New Jersey Form NJ 2450 Employee's Claim for Credit for Excess 2021

What is the New Jersey Form NJ 2450 Employee's Claim For Credit For Excess

The New Jersey Form NJ 2450 is a tax form used by employees to claim a credit for excess contributions made to their New Jersey income tax. This form is specifically designed for individuals who have overpaid their state income tax due to withholding or estimated tax payments. Understanding this form is crucial for ensuring that taxpayers receive the appropriate credits and refunds they are entitled to under New Jersey tax law.

Steps to complete the New Jersey Form NJ 2450 Employee's Claim For Credit For Excess

Completing the NJ 2450 form involves several key steps:

- Gather necessary information: Collect your W-2 forms, pay stubs, and any other relevant tax documents that detail your income and tax withholdings.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Detail your income: Report your total income and the amount of tax withheld from your earnings.

- Calculate excess contributions: Determine the excess amount you have contributed based on your total tax liability and withholdings.

- Sign and date the form: Ensure that you sign and date the form to validate your claim.

Legal use of the New Jersey Form NJ 2450 Employee's Claim For Credit For Excess

The NJ 2450 form is legally recognized as a valid document for claiming tax credits in the state of New Jersey. To ensure its legal standing, it must be completed accurately and submitted within the designated timeframes. The form must also comply with all relevant state tax laws and regulations to be considered valid in the eyes of the New Jersey Division of Taxation.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the NJ 2450 form. Typically, the form should be submitted by the same deadline as your New Jersey income tax return. For most taxpayers, this means the form is due on April fifteenth. However, if you are unable to meet this deadline, you may be eligible for an extension, but you must follow the appropriate procedures to avoid penalties.

Eligibility Criteria

To be eligible to file the NJ 2450 form, you must meet specific criteria:

- You must be an employee who has had excess tax withheld from your wages.

- Your total income must fall within the limits set by New Jersey tax regulations.

- You must have documentation supporting your claim for the excess tax credit.

Form Submission Methods (Online / Mail / In-Person)

The NJ 2450 form can be submitted through various methods to accommodate different preferences:

- Online: You may be able to file electronically through the New Jersey Division of Taxation's online services, depending on the current regulations.

- Mail: Print the completed form and send it to the appropriate address provided by the New Jersey Division of Taxation.

- In-Person: You can also visit a local tax office to submit your form directly.

Quick guide on how to complete new jersey form nj 2450 employees claim for credit for excess

Complete New Jersey Form NJ 2450 Employee's Claim For Credit For Excess effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage New Jersey Form NJ 2450 Employee's Claim For Credit For Excess on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign New Jersey Form NJ 2450 Employee's Claim For Credit For Excess with ease

- Obtain New Jersey Form NJ 2450 Employee's Claim For Credit For Excess and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your desktop.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you choose. Alter and eSign New Jersey Form NJ 2450 Employee's Claim For Credit For Excess and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new jersey form nj 2450 employees claim for credit for excess

Create this form in 5 minutes!

How to create an eSignature for the new jersey form nj 2450 employees claim for credit for excess

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature straight from your smart phone

How to make an e-signature for a PDF on iOS devices

The way to generate an e-signature for a PDF document on Android OS

People also ask

-

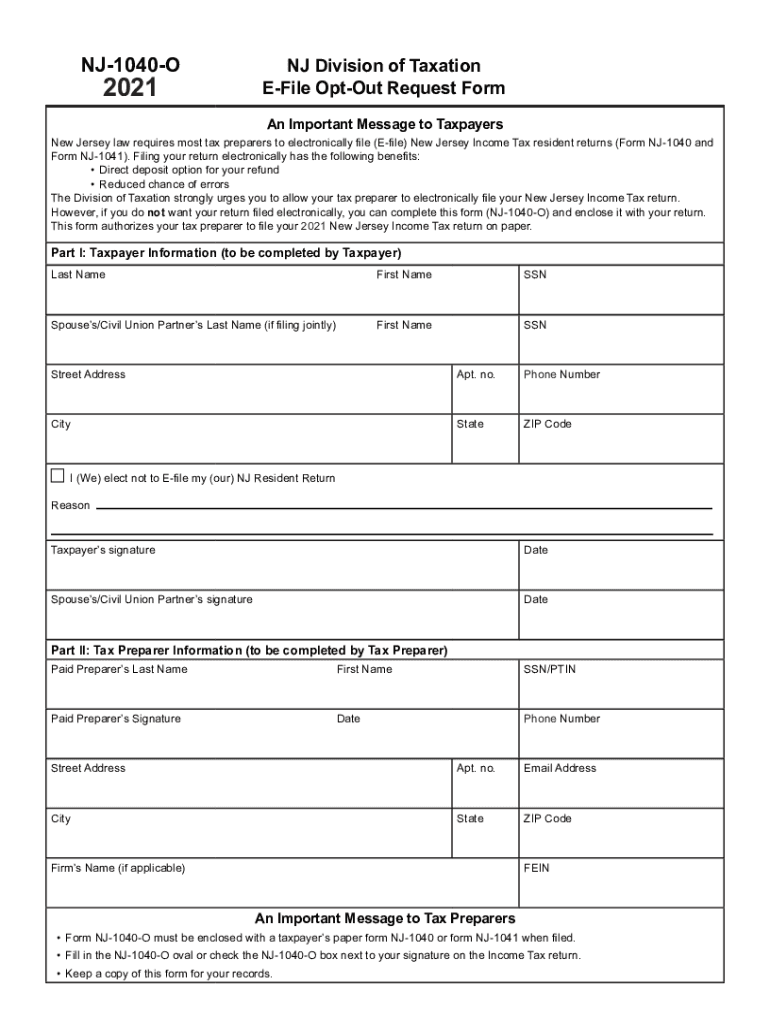

What is the 2022 nj 1040o form?

The 2022 nj 1040o form is a New Jersey income tax return that allows residents to declare their income and calculate their state tax liability. It is important for taxpayers to accurately complete this form to ensure compliance with state tax laws.

-

How can airSlate SignNow help with the 2022 nj 1040o form?

airSlate SignNow provides an efficient way to eSign and send your 2022 nj 1040o form securely. Our platform ensures compliance and simplifies the document submission process, making tax time easier for individuals and businesses alike.

-

What are the pricing options for using airSlate SignNow for the 2022 nj 1040o?

airSlate SignNow offers various pricing plans tailored to different business needs. Whether you’re a solo taxpayer or part of a larger organization, we have a cost-effective solution to manage your 2022 nj 1040o and other documents.

-

Is it easy to integrate airSlate SignNow with tax software for the 2022 nj 1040o?

Yes, airSlate SignNow seamlessly integrates with popular tax software, allowing you to easily manage your 2022 nj 1040o. These integrations enhance efficiency by streamlining the process of filling out and eSigning your tax documents.

-

What features does airSlate SignNow offer for managing the 2022 nj 1040o?

airSlate SignNow provides features such as customizable templates, secure eSignature capabilities, and real-time tracking for your 2022 nj 1040o. These features ensure that your documents are prepared, signed, and submitted in a timely manner.

-

How secure is airSlate SignNow for submitting the 2022 nj 1040o?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure access protocols to protect your 2022 nj 1040o documents and personal information, giving you peace of mind during tax season.

-

Can I use airSlate SignNow on mobile devices for the 2022 nj 1040o?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to manage your 2022 nj 1040o on-the-go. Our mobile app ensures you can eSign and send your documents anytime, anywhere, providing ultimate flexibility.

Get more for New Jersey Form NJ 2450 Employee's Claim For Credit For Excess

- Missouri small form

- Missouri detainer form

- Motion family access form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497313360 form

- Missouri annual 497313361 form

- Notices resolutions simple stock ledger and certificate missouri form

- Minutes for organizational meeting missouri missouri form

- Missouri transmittal form

Find out other New Jersey Form NJ 2450 Employee's Claim For Credit For Excess

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template