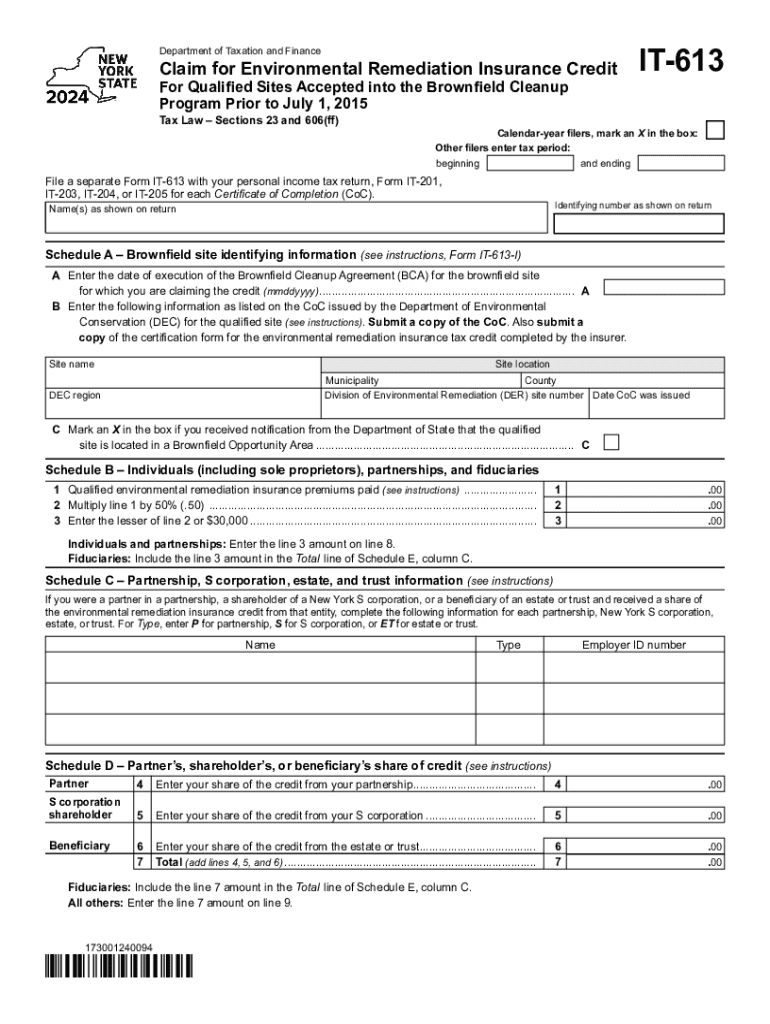

Form it 613 Claim for Environmental Remediation Insurance Credit Tax Year 2024-2026

What is the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year

The Form IT 613 Claim For Environmental Remediation Insurance Credit is a tax form used by businesses in the United States to claim a credit for certain expenses related to environmental remediation insurance. This form is specifically designed for taxpayers who have incurred costs associated with cleaning up contaminated sites or managing environmental risks. The credit aims to incentivize businesses to take proactive measures in environmental protection and remediation efforts. By filing this form, eligible taxpayers can reduce their overall tax liability, making it a valuable financial tool for those involved in environmental management.

How to use the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year

Using the Form IT 613 involves several steps to ensure accurate completion and submission. First, gather all necessary documentation that supports your claim for the environmental remediation insurance credit. This may include receipts, invoices, and any relevant contracts. Next, fill out the form with precise information regarding your business, the nature of the remediation activities, and the total amount of the claim. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form to the appropriate tax authority by the designated deadline, ensuring you keep a copy for your records.

Steps to complete the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year

Completing the Form IT 613 requires attention to detail and a systematic approach. Follow these steps:

- Obtain the latest version of Form IT 613 from the appropriate tax authority.

- Fill in your business name, address, and identification number accurately.

- Document the specific environmental remediation activities undertaken and the associated costs.

- Calculate the total credit amount based on the expenses incurred.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form by the filing deadline.

Eligibility Criteria

To qualify for the environmental remediation insurance credit, businesses must meet specific eligibility criteria. Generally, the credit is available to taxpayers who have incurred costs related to environmental remediation activities. These activities should align with the guidelines set forth by the Internal Revenue Service. Additionally, businesses must be able to provide documentation that verifies the expenses claimed. It is essential to review the specific requirements outlined by the IRS to ensure compliance and eligibility for the credit.

Required Documents

When filing the Form IT 613, several documents are necessary to support your claim for the environmental remediation insurance credit. Required documents typically include:

- Receipts or invoices for remediation expenses.

- Contracts or agreements related to environmental remediation services.

- Any correspondence with environmental agencies or authorities.

- Documentation demonstrating the nature of the contamination and the remediation efforts undertaken.

Having these documents ready will facilitate a smoother filing process and help substantiate your claim.

Form Submission Methods

The Form IT 613 can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the tax authority. Common submission methods include:

- Online submission through the tax authority's e-filing system.

- Mailing a physical copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Choosing the right submission method can help ensure that your claim is processed efficiently.

Create this form in 5 minutes or less

Find and fill out the correct form it 613 claim for environmental remediation insurance credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 613 claim for environmental remediation insurance credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year?

The Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year is a tax form used by businesses to claim a credit for expenses related to environmental remediation. This form helps businesses offset costs incurred while cleaning up contaminated sites, promoting environmental responsibility.

-

How can airSlate SignNow assist with the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year?

airSlate SignNow provides an efficient platform for businesses to prepare, sign, and submit the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year. With our easy-to-use interface, you can streamline the documentation process, ensuring compliance and accuracy.

-

What are the pricing options for using airSlate SignNow for the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solutions ensure that you can manage your Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year without breaking the bank.

-

What features does airSlate SignNow offer for managing the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all designed to simplify the management of the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year. These tools enhance efficiency and ensure that your documents are always accessible.

-

Are there any benefits to using airSlate SignNow for the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year?

Using airSlate SignNow for the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year offers numerous benefits, including faster processing times and reduced paperwork. Our platform enhances collaboration and ensures that all stakeholders can easily access and sign necessary documents.

-

Can airSlate SignNow integrate with other software for the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing you to manage the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year alongside your existing tools. This integration helps streamline your workflow and enhances productivity.

-

Is airSlate SignNow secure for handling the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data while handling the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year. You can trust that your sensitive information is safe with us.

Get more for Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year

Find out other Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year

- Can I Implement Electronic signature in Car Dealer

- How To Install Electronic signature in Charity

- How To Add Electronic signature in Charity

- How To Set Up Electronic signature in Charity

- How To Save Electronic signature in Charity

- How To Use Electronic signature in Construction

- How To Implement Electronic signature in Charity

- How To Set Up Electronic signature in Construction

- How To Integrate Electronic signature in Doctors

- How To Use Electronic signature in Doctors

- How To Install Electronic signature in Doctors

- How To Add Electronic signature in Doctors

- How To Set Up Electronic signature in Doctors

- How To Save Electronic signature in Doctors

- How To Implement Electronic signature in Doctors

- Can I Implement Electronic signature in Doctors

- How To Add Electronic signature in Education

- How To Integrate Electronic signature in Government

- How To Install Electronic signature in Government

- How To Add Electronic signature in Government