Topic No 404 DividendsInternal Revenue Service 2020

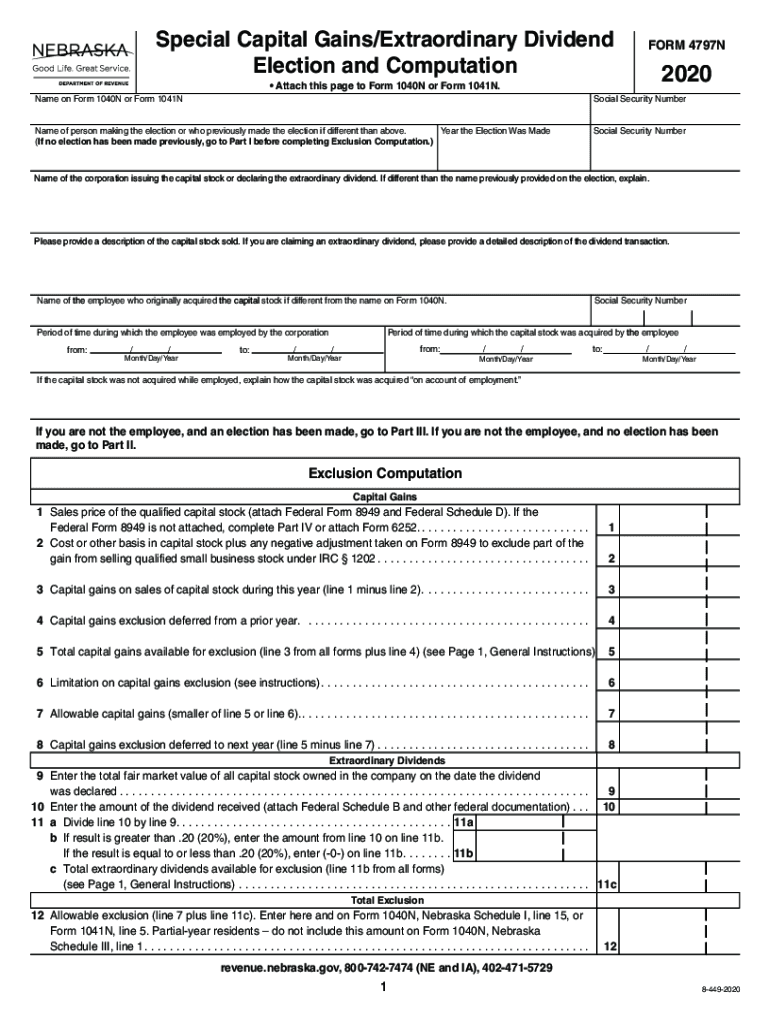

Understanding the Nebraska 4797n Form

The Nebraska 4797n form is essential for reporting capital gains and dividends for state tax purposes. It is specifically designed for individuals and businesses that need to declare income derived from the sale of assets or investments. Understanding its requirements is crucial for accurate tax reporting and compliance with Nebraska state laws.

Steps to Complete the Nebraska 4797n Form

Filling out the Nebraska 4797n form involves several key steps:

- Gather necessary financial documents, including records of asset sales and dividend income.

- Begin the form by entering your personal information, such as name, address, and Social Security number.

- Report the details of each asset sold, including the date of sale, sale price, and cost basis.

- Calculate the total capital gains or losses from your transactions.

- Complete the section for dividend income, ensuring all amounts are accurately reported.

- Review the form for accuracy before submission.

Key Elements of the Nebraska 4797n Form

Several key elements must be included in the Nebraska 4797n form to ensure it is complete:

- Personal Information: This includes your name, address, and identification number.

- Asset Sales: Detailed reporting of each asset sold, including dates and amounts.

- Dividend Income: Accurate reporting of all dividends received during the tax year.

- Calculations: Clear calculations of capital gains or losses, which affect your overall tax liability.

IRS Guidelines for Reporting Dividends

When completing the Nebraska 4797n form, it is important to adhere to IRS guidelines regarding the reporting of dividends. The IRS requires that all dividends be reported as income, and they must be included in the total income calculation for the tax year. Familiarizing yourself with these guidelines ensures compliance and helps avoid potential penalties.

Filing Deadlines for the Nebraska 4797n Form

Timely submission of the Nebraska 4797n form is crucial. The filing deadline typically aligns with the federal tax return deadline, which is usually April fifteenth. If you require additional time, consider applying for an extension, but be aware that any taxes owed must still be paid by the original deadline to avoid penalties.

Penalties for Non-Compliance

Failure to accurately complete and submit the Nebraska 4797n form can result in penalties. These may include fines or interest on unpaid taxes. It is important to ensure that all information is correct and submitted on time to avoid these consequences.

Quick guide on how to complete topic no 404 dividendsinternal revenue service

Complete Topic No 404 DividendsInternal Revenue Service effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage Topic No 404 DividendsInternal Revenue Service on any platform using the airSlate SignNow Android or iOS applications and simplify your document-centric processes today.

How to modify and eSign Topic No 404 DividendsInternal Revenue Service effortlessly

- Find Topic No 404 DividendsInternal Revenue Service and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your adjustments.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the risks of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign Topic No 404 DividendsInternal Revenue Service and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct topic no 404 dividendsinternal revenue service

Create this form in 5 minutes!

How to create an eSignature for the topic no 404 dividendsinternal revenue service

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is 4797n and how does it relate to airSlate SignNow?

The term 4797n refers to a unique code related to our airSlate SignNow services. It indicates specific features and functionalities that enhance the document signing process. By utilizing airSlate SignNow, you can effectively streamline your workflow with 4797n capabilities.

-

How much does airSlate SignNow cost for businesses looking to use 4797n features?

Pricing for airSlate SignNow varies based on the plan you choose, which includes access to 4797n features. We offer flexible pricing options that cater to different business needs, allowing you to select a plan that fits your budget while maximizing the 4797n capabilities.

-

What key features does airSlate SignNow offer with the 4797n integration?

With the 4797n integration, airSlate SignNow provides essential features such as customizable templates, automated workflows, and robust eSignature capabilities. These features not only enhance efficiency but also ensure compliance and security while managing your documents.

-

Are there any benefits to using 4797n in airSlate SignNow?

Yes, utilizing the 4797n features in airSlate SignNow offers signNow benefits, such as improved productivity and faster turnaround times for document signing. By leveraging these capabilities, businesses can increase operational efficiency and enhance customer satisfaction.

-

Can airSlate SignNow with 4797n integrate with other business tools?

Absolutely! airSlate SignNow with 4797n is designed to seamlessly integrate with various business tools such as CRM systems, cloud storage, and project management software. This integration allows for a more cohesive workflow and simplifies document management across platforms.

-

Is airSlate SignNow compliant with legal standards involving the use of 4797n?

Yes, airSlate SignNow is fully compliant with legal standards and regulations regarding eSignatures, including the functionalities associated with 4797n. This compliance ensures that your documents are legally binding and secure, giving you peace of mind when using our services.

-

How easy is it to get started with airSlate SignNow and utilize 4797n features?

Getting started with airSlate SignNow and its 4797n features is simple and user-friendly. You can create an account quickly and access a range of resources to help you navigate the platform, making the transition to electronic signatures smooth and efficient.

Get more for Topic No 404 DividendsInternal Revenue Service

Find out other Topic No 404 DividendsInternal Revenue Service

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form