New JerseyE File Opt Out Request Form Tax Brackets Org 2020

Understanding the New Jersey E-File Opt Out Request Form

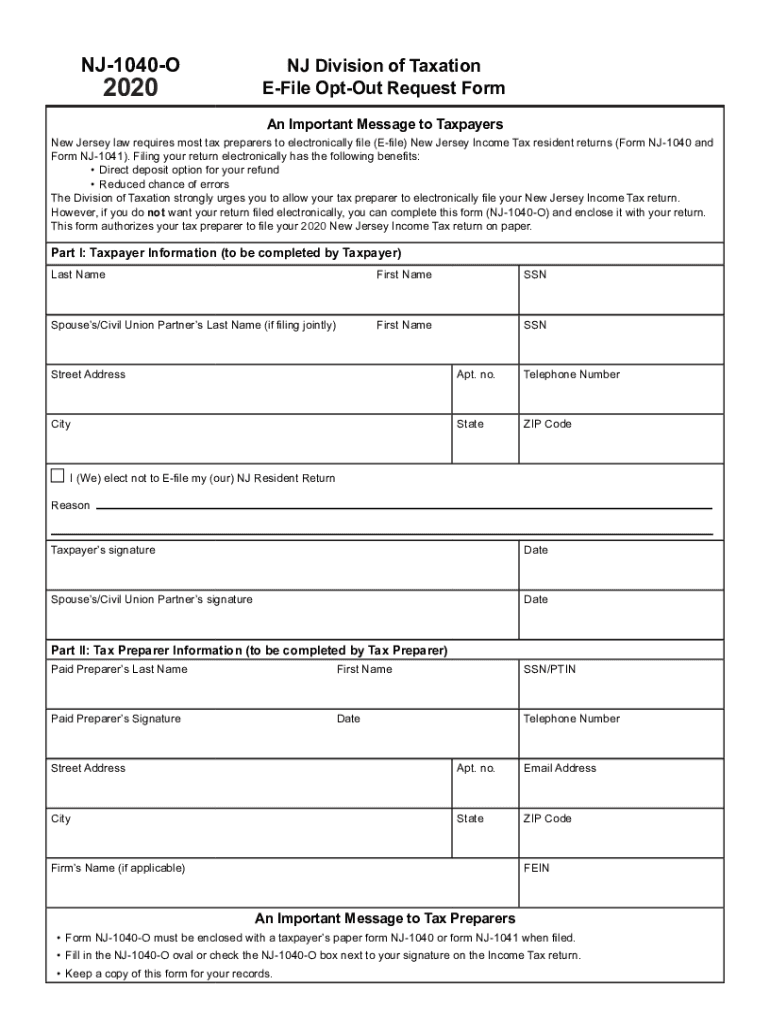

The New Jersey E-File Opt Out Request Form allows taxpayers to formally request to opt out of electronic filing for their state tax returns. This form is essential for individuals who prefer to file their taxes using paper methods rather than electronically. Understanding the purpose and requirements of this form can help ensure compliance with state tax laws.

Steps to Complete the New Jersey E-File Opt Out Request Form

Completing the New Jersey E-File Opt Out Request Form involves several key steps:

- Gather necessary personal information, including your name, address, and Social Security number.

- Clearly indicate your intention to opt out of e-filing by checking the appropriate box on the form.

- Provide any additional information requested, such as the reason for opting out.

- Sign and date the form to validate your request.

Once completed, ensure that the form is submitted to the appropriate tax authority as directed.

Legal Use of the New Jersey E-File Opt Out Request Form

The New Jersey E-File Opt Out Request Form is legally binding once submitted. It serves as an official record of your choice to opt out of electronic filing. To ensure that your request is honored, it is crucial to follow all instructions carefully and submit the form by the specified deadlines set by the New Jersey Division of Taxation.

Eligibility Criteria for Opting Out

Not all taxpayers may be eligible to opt out of e-filing. Common eligibility criteria include:

- Taxpayers who do not have access to the necessary technology to file electronically.

- Individuals who prefer traditional filing methods for personal or privacy reasons.

- Specific cases where state regulations permit opting out due to unique circumstances.

Reviewing these criteria before completing the form can help avoid unnecessary complications.

Form Submission Methods

The completed New Jersey E-File Opt Out Request Form can typically be submitted in several ways:

- Online submission through the New Jersey Division of Taxation's official website, if available.

- Mailing the form to the designated tax office address provided on the form.

- In-person delivery at local tax offices or designated locations.

Choosing the right submission method can ensure timely processing of your request.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines associated with the New Jersey E-File Opt Out Request Form. Generally, the form should be submitted before the tax filing deadline for the respective tax year. Keeping track of these dates can help prevent any penalties or issues with your tax return.

Key Elements of the New Jersey E-File Opt Out Request Form

When filling out the New Jersey E-File Opt Out Request Form, several key elements must be included:

- Your full name and contact information.

- Your Social Security number or taxpayer identification number.

- A clear statement of your intent to opt out of e-filing.

- Your signature and date to validate the request.

Ensuring all required information is accurately filled out will facilitate a smoother processing experience.

Quick guide on how to complete new jerseye file opt out request form tax bracketsorg

Complete New JerseyE File Opt Out Request Form Tax Brackets org easily on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle New JerseyE File Opt Out Request Form Tax Brackets org on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign New JerseyE File Opt Out Request Form Tax Brackets org seamlessly

- Find New JerseyE File Opt Out Request Form Tax Brackets org and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign New JerseyE File Opt Out Request Form Tax Brackets org and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new jerseye file opt out request form tax bracketsorg

Create this form in 5 minutes!

How to create an eSignature for the new jerseye file opt out request form tax bracketsorg

The best way to generate an eSignature for your PDF document in the online mode

The best way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to nj o?

airSlate SignNow is a powerful eSignature solution that allows businesses to streamline document signing processes. With its user-friendly interface, it simplifies nj o tasks by enabling quick, secure, and legally binding eSignatures, making transaction workflows more efficient.

-

How much does airSlate SignNow cost for nj o users?

airSlate SignNow offers several pricing plans tailored for different business needs. Specifically for nj o users, we provide a cost-effective subscription model that scales with your usage, ensuring affordability while accessing premium features.

-

What features does airSlate SignNow provide for nj o purposes?

The features of airSlate SignNow include custom workflows, template creation, and real-time tracking of document statuses. These functionalities are particularly beneficial for nj o applications, allowing businesses to manage their documents efficiently and effectively.

-

What are the benefits of using airSlate SignNow for nj o?

Using airSlate SignNow offers numerous benefits for nj o users, such as improved efficiency in managing signatures and reduced turnaround time for contracts. Additionally, it enhances security and compliance, ensuring all nj o documentation is legally protected.

-

Can airSlate SignNow integrate with other software commonly used in nj o?

Yes, airSlate SignNow seamlessly integrates with a variety of applications used for nj o processes, such as CRM systems, document management tools, and cloud storage services. This integration capability allows for a more streamlined workflow, enhancing overall productivity.

-

Is airSlate SignNow compliant with nj o regulations?

airSlate SignNow is fully compliant with relevant nj o regulations and standards governing electronic signatures. This compliance ensures that all signed documents are legally enforceable and meet the necessary legal requirements, providing peace of mind for your business.

-

How can airSlate SignNow improve document management for nj o users?

airSlate SignNow simplifies document management for nj o users by enabling easy document sharing and real-time collaboration. With its advanced features, businesses can track changes, manage approvals, and store signed documents securely in one centralized location.

Get more for New JerseyE File Opt Out Request Form Tax Brackets org

Find out other New JerseyE File Opt Out Request Form Tax Brackets org

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online