FORM 4797N Nebraska Department of Revenue 2022-2026

What is the FORM 4797N Nebraska Department Of Revenue

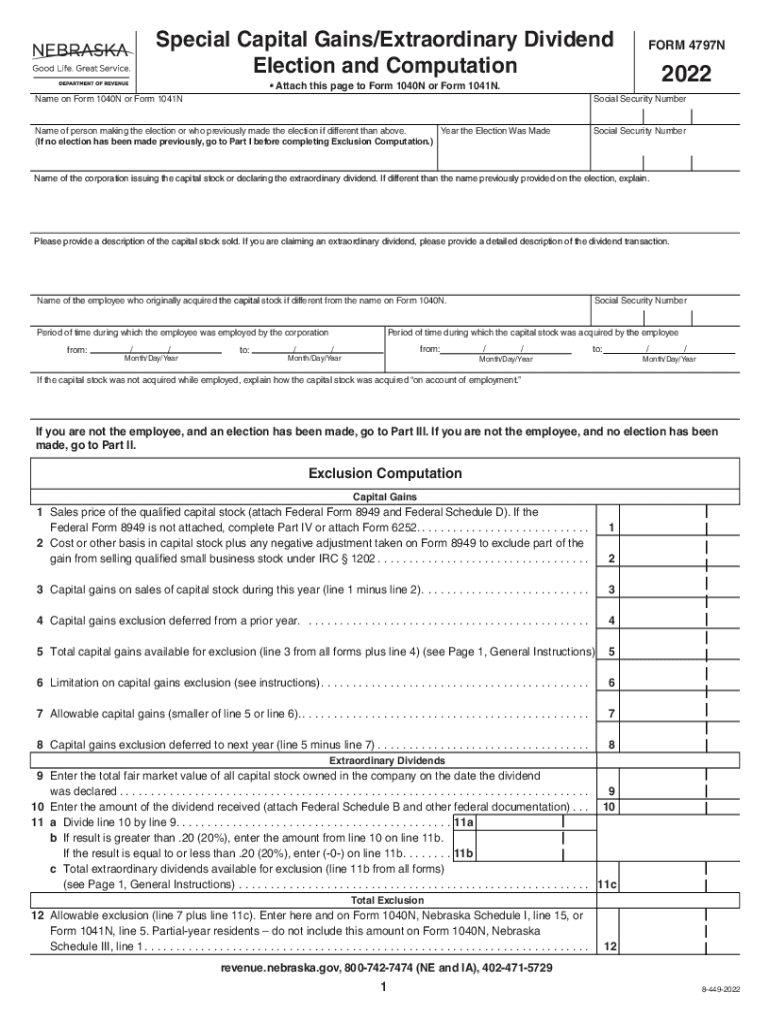

The FORM 4797N is a tax document used by the Nebraska Department of Revenue for reporting gains and losses from the sale of business property. This form is specifically designed for individuals and businesses to report capital gains, losses, and certain special gains as defined by Nebraska tax laws. It is essential for ensuring compliance with state tax regulations and accurately reflecting financial transactions related to business assets.

How to use the FORM 4797N Nebraska Department Of Revenue

Using the FORM 4797N involves several steps to ensure accurate reporting of gains and losses. Taxpayers must first gather all relevant information regarding the sale of business property, including purchase price, sale price, and any associated costs. Once the necessary data is collected, taxpayers can fill out the form, detailing each transaction. It is important to follow the instructions carefully to avoid errors that could lead to penalties or delays in processing.

Steps to complete the FORM 4797N Nebraska Department Of Revenue

Completing the FORM 4797N requires careful attention to detail. Here are the steps to follow:

- Gather all documentation related to the sale of business property.

- Provide your personal and business information at the top of the form.

- List each transaction, including the description of the property, date of acquisition, date of sale, and amounts involved.

- Calculate the gain or loss for each transaction based on the information provided.

- Review the completed form for accuracy before submission.

Legal use of the FORM 4797N Nebraska Department Of Revenue

The legal use of the FORM 4797N is governed by Nebraska tax laws, which require accurate reporting of capital gains and losses. Failure to properly complete and submit this form can result in penalties, including fines and interest on unpaid taxes. It is crucial for taxpayers to understand their obligations under state law and to ensure that all information provided on the form is truthful and complete to maintain compliance.

Key elements of the FORM 4797N Nebraska Department Of Revenue

Key elements of the FORM 4797N include sections for reporting the sale of property, calculating gains or losses, and providing necessary details about each transaction. Taxpayers must include:

- Description of the property sold.

- Date of acquisition and sale.

- Cost basis and sale price.

- Any adjustments to gain or loss, such as improvements made to the property.

Filing Deadlines / Important Dates

Filing deadlines for the FORM 4797N align with the annual tax return deadlines in Nebraska. Typically, the form must be submitted by April 15 for individuals or the corresponding deadline for business entities. It is important to stay informed about any changes to tax laws or deadlines to avoid late filing penalties.

Quick guide on how to complete form 4797n nebraska department of revenue

Prepare FORM 4797N Nebraska Department Of Revenue easily on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle FORM 4797N Nebraska Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign FORM 4797N Nebraska Department Of Revenue with ease

- Locate FORM 4797N Nebraska Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your preference. Modify and eSign FORM 4797N Nebraska Department Of Revenue and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4797n nebraska department of revenue

Create this form in 5 minutes!

How to create an eSignature for the form 4797n nebraska department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska revenue dividend and how does it relate to airSlate SignNow?

The Nebraska revenue dividend is a financial benefit that may be received by citizens, and it is essential for businesses in Nebraska to manage related documents efficiently. airSlate SignNow provides an easy-to-use platform for eSigning documents pertaining to the Nebraska revenue dividend, ensuring compliance and streamlined processes for your financial transactions.

-

How can airSlate SignNow help with the documentation for the Nebraska revenue dividend?

With airSlate SignNow, users can easily create, send, and eSign documents related to the Nebraska revenue dividend. Our platform offers templates and automation features that streamline the process, decreasing the time spent on paperwork, and ensuring you focus on your business objectives.

-

Are there any specific features of airSlate SignNow that support Nebraska businesses?

Yes, airSlate SignNow is designed with features that cater specifically to Nebraska businesses, including advanced eSignature options and document management tools that simplify the handling of the Nebraska revenue dividend. Our platform is intuitive, helping local businesses to maintain compliance while maximizing efficiency.

-

What pricing plans does airSlate SignNow offer for businesses interested in the Nebraska revenue dividend?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Whether you are a small startup or a large organization, our plans are cost-effective and provide access to all necessary features for managing documents related to the Nebraska revenue dividend.

-

Can airSlate SignNow integrate with other tools used in Nebraska?

Absolutely! airSlate SignNow seamlessly integrates with several tools and applications commonly used by Nebraska businesses. This integration capability ensures that you can efficiently manage your documents related to the Nebraska revenue dividend alongside your existing systems.

-

What security measures does airSlate SignNow have for handling sensitive Nebraska revenue dividend documents?

airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect sensitive documents related to the Nebraska revenue dividend. You can trust that your agreements are safe, allowing you to focus on your business without worrying about data bsignNowes.

-

How user-friendly is airSlate SignNow for new users handling the Nebraska revenue dividend?

airSlate SignNow is designed for ease of use, making it simple for new users to manage documents concerning the Nebraska revenue dividend. Our user-friendly interface ensures that anyone can quickly learn to send and eSign documents, streamlining the process from day one.

Get more for FORM 4797N Nebraska Department Of Revenue

Find out other FORM 4797N Nebraska Department Of Revenue

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now