Of Revenue Estimated Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight necessary sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form Indiana Department Of Revenue Estimated Tax to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2015 indiana department of revenue estimated tax

Create this form in 5 minutes!

People also ask

-

What is the es40 form, and how can it be used?

The es40 form is a specific document used for certain business transactions that require electronic signatures. With airSlate SignNow, you can easily create, send, and eSign es40 forms in a secure and efficient manner, ensuring compliance with legal standards.

-

How much does it cost to use airSlate SignNow for the es40 form?

airSlate SignNow offers flexible pricing plans tailored to your business needs, starting with a free trial. For the es40 form and other documents, you can choose a plan that ensures you have all the features you need at an affordable rate.

-

What features does airSlate SignNow offer for managing the es40 form?

When managing the es40 form, airSlate SignNow provides features such as template creation, automated workflows, and customizable fields. These tools streamline the document signing process, making it easier to get necessary approvals.

-

Can I track the status of my es40 form after sending it?

Yes, airSlate SignNow allows you to track the status of your es40 form in real-time. You will receive notifications when the document is opened, signed, or completed, ensuring you stay updated throughout the process.

-

Is airSlate SignNow compliant with regulations for the es40 form?

Absolutely! airSlate SignNow is compliant with e-signature laws such as ESIGN and UETA, ensuring that your es40 form is legally binding and secure. We prioritize compliance and security for all our users.

-

What integrations does airSlate SignNow offer for using the es40 form?

airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and CRM systems, allowing you to streamline your workflow with the es40 form. These integrations enhance productivity by allowing you to manage documents from one platform.

-

Why should I choose airSlate SignNow for the es40 form over other solutions?

airSlate SignNow provides a user-friendly interface, robust security features, and cost-effective pricing, making it an ideal choice for handling the es40 form. With our platform, you can improve efficiency and minimize errors in document processing.

Get more for Form Indiana Department Of Revenue Estimated Tax

- Bill of sale without warranty by corporate seller nevada form

- Verification of creditors matrix nevada form

- Correction statement and agreement nevada form

- Closing statement nevada form

- Flood zone statement and authorization nevada form

- Name affidavit of buyer nevada form

- Name affidavit of seller nevada form

- Non foreign affidavit under irc 1445 nevada form

Find out other Form Indiana Department Of Revenue Estimated Tax

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer