Long Term Care Insurance CreditMinnesota Department of Revenue 2020

What is the Long Term Care Insurance Credit Minnesota Department Of Revenue

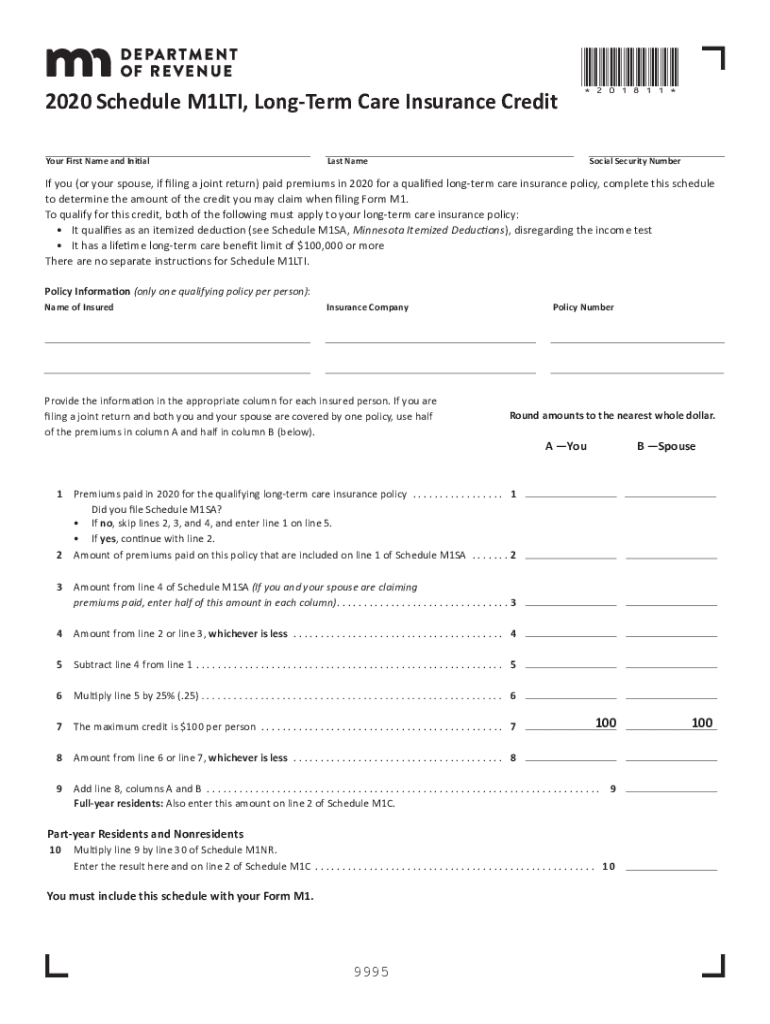

The Long Term Care Insurance Credit offered by the Minnesota Department of Revenue is a tax credit designed to assist individuals who purchase long-term care insurance. This credit aims to encourage residents to invest in long-term care coverage, which can help alleviate the financial burden associated with long-term care services. The credit is applicable to premiums paid for qualified long-term care insurance policies, providing a financial incentive for individuals to secure their future health care needs.

Eligibility Criteria

To qualify for the Long Term Care Insurance Credit, taxpayers must meet specific criteria set forth by the Minnesota Department of Revenue. Eligibility generally includes:

- Being a resident of Minnesota for the entire tax year.

- Purchasing a qualified long-term care insurance policy that meets state requirements.

- Filing a Minnesota tax return for the year in which the credit is claimed.

It is essential for applicants to review the detailed requirements to ensure they meet all conditions necessary to receive the credit.

Steps to complete the Long Term Care Insurance Credit Minnesota Department Of Revenue

Completing the Long Term Care Insurance Credit form involves several steps to ensure accurate filing. Here’s a simplified process:

- Gather all necessary documentation, including proof of long-term care insurance premiums paid.

- Obtain the Long Term Care Insurance Credit form from the Minnesota Department of Revenue.

- Fill out the form, ensuring all information is accurate and complete.

- Submit the form along with your tax return by the designated deadline.

Following these steps carefully can help streamline the process and ensure that you receive the credit you are eligible for.

Required Documents

When applying for the Long Term Care Insurance Credit, specific documents are necessary to support your claim. These may include:

- Proof of premium payments for long-term care insurance, such as receipts or statements from the insurer.

- Your completed tax return for the year in which you are claiming the credit.

- Any additional documentation requested by the Minnesota Department of Revenue.

Having these documents ready can facilitate a smoother application process and help avoid delays.

Form Submission Methods

Taxpayers can submit the Long Term Care Insurance Credit form through various methods, depending on their preference:

- Online: Many taxpayers choose to file electronically through approved e-filing services.

- By Mail: Completed forms can be mailed to the Minnesota Department of Revenue at the address specified on the form.

- In-Person: Some individuals may opt to deliver their forms directly to a local Department of Revenue office.

Each submission method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Legal use of the Long Term Care Insurance Credit Minnesota Department Of Revenue

The Long Term Care Insurance Credit is legally recognized under Minnesota tax law, and its proper use is essential for compliance. Taxpayers must ensure that they are claiming the credit in accordance with state regulations. This includes using the correct form, providing accurate information, and adhering to all filing deadlines. Failure to comply with these legal stipulations could result in penalties or denial of the credit.

Quick guide on how to complete long term care insurance creditminnesota department of revenue

Effortlessly prepare Long Term Care Insurance CreditMinnesota Department Of Revenue on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Long Term Care Insurance CreditMinnesota Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Long Term Care Insurance CreditMinnesota Department Of Revenue with ease

- Obtain Long Term Care Insurance CreditMinnesota Department Of Revenue and then select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the equivalent legal validity of a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Long Term Care Insurance CreditMinnesota Department Of Revenue and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct long term care insurance creditminnesota department of revenue

Create this form in 5 minutes!

How to create an eSignature for the long term care insurance creditminnesota department of revenue

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is Long Term Care Insurance Credit Minnesota Department Of Revenue?

The Long Term Care Insurance Credit Minnesota Department Of Revenue is designed to provide tax credits to individuals who purchase long-term care insurance. This credit aims to help reduce the financial burden associated with long-term care, supporting citizens in obtaining necessary healthcare services as they age. Understanding this credit can make a signNow difference in your financial planning.

-

How can I apply for the Long Term Care Insurance Credit Minnesota Department Of Revenue?

To apply for the Long Term Care Insurance Credit Minnesota Department Of Revenue, you must complete the appropriate forms during tax season and include them with your tax return. Ensure you have documentation of your long-term care insurance policy and any qualifying expenses. It's advisable to consult a tax professional to navigate this process effectively.

-

Are there specific eligibility requirements for the Long Term Care Insurance Credit Minnesota Department Of Revenue?

Yes, to qualify for the Long Term Care Insurance Credit Minnesota Department Of Revenue, you must hold a qualifying insurance policy that meets state standards. Additionally, there may be income limitations and other specific criteria to consider. Review the guidelines provided by the Minnesota Department of Revenue for the most accurate information.

-

What are the potential benefits of the Long Term Care Insurance Credit Minnesota Department Of Revenue?

The primary benefit of the Long Term Care Insurance Credit Minnesota Department Of Revenue is the financial relief it provides in the form of tax credits, which can signNowly lower your tax burden. This credit encourages individuals to invest in long-term care insurance, promoting peace of mind as it aids in covering potential healthcare needs in later life. Additionally, it may lead to broader access to necessary long-term care services.

-

How does long-term care insurance work with respect to the Long Term Care Insurance Credit Minnesota Department Of Revenue?

Long-term care insurance typically covers various services, including in-home care, assisted living, and nursing home expenses. If your policy qualifies under the guidelines of the Long Term Care Insurance Credit Minnesota Department Of Revenue, you can file for tax credits based on your premiums. Understanding how your insurance integrates with this credit can help you maximize your benefits.

-

What is the process for renewing my long-term care insurance policy in relation to the Long Term Care Insurance Credit Minnesota Department Of Revenue?

Renewing your long-term care insurance policy involves confirming your policy's terms and ensuring it still qualifies for the Long Term Care Insurance Credit Minnesota Department Of Revenue. It is essential to stay updated on any changes in eligibility requirements or benefits that might affect your tax credits. Consult your insurance provider for specific renewal options and coverage information.

-

Can the Long Term Care Insurance Credit Minnesota Department Of Revenue be claimed every year?

Yes, the Long Term Care Insurance Credit Minnesota Department Of Revenue can generally be claimed annually, as long as you meet the eligibility criteria each tax year. It's essential to track your policy and any premium payments consistently to ensure you can claim the credit. Making long-term planning decisions based on annual claims can further maximize your financial advantages.

Get more for Long Term Care Insurance CreditMinnesota Department Of Revenue

- Sebb employee request for reviewnotice of appeal 2020 form

- Agreement to pay for healthcare services health care authority form

- Forms available online washington state health care authority

- Fillable online hca wa medical claim form uniform

- Safety and emergency response documentation group child care centers dcf f cfs543 child care licensing form

- Continuing education record independent reading video viewing dcf f cfs 2114 form dcf wisconsin

- Filled form of student dcf fill online printable fillable

- Safety and emergency response documentation form

Find out other Long Term Care Insurance CreditMinnesota Department Of Revenue

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors