M1LTI, Long Term Care Insurance Credit Long Term Care Insurance Credit 2022-2026

What is the M1LTI, Long Term Care Insurance Credit?

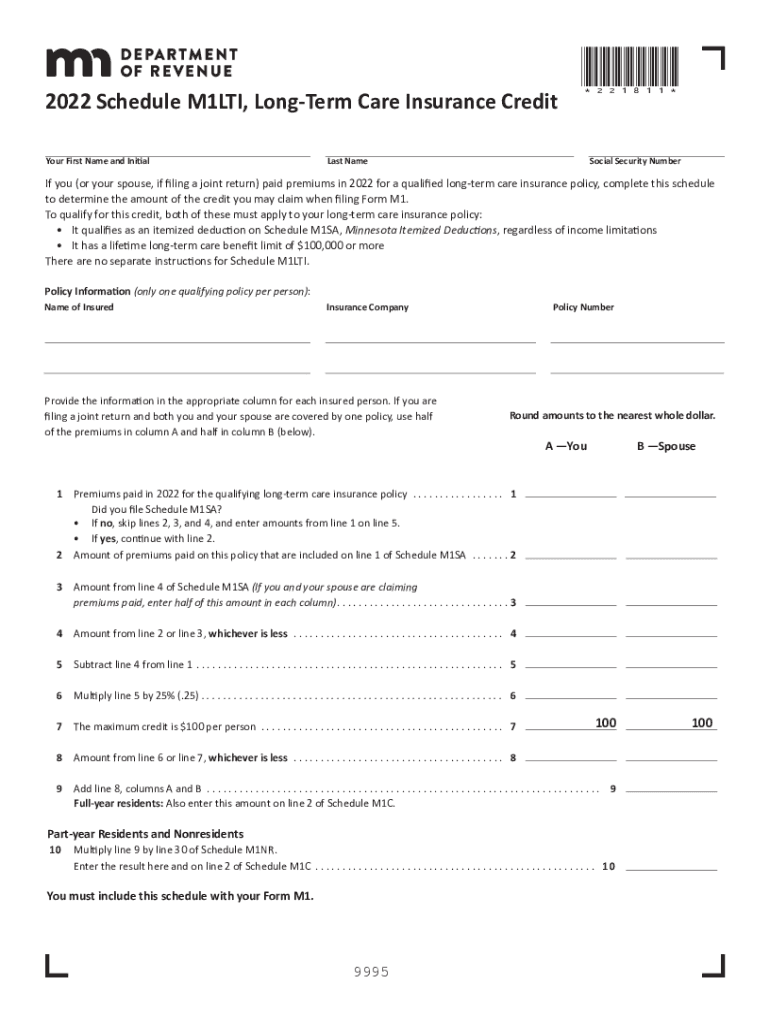

The M1LTI form is a crucial document related to long-term care insurance credits in the United States. This form is designed for individuals seeking to claim credits that can significantly reduce their tax liabilities associated with long-term care insurance premiums. Understanding the purpose of the M1LTI is essential for anyone looking to benefit from these credits, as it outlines eligibility criteria and the necessary information required for submission.

How to Use the M1LTI, Long Term Care Insurance Credit

Using the M1LTI form involves several straightforward steps. First, gather all necessary documentation, including proof of long-term care insurance premiums paid. Next, accurately fill out the form, ensuring that all information is complete and correct. It is important to double-check for any errors that could delay processing. After completing the form, submit it according to the specified guidelines, either online or through traditional mail, depending on your preference and the requirements set forth by the relevant tax authority.

Steps to Complete the M1LTI, Long Term Care Insurance Credit

Completing the M1LTI form requires careful attention to detail. Here are the steps to follow:

- Gather your long-term care insurance policy documents and payment records.

- Download the M1LTI form from the official website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your long-term care insurance, including the policy number and the amount of premiums paid.

- Review the completed form for accuracy and completeness.

- Submit the form through the designated method, ensuring you keep a copy for your records.

Legal Use of the M1LTI, Long Term Care Insurance Credit

The M1LTI form is legally recognized as a valid document for claiming long-term care insurance credits. To ensure its legal standing, it must be filled out accurately and submitted in accordance with IRS guidelines. Compliance with the relevant tax laws is crucial, as improper use of the form can lead to penalties or denial of credits. It is advisable to consult a tax professional if there are any uncertainties regarding the legal implications of using the M1LTI form.

Eligibility Criteria for the M1LTI, Long Term Care Insurance Credit

To qualify for the credits associated with the M1LTI form, certain eligibility criteria must be met. Primarily, the individual must have paid premiums for a qualifying long-term care insurance policy. Additionally, the policy must meet specific requirements set by the IRS, such as being recognized as a qualified long-term care insurance policy. Income limits and other factors may also influence eligibility, making it important to review the criteria thoroughly before applying.

Form Submission Methods for the M1LTI, Long Term Care Insurance Credit

The M1LTI form can be submitted through various methods, providing flexibility for users. Individuals can choose to submit the form online through the official tax authority's website, ensuring a quicker processing time. Alternatively, the form can be mailed to the appropriate address, allowing for traditional submission. In-person submission may also be an option at designated tax offices, depending on local regulations and availability.

Quick guide on how to complete 2022 m1lti long term care insurance credit long term care insurance credit

Accomplish M1LTI, Long Term Care Insurance Credit Long Term Care Insurance Credit effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents swiftly without interruptions. Manage M1LTI, Long Term Care Insurance Credit Long Term Care Insurance Credit on any device using the airSlate SignNow applications for Android or iOS, and streamline any document-related procedure today.

Ways to modify and eSign M1LTI, Long Term Care Insurance Credit Long Term Care Insurance Credit with ease

- Obtain M1LTI, Long Term Care Insurance Credit Long Term Care Insurance Credit and click Get Form to initiate the process.

- Utilize the tools at your disposal to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal legitimacy as a conventional wet ink signature.

- Verify all details and click on the Done button to secure your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Revise and eSign M1LTI, Long Term Care Insurance Credit Long Term Care Insurance Credit while ensuring excellent communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 m1lti long term care insurance credit long term care insurance credit

Create this form in 5 minutes!

People also ask

-

What is the best way to schedule m1lti using airSlate SignNow?

To schedule m1lti effectively with airSlate SignNow, you can utilize our intuitive scheduling features to set up your document signing process ahead of time. Easily select your recipients, define signing order, and add deadlines for each signer. This ensures a seamless workflow and helps you manage your time efficiently.

-

How does airSlate SignNow ensure the security of scheduled m1lti documents?

Security is a top priority at airSlate SignNow when you schedule m1lti documents. We utilize bank-level encryption and secure cloud storage to protect your data. Additionally, every transaction is tracked and logged, providing an audit trail that guarantees the integrity of your signed documents.

-

Can I integrate airSlate SignNow with my existing software to schedule m1lti?

Yes, airSlate SignNow offers various integrations with popular platforms to help you schedule m1lti seamlessly. You can integrate with tools like Google Drive, Salesforce, and Microsoft Office to automate your document workflows. This allows you to manage everything from a central location.

-

What are the pricing options for scheduling m1lti with airSlate SignNow?

airSlate SignNow provides flexible pricing plans to cater to different business needs when you schedule m1lti. We offer cost-effective monthly and annual subscriptions, with options that grow with your business. Each plan includes all essential features for document signing and scheduling.

-

What features should I expect when I schedule m1lti with airSlate SignNow?

When you schedule m1lti with airSlate SignNow, you can expect features like automated reminders for signers, customizable document templates, and real-time tracking of document status. These tools streamline the signing process and ensure that your documents are completed on time.

-

Are there any mobile options to schedule m1lti?

Absolutely! airSlate SignNow provides a mobile app that allows you to schedule m1lti documents on-the-go. You can send, sign, and manage your documents from any smartphone or tablet, making it easy to stay connected and productive no matter where you are.

-

Can I access support while scheduling m1lti with airSlate SignNow?

Yes, airSlate SignNow offers comprehensive customer support to assist you while you schedule m1lti. Our support team is available via chat, email, and phone to answer any questions you may have and help you navigate the platform effectively.

Get more for M1LTI, Long Term Care Insurance Credit Long Term Care Insurance Credit

- Letter landlord demand sample 497318064 form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles nebraska form

- Letter from tenant to landlord about landlords failure to make repairs nebraska form

- Letter from landlord to tenant as notice that rent was voluntarily lowered in exchange for tenant agreeing to make repairs 497318067 form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession nebraska form

- Letter from tenant to landlord about illegal entry by landlord nebraska form

- Letter from landlord to tenant about time of intent to enter premises nebraska form

- Ne tenant landlord notice form

Find out other M1LTI, Long Term Care Insurance Credit Long Term Care Insurance Credit

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate