K 210 Underpayment of Individual Estimated Tax Rev 7 22 If You Are an Individual Taxpayer Including Farmer or Fisher, Use This S 2022-2026

Understanding the K-210 Underpayment of Individual Estimated Tax

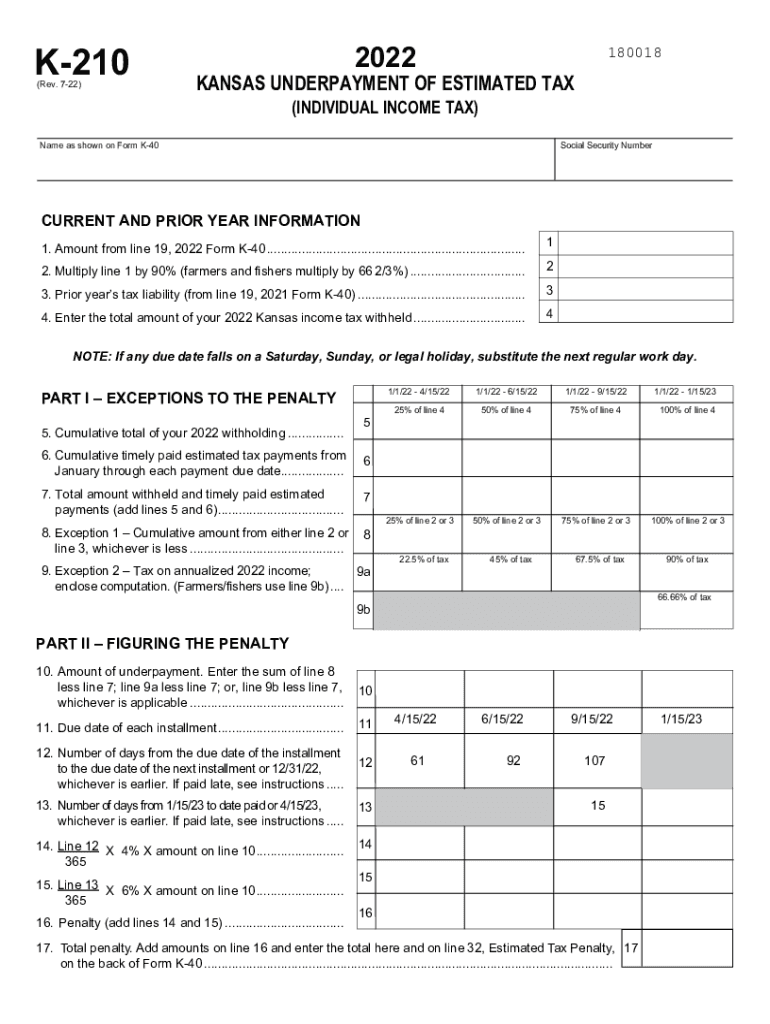

The K-210 form is essential for individual taxpayers, including farmers and fishermen, to assess if their income tax obligations were met throughout the year. This form determines whether sufficient tax has been withheld or paid through estimated tax payments. It is particularly useful for those who earn income not subject to withholding, ensuring compliance with state tax laws.

Steps to Complete the K-210 Underpayment of Individual Estimated Tax

Completing the K-210 form involves several key steps:

- Gather your income information for the year, including any wages, self-employment income, and other earnings.

- Review your tax withholding and estimated payments to determine if they meet the required thresholds.

- Fill out the K-210 form, ensuring all sections are accurately completed, including your total income and any credits or deductions.

- Submit the completed form to the appropriate state tax authority, either electronically or by mail.

Legal Use of the K-210 Underpayment of Individual Estimated Tax

The K-210 form is legally recognized for determining tax compliance in Kansas. It must be filled out accurately to avoid penalties. The information provided on the form can be used in legal contexts, such as audits or disputes with the tax authority, to demonstrate compliance with state tax laws.

Filing Deadlines for the K-210 Underpayment of Individual Estimated Tax

It is crucial to be aware of filing deadlines associated with the K-210 form. Generally, the form must be filed by the tax return due date, which is typically April fifteenth for individual taxpayers. Missing this deadline may result in penalties and interest on any unpaid taxes.

Required Documents for the K-210 Underpayment of Individual Estimated Tax

To complete the K-210 form, you will need the following documents:

- Income statements, such as W-2s or 1099s, reflecting your earnings for the year.

- Records of any estimated tax payments made throughout the year.

- Documentation of any tax credits or deductions you plan to claim.

Penalties for Non-Compliance with the K-210 Underpayment of Individual Estimated Tax

Failure to comply with the requirements of the K-210 form can result in significant penalties. Taxpayers may face fines for underpayment, which can accumulate over time. Understanding these penalties is essential for maintaining compliance and avoiding unnecessary financial burdens.

Quick guide on how to complete k 210 underpayment of individual estimated tax rev 7 22 if you are an individual taxpayer including farmer or fisher use this

Complete K 210 Underpayment Of Individual Estimated Tax Rev 7 22 If You Are An Individual Taxpayer including Farmer Or Fisher, Use This S effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle K 210 Underpayment Of Individual Estimated Tax Rev 7 22 If You Are An Individual Taxpayer including Farmer Or Fisher, Use This S on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign K 210 Underpayment Of Individual Estimated Tax Rev 7 22 If You Are An Individual Taxpayer including Farmer Or Fisher, Use This S with ease

- Obtain K 210 Underpayment Of Individual Estimated Tax Rev 7 22 If You Are An Individual Taxpayer including Farmer Or Fisher, Use This S and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign K 210 Underpayment Of Individual Estimated Tax Rev 7 22 If You Are An Individual Taxpayer including Farmer Or Fisher, Use This S to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 210 underpayment of individual estimated tax rev 7 22 if you are an individual taxpayer including farmer or fisher use this

Create this form in 5 minutes!

How to create an eSignature for the k 210 underpayment of individual estimated tax rev 7 22 if you are an individual taxpayer including farmer or fisher use this

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'kansas 210 estimated' in relation to airSlate SignNow?

The term 'kansas 210 estimated' refers to the anticipated costs associated with using airSlate SignNow in Kansas. This estimate helps businesses understand the potential pricing structure for eSigning documents and document management within the state.

-

How does airSlate SignNow support businesses looking for 'kansas 210 estimated' costs?

AirSlate SignNow provides transparent pricing models, including options that can be tailored to fit the 'kansas 210 estimated' range. This makes it easier for Kansas businesses to budget for their eSignature needs and maximize their investment.

-

What features does airSlate SignNow offer that relate to 'kansas 210 estimated'?

AirSlate SignNow offers a variety of features including document templates, advanced signing options, and automated workflows. These capabilities make it easier for Kansas businesses to manage their documents efficiently while staying within the 'kansas 210 estimated' costs.

-

Are there any benefits to using airSlate SignNow for 'kansas 210 estimated' documentation?

Yes, by using airSlate SignNow, businesses can streamline their document signing processes, reducing turnaround times and operational costs. This directly supports Kansas businesses looking to adhere to their 'kansas 210 estimated' budgets effectively.

-

How does airSlate SignNow's pricing compare for the 'kansas 210 estimated' market?

AirSlate SignNow offers competitive pricing compared to other eSignature solutions in the market, making it a cost-effective choice for the 'kansas 210 estimated' landscape. The various pricing tiers mean that businesses can choose a plan that fits their specific needs without overextending their budgets.

-

What integrations does airSlate SignNow support within the 'kansas 210 estimated' framework?

AirSlate SignNow integrates seamlessly with various applications, such as CRM software and cloud storage platforms, which is beneficial for Kansas businesses operating under the 'kansas 210 estimated' guidelines. These integrations enhance productivity by allowing users to work within platforms they already use.

-

Can airSlate SignNow help with compliance related to 'kansas 210 estimated' documents?

Absolutely, airSlate SignNow is designed with compliance in mind, ensuring that all signed documents meet legal requirements. This compliance support is vital for Kansas businesses aiming to stay compliant while managing their 'kansas 210 estimated' document workflows.

Get more for K 210 Underpayment Of Individual Estimated Tax Rev 7 22 If You Are An Individual Taxpayer including Farmer Or Fisher, Use This S

- Tx 2 form

- Warranty deed from two individuals to corporation texas form

- Enhanced life estate or lady bird quitclaim deed from an individual to three individuals texas form

- Enhanced life estate or lady bird warranty deed from an individual to three individuals texas form

- Gift deed from four grantors to one grantee texas form

- General warranty deed from four individual grantors to one grantee texas form

- Texas warranty trust form

- General warranty deed husband and wife to husband and wife texas form

Find out other K 210 Underpayment Of Individual Estimated Tax Rev 7 22 If You Are An Individual Taxpayer including Farmer Or Fisher, Use This S

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney