Department of Taxation and Finance Claim for Environmental 2020

What is the Department Of Taxation And Finance Claim For Environmental

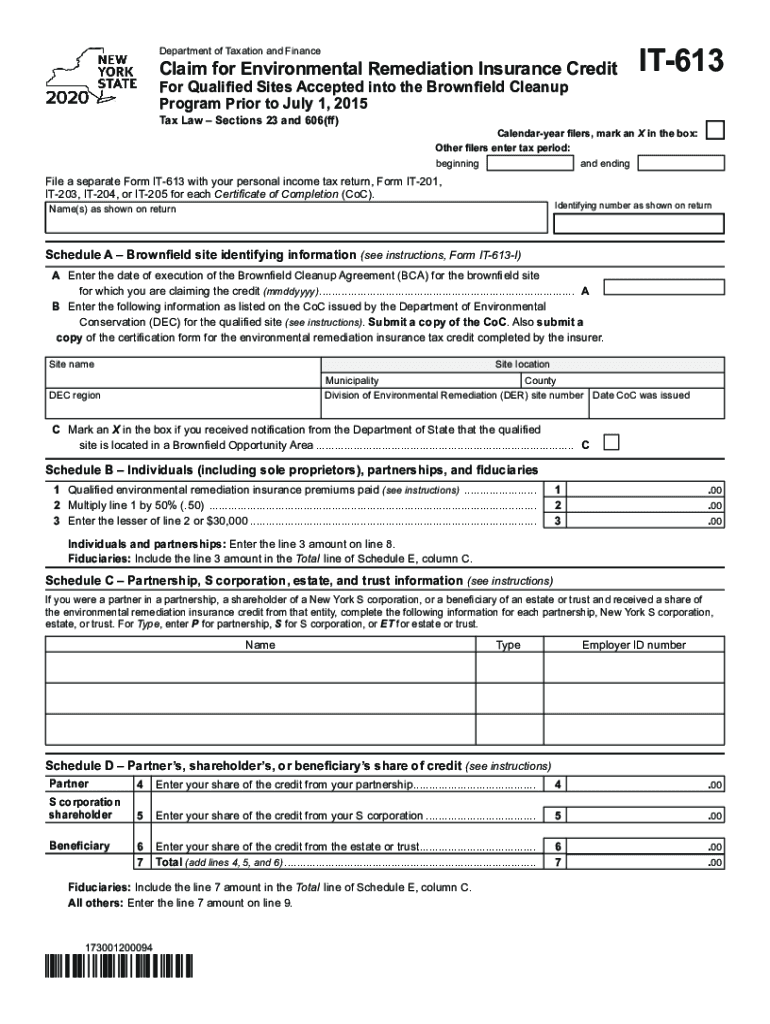

The Department Of Taxation And Finance Claim For Environmental is a specific form used by taxpayers in the United States to request environmental tax credits or refunds. This form is essential for individuals and businesses that have incurred expenses related to environmental improvements or compliance with environmental regulations. It serves as a formal request to the state tax authority to review and process claims for eligible environmental expenditures.

How to use the Department Of Taxation And Finance Claim For Environmental

Using the Department Of Taxation And Finance Claim For Environmental requires careful completion of the form to ensure all necessary information is provided. Taxpayers should gather relevant documentation that supports their claim, such as receipts for environmental projects or compliance costs. Once the form is filled out, it can be submitted electronically or via mail, depending on the state’s submission guidelines.

Steps to complete the Department Of Taxation And Finance Claim For Environmental

Completing the Department Of Taxation And Finance Claim For Environmental involves several key steps:

- Gather all necessary documentation, including receipts and proof of environmental expenditures.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form according to the state’s guidelines, either online or by mail.

Legal use of the Department Of Taxation And Finance Claim For Environmental

The legal use of the Department Of Taxation And Finance Claim For Environmental is governed by state tax laws and regulations. To ensure the claim is valid, taxpayers must adhere to the specific eligibility criteria and documentation requirements outlined by the state tax authority. This form must be used in compliance with all legal standards to protect against potential audits or penalties.

Required Documents

To successfully file the Department Of Taxation And Finance Claim For Environmental, taxpayers need to provide several required documents, including:

- Receipts for environmental expenditures.

- Proof of compliance with environmental regulations.

- Any additional documentation specified by the state tax authority.

Eligibility Criteria

Eligibility for the Department Of Taxation And Finance Claim For Environmental typically includes criteria such as:

- Proof of incurred environmental expenses.

- Compliance with state environmental regulations.

- Timely submission of the claim within the specified deadlines.

Quick guide on how to complete department of taxation and finance claim for environmental

Complete Department Of Taxation And Finance Claim For Environmental seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly and without delays. Manage Department Of Taxation And Finance Claim For Environmental on any platform using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

The simplest method to modify and eSign Department Of Taxation And Finance Claim For Environmental effortlessly

- Find Department Of Taxation And Finance Claim For Environmental and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal authority as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form—via email, text message (SMS), or an invitation link—or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with a few clicks from any device of your choosing. Edit and eSign Department Of Taxation And Finance Claim For Environmental to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of taxation and finance claim for environmental

Create this form in 5 minutes!

How to create an eSignature for the department of taxation and finance claim for environmental

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the Department Of Taxation And Finance Claim For Environmental?

The Department Of Taxation And Finance Claim For Environmental is a process through which businesses can file for tax credits related to environmental initiatives. This claim helps organizations reduce their tax burden while promoting eco-friendly practices. Utilizing tools like airSlate SignNow can streamline the submission of related documents.

-

How can airSlate SignNow assist with the Department Of Taxation And Finance Claim For Environmental?

airSlate SignNow simplifies the preparation and e-signing of documents required for the Department Of Taxation And Finance Claim For Environmental. Our platform provides an easy-to-use interface that allows users to quickly create, send, and track their claims, ensuring a seamless experience. This efficiency can contribute to faster processing times for your claims.

-

What features does airSlate SignNow offer for managing the Department Of Taxation And Finance Claim For Environmental?

airSlate SignNow offers a variety of features for managing the Department Of Taxation And Finance Claim For Environmental, including customizable templates, electronic signatures, and automated workflows. These features help users efficiently handle the entire claims process while ensuring compliance with regulatory requirements. Additionally, real-time status tracking keeps you informed of your claim’s progress.

-

Is there a cost associated with using airSlate SignNow for the Department Of Taxation And Finance Claim For Environmental?

Yes, airSlate SignNow operates on a subscription model, offering various pricing tiers to cater to different business needs. These plans are designed to be cost-effective, allowing businesses to manage their Department Of Taxation And Finance Claim For Environmental without breaking the bank. You can choose the plan that best suits your operational scale and document handling requirements.

-

What are the benefits of using airSlate SignNow for environmental claims?

Utilizing airSlate SignNow for the Department Of Taxation And Finance Claim For Environmental offers multiple benefits, including increased efficiency, reduced paper usage, and enhanced security. By going digital, businesses can decrease turnaround times and ensure their claims are submitted accurately. Furthermore, e-signatures strengthen the legitimacy of your documents for regulatory purposes.

-

Can airSlate SignNow integrate with other software for the Department Of Taxation And Finance Claim For Environmental?

Absolutely! airSlate SignNow offers seamless integrations with various business tools, enhancing the workflow for the Department Of Taxation And Finance Claim For Environmental. This means you can connect it with your existing software solutions, such as accounting or project management platforms, to ensure all your processes work in harmony.

-

How secure is the data I submit for the Department Of Taxation And Finance Claim For Environmental?

airSlate SignNow prioritizes the security of your information, utilizing advanced encryption and compliance with industry standards. When you submit documents for the Department Of Taxation And Finance Claim For Environmental, you can trust that your data is protected against unauthorized access. Regular audits further ensure that our platform maintains high-security protocols.

Get more for Department Of Taxation And Finance Claim For Environmental

- Fertilizer license massachusetts form

- Verification of supervised professional practice ncblpc form

- Nc abc inventory form

- Pdf verification of supervised professional practice form

- Ny doing business name form

- Www dec ny gov permits 25010 html form

- Select and check one form

- Retail laundry self certification form

Find out other Department Of Taxation And Finance Claim For Environmental

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe