Kansas Form K 210 Individual Underpayment of Estimated 2020

What is the Kansas Form K-210 Individual Underpayment of Estimated Tax?

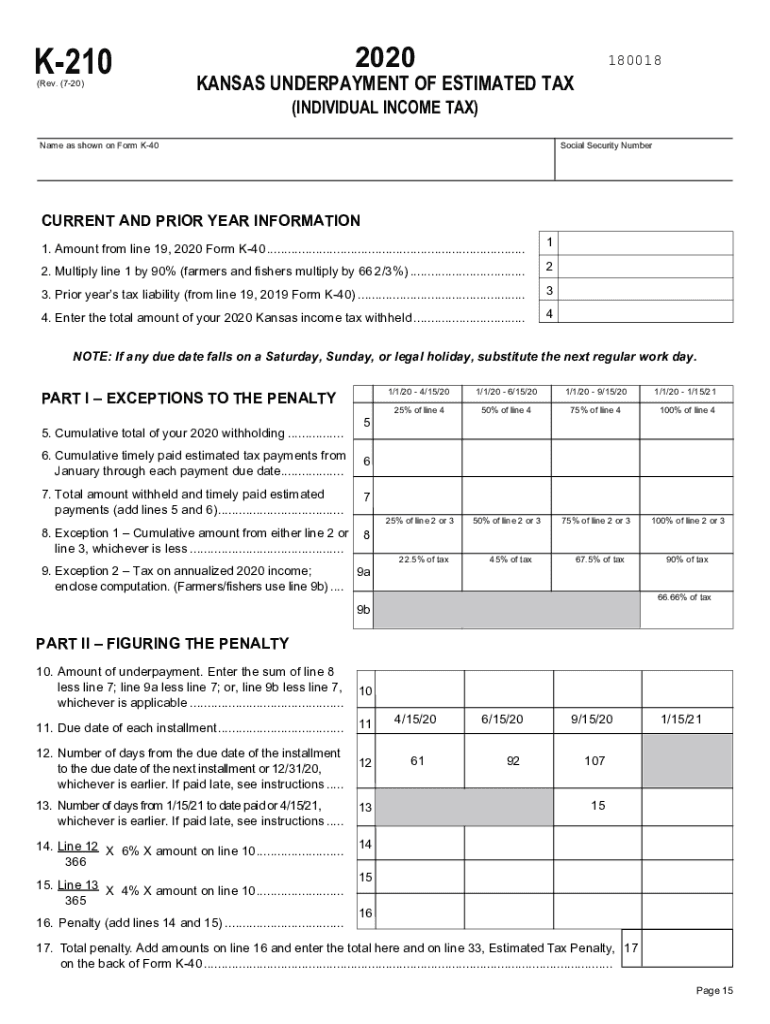

The Kansas Form K-210 is designed for individuals who may have underpaid their estimated taxes throughout the year. This form allows taxpayers to calculate any penalties for underpayment and report them to the Kansas Department of Revenue. The K-210 form is essential for ensuring compliance with state tax regulations and helps taxpayers avoid additional penalties by addressing any discrepancies in their estimated tax payments.

Steps to Complete the Kansas Form K-210 Individual Underpayment of Estimated Tax

Completing the Kansas Form K-210 involves several key steps:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year.

- Determine the amount of estimated tax payments you have made.

- Use the K-210 form to calculate any underpayment penalties based on your total tax liability and payments made.

- Fill out the form accurately, ensuring all calculations are correct.

- Submit the completed form to the Kansas Department of Revenue by the specified deadline.

Legal Use of the Kansas Form K-210 Individual Underpayment of Estimated Tax

The Kansas Form K-210 serves a legal purpose in the tax filing process. It is used to report underpayment of estimated taxes, which is a requirement under Kansas tax law. By filing this form, taxpayers acknowledge their tax obligations and demonstrate compliance with state regulations. This form can also be used as evidence in case of disputes regarding tax payments or penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Kansas Form K-210 is crucial for avoiding penalties. Typically, the form must be submitted by the same date as your annual tax return. Taxpayers should be aware of any changes in deadlines, especially in light of adjustments made by the Kansas Department of Revenue. Keeping track of these dates ensures timely compliance and helps prevent unnecessary penalties.

Penalties for Non-Compliance

Failing to file the Kansas Form K-210 or underpaying estimated taxes can result in significant penalties. The Kansas Department of Revenue may impose fines based on the amount of underpayment and the duration of non-compliance. Taxpayers should be aware that these penalties can accumulate, leading to a larger financial burden. It is advisable to address any underpayment issues promptly to mitigate potential penalties.

Who Issues the Form

The Kansas Form K-210 is issued by the Kansas Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring compliance with Kansas tax laws. Taxpayers can obtain the form directly from the department's official website or through authorized tax professionals. Understanding the issuing authority helps in ensuring that taxpayers are using the most current version of the form.

Quick guide on how to complete kansas form k 210 individual underpayment of estimated

Effortlessly prepare Kansas Form K 210 Individual Underpayment Of Estimated on any device

Online document management has become favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to swiftly create, modify, and eSign your documents without any holdups. Manage Kansas Form K 210 Individual Underpayment Of Estimated on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to modify and eSign Kansas Form K 210 Individual Underpayment Of Estimated with ease

- Locate Kansas Form K 210 Individual Underpayment Of Estimated and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign Kansas Form K 210 Individual Underpayment Of Estimated to ensure superb communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas form k 210 individual underpayment of estimated

Create this form in 5 minutes!

How to create an eSignature for the kansas form k 210 individual underpayment of estimated

The best way to generate an electronic signature for your PDF document online

The best way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the k 210 feature in airSlate SignNow?

The k 210 feature in airSlate SignNow refers to advanced electronic signing capabilities that enhance document management. This feature ensures that your agreements are completed quickly and securely, optimizing workflow efficiency for businesses using the k 210 solution.

-

How much does airSlate SignNow cost with the k 210 features?

Pricing for airSlate SignNow with k 210 features varies based on the subscription plan selected. Businesses can choose from monthly or annual plans that fit their budget while enjoying the benefits of k 210's powerful document signing capabilities.

-

Can the k 210 features integrate with other software?

Yes, airSlate SignNow's k 210 features are designed to seamlessly integrate with various software applications. This allows users to streamline their existing workflows and enhance productivity by connecting with tools like CRMs and project management software.

-

What are the benefits of using the k 210 feature in airSlate SignNow?

Utilizing the k 210 feature in airSlate SignNow offers several benefits including increased efficiency, improved security for documents, and user-friendly navigation. These advantages make it an ideal solution for businesses looking to enhance their electronic signature processes.

-

Is the k 210 feature suitable for all business types?

Absolutely! The k 210 feature in airSlate SignNow is versatile enough to accommodate businesses of all sizes and industries. Whether you're a small startup or a large corporation, k 210 can support your document signing needs effectively.

-

How does airSlate SignNow ensure the security of k 210 signed documents?

airSlate SignNow secures k 210 signed documents using advanced encryption and authentication protocols. This ensures that your sensitive information remains confidential and that the integrity of each signed document is maintained.

-

What types of documents can be signed using the k 210 feature?

The k 210 feature in airSlate SignNow can be used to sign a wide range of documents, including contracts, agreements, and forms. This flexibility allows organizations to digitize various processes and enhance their operational efficiency.

Get more for Kansas Form K 210 Individual Underpayment Of Estimated

- Placed in service report rev 092216 service person agency form tor palcing divices into service

- Place in service report form

- Boiler checklist form

- Credit card request form

- Boiler inspection checklist template form

- 2400 portland ave s suite 190 form

- Face fit certificate template form

- Homebound school form

Find out other Kansas Form K 210 Individual Underpayment Of Estimated

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template