Indiana Department of Revenue in Gov 2023

Understanding the Indiana Department of Revenue

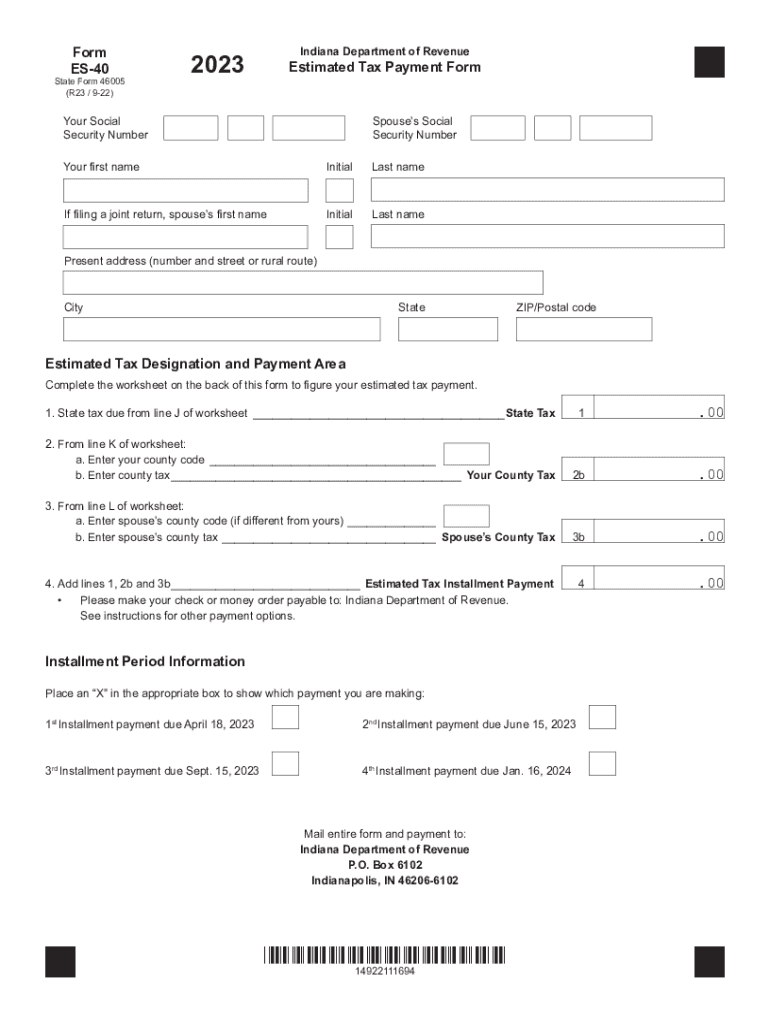

The Indiana Department of Revenue (DOR) is the state agency responsible for administering tax laws and collecting taxes in Indiana. It plays a crucial role in ensuring compliance with state tax regulations, including the management of various tax forms such as the Indiana ES 40 form. The DOR provides resources and guidance to taxpayers, helping them navigate their tax obligations and understand their rights and responsibilities.

Steps to Complete the Indiana ES 40 Form

Completing the Indiana ES 40 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information, including income details and any deductions you plan to claim. Next, accurately fill out each section of the form, ensuring that you follow the instructions provided by the Indiana DOR. After completing the form, review it for any errors or omissions. Finally, submit the form electronically or via mail, depending on your preference.

Legal Use of the Indiana ES 40 Form

The Indiana ES 40 form is legally binding when completed and signed according to state regulations. To ensure that your submission is recognized as valid, it is important to comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws affirm the legality of electronic signatures and documents, provided that certain criteria are met, including the use of a reliable eSignature solution.

Filing Deadlines and Important Dates

Filing deadlines for the Indiana ES 40 form are typically aligned with the tax year. For the 2023 tax year, it is essential to be aware of the specific due dates to avoid penalties. Generally, estimated tax payments for the year are due quarterly. Keeping track of these deadlines will help ensure that you remain compliant with state tax laws and avoid unnecessary penalties.

Form Submission Methods

Taxpayers can submit the Indiana ES 40 form using various methods, including online submission through the Indiana DOR website, mailing a paper form, or delivering it in person to a local DOR office. Online submission is often the most efficient method, providing immediate confirmation of receipt. Each method has its own advantages, so choose the one that best suits your needs and preferences.

Penalties for Non-Compliance

Failure to file the Indiana ES 40 form on time or to make estimated tax payments can result in penalties. These penalties may include late fees and interest on unpaid taxes. It is important to understand the implications of non-compliance and to take proactive steps to meet your tax obligations to avoid these financial repercussions.

Quick guide on how to complete indiana department of revenue ingov

Effortlessly Prepare Indiana Department Of Revenue IN gov on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and electronically sign your documents quickly without any hassles. Handle Indiana Department Of Revenue IN gov on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The Easiest Way to Edit and Electronically Sign Indiana Department Of Revenue IN gov with Ease

- Locate Indiana Department Of Revenue IN gov and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to misplaced or lost documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Indiana Department Of Revenue IN gov and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana department of revenue ingov

Create this form in 5 minutes!

How to create an eSignature for the indiana department of revenue ingov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana ES 40 2023 compliance for electronic signatures?

The Indiana ES 40 2023 compliance refers to the regulations governing electronic signatures in the state of Indiana, ensuring that eSignatures are legally binding. airSlate SignNow fully complies with these regulations, providing you with a secure platform to sign documents electronically. This means your digital transactions are as valid as traditional signatures, allowing you to streamline your processes efficiently.

-

How does airSlate SignNow simplify document signing in Indiana?

AirSlate SignNow simplifies document signing in Indiana by offering a user-friendly interface that allows users to send and eSign documents quickly. With features specifically designed to meet Indiana ES 40 2023 requirements, you can capture signatures, initials, and more with just a few clicks. This convenience helps businesses reduce turnaround time on critical documents.

-

What are the pricing options for airSlate SignNow in Indiana?

AirSlate SignNow offers various pricing plans tailored to meet the needs of businesses in Indiana looking for eSignature solutions. Each plan is designed to provide value while ensuring compliance with Indiana ES 40 2023. You can choose from flexible monthly or yearly subscriptions that fit your budget and workflow demands.

-

What features does airSlate SignNow provide to users in Indiana?

AirSlate SignNow includes essential features such as document templates, real-time tracking, and customizable workflows to enhance the signing experience in Indiana. These features help businesses create efficient signing processes that adhere to Indiana ES 40 2023 guidelines. Additionally, users can access mobile applications to sign documents on the go.

-

Can airSlate SignNow be integrated with other systems in Indiana?

Yes, airSlate SignNow can be easily integrated with various business applications you may already be using in Indiana. Whether it's CRM systems, document management software, or other tools, these integrations allow for a seamless workflow. This functionality ensures compliance with Indiana ES 40 2023 while enhancing operational efficiency.

-

What benefits does airSlate SignNow offer businesses in Indiana?

Businesses in Indiana benefit from using airSlate SignNow through increased efficiency, cost savings, and legal compliance with Indiana ES 40 2023. The platform reduces the need for physical documents, saving time and resources. Furthermore, real-time notifications and tracking help streamline communication between parties involved in the signing process.

-

Is airSlate SignNow secure for handling sensitive documents in Indiana?

Absolutely, airSlate SignNow prioritizes security to ensure that all sensitive documents are handled safely and compliant with Indiana ES 40 2023 regulations. Advanced encryption, multi-factor authentication, and audit trails are in place to protect your data. This means that your electronic transactions are kept confidential and secure throughout the signing process.

Get more for Indiana Department Of Revenue IN gov

- Anoka county energy assistance form

- Request for reasonable accommodation form

- Vics bolbill of lading requiring additional specific a form

- Job completion form 381070596

- Pers bsd 241 form

- Cpc apprentice removal letter example form

- Treverton college scholarship form

- Registrationtaxtitle application vermont department of motor form

Find out other Indiana Department Of Revenue IN gov

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document