NJ 1040 O E File Opt Out Request Form NJ 1040 O E File Opt Out Request Form 2022

Understanding the NJ 1040 O E File Opt Out Request Form

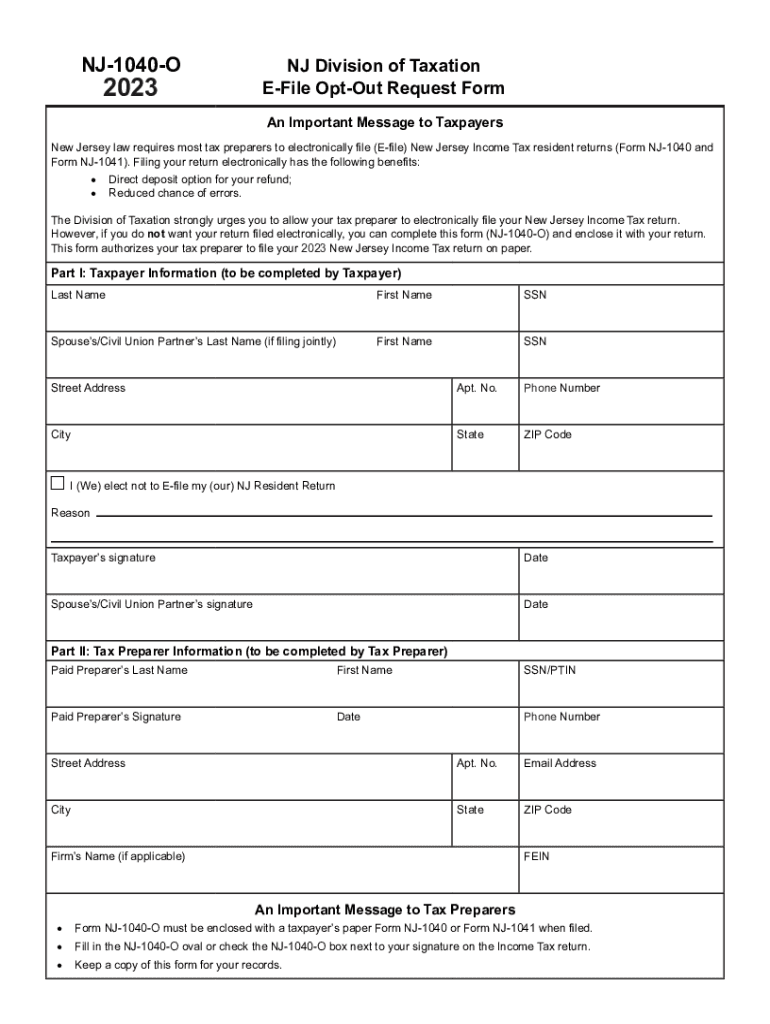

The NJ 1040 O E File Opt Out Request Form is a crucial document for taxpayers in New Jersey who prefer to file their state income tax returns using paper methods rather than electronically. This form allows individuals to officially opt out of the electronic filing system mandated by the state, ensuring that they can submit their tax returns in a manner that suits their preferences and needs. Understanding the purpose of this form is essential for compliance and to avoid any potential issues with the New Jersey Division of Taxation.

Steps to Complete the NJ 1040 O E File Opt Out Request Form

Completing the NJ 1040 O E File Opt Out Request Form involves several straightforward steps:

- Obtain the form from the New Jersey Division of Taxation's official website or through authorized channels.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your choice to opt out of electronic filing by checking the appropriate box.

- Review the form for accuracy and completeness to prevent delays in processing.

- Sign and date the form to validate your request.

- Submit the completed form according to the instructions provided, either by mail or in person.

How to Obtain the NJ 1040 O E File Opt Out Request Form

The NJ 1040 O E File Opt Out Request Form can be obtained through several methods:

- Visit the official New Jersey Division of Taxation website to download the form directly in PDF format.

- Request a physical copy by contacting the New Jersey Division of Taxation through their customer service.

- Check local tax offices or libraries that may have copies available for public use.

Legal Use of the NJ 1040 O E File Opt Out Request Form

The NJ 1040 O E File Opt Out Request Form serves a legal purpose by allowing taxpayers to formally decline electronic filing. This is particularly important for individuals who may not have access to the necessary technology or prefer traditional filing methods. By submitting this form, taxpayers ensure they comply with New Jersey's tax regulations while exercising their right to choose their filing method.

Key Elements of the NJ 1040 O E File Opt Out Request Form

Key elements of the NJ 1040 O E File Opt Out Request Form include:

- Personal identification details, such as name and Social Security number.

- Clear options for opting out of electronic filing.

- Signature and date fields to confirm the taxpayer's request.

These elements are essential for ensuring that the form is processed correctly and that the taxpayer's preferences are duly noted by the tax authorities.

Filing Deadlines and Important Dates

It is crucial for taxpayers to be aware of filing deadlines related to the NJ 1040 O E File Opt Out Request Form. Generally, the form should be submitted before the due date of the state income tax return to ensure that the opt-out request is honored. Taxpayers should check the New Jersey Division of Taxation's website for specific dates, as these can vary from year to year, especially around tax season.

Quick guide on how to complete nj 1040 o e file opt out request form nj 1040 o e file opt out request form

Complete NJ 1040 O E File Opt Out Request Form NJ 1040 O E File Opt Out Request Form seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without any delays. Manage NJ 1040 O E File Opt Out Request Form NJ 1040 O E File Opt Out Request Form on any platform using the airSlate SignNow applications for Android or iOS and simplify your document-related tasks today.

The simplest way to modify and electronically sign NJ 1040 O E File Opt Out Request Form NJ 1040 O E File Opt Out Request Form without hassle

- Find NJ 1040 O E File Opt Out Request Form NJ 1040 O E File Opt Out Request Form and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact confidential information with tools specifically designed for this purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Modify and electronically sign NJ 1040 O E File Opt Out Request Form NJ 1040 O E File Opt Out Request Form and ensure exceptional communication throughout every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nj 1040 o e file opt out request form nj 1040 o e file opt out request form

Create this form in 5 minutes!

How to create an eSignature for the nj 1040 o e file opt out request form nj 1040 o e file opt out request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NJ state tax form 2024 PDF?

The NJ state tax form 2024 PDF is the official document required for individuals and businesses to report their income and calculate their taxes for the year 2024. It is essential for compliance with New Jersey tax regulations. You can easily find and download this form from the New Jersey Division of Taxation's website.

-

How can I access the NJ state tax form 2024 PDF?

You can access the NJ state tax form 2024 PDF directly from the New Jersey Division of Taxation website or through tax preparation software. If you're using airSlate SignNow, you can also upload this PDF for easy eSigning and sharing with your tax professional, streamlining your tax filing process.

-

Is there a cost associated with downloading the NJ state tax form 2024 PDF?

No, downloading the NJ state tax form 2024 PDF is free of charge through official state resources. However, if you use airSlate SignNow to manage your documents and eSign the form, there may be associated subscription fees. The efficiency gained can outweigh the cost.

-

Can I electronically sign the NJ state tax form 2024 PDF?

Yes, you can electronically sign the NJ state tax form 2024 PDF using airSlate SignNow. This platform allows for quick and secure eSigning, ensuring your form is legally compliant and easily submitted. This feature simplifies the process of finalizing your tax documents.

-

What features does airSlate SignNow offer for handling the NJ state tax form 2024 PDF?

airSlate SignNow provides various features such as document templates, secure eSigning, integration with various applications, and real-time collaboration. These features can enhance your efficiency while managing the NJ state tax form 2024 PDF. It's designed to make document handling straightforward for individuals and businesses alike.

-

How does airSlate SignNow integrate with accounting software when using the NJ state tax form 2024 PDF?

airSlate SignNow can integrate seamlessly with popular accounting software, allowing users to import or export the NJ state tax form 2024 PDF directly. This integration enables you to manage your financial documents efficiently while keeping your tax filings organized. It streamlines the workflow between document signing and financial planning.

-

What are the benefits of using airSlate SignNow for the NJ state tax form 2024 PDF?

Using airSlate SignNow for the NJ state tax form 2024 PDF offers numerous benefits, including time-saving eSigning, automatic reminders for submission, and a secure platform for document storage. It also enhances compliance with legally binding electronic signatures. Overall, it provides a cost-effective solution for managing your tax documents.

Get more for NJ 1040 O E File Opt Out Request Form NJ 1040 O E File Opt Out Request Form

- How to fill out a fom 1604 counterfeit nopte report form

- Board of governors fee waiver 14 form

- Tonch map form

- Pnb bank certificate sample form

- Name this test does not measure your intelligence your leeds faculty colorado form

- Terrorism risk insurance department of the treasury treasury form

- Rpd 41202 list of owners of unclaimed property state of new form

- Operating incorporation agreement template form

Find out other NJ 1040 O E File Opt Out Request Form NJ 1040 O E File Opt Out Request Form

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy