Child and Dependent Care CreditMinnesota Department of Revenue 2020

What is the Child And Dependent Care Credit Minnesota Department Of Revenue

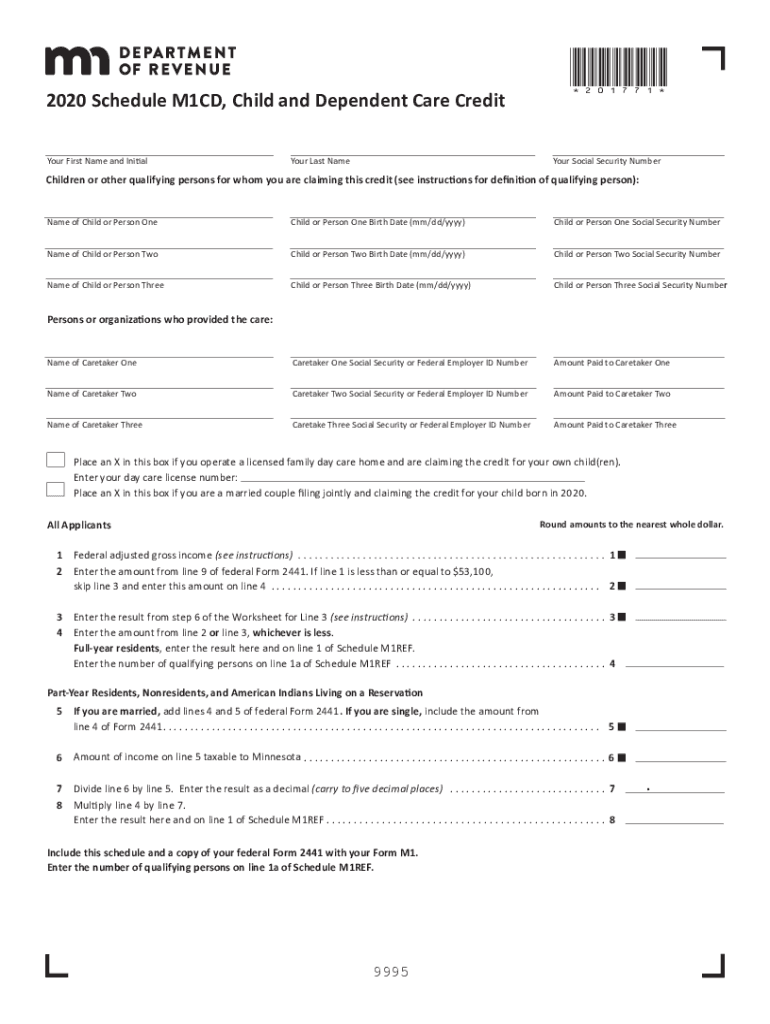

The Child and Dependent Care Credit is a tax benefit provided by the Minnesota Department of Revenue that assists families in covering the costs associated with child care and care for dependents. This credit is designed to ease the financial burden on working families, allowing them to claim a percentage of their qualifying expenses on their state tax returns. Eligible expenses may include payments made for child care services, as well as care for dependents who are unable to care for themselves due to physical or mental limitations.

Eligibility Criteria

To qualify for the Child and Dependent Care Credit, taxpayers must meet specific criteria. The individual claiming the credit must have earned income from employment or self-employment. Additionally, the care must be provided for a child under the age of thirteen or for a dependent who is physically or mentally incapable of self-care. The care must enable the taxpayer to work or look for work, and the taxpayer must provide the necessary documentation of expenses incurred for care services.

Steps to Complete the Child And Dependent Care Credit Minnesota Department Of Revenue

Completing the Child and Dependent Care Credit involves several key steps. First, gather all relevant documentation, including receipts for care expenses and the provider's tax identification number. Next, fill out the appropriate forms provided by the Minnesota Department of Revenue, ensuring that all information is accurate and complete. After completing the forms, review them for any errors before submitting them either online or via mail. It is essential to keep copies of all submitted documents for your records.

Required Documents

When applying for the Child and Dependent Care Credit, specific documents are necessary to support your claim. These typically include:

- Receipts or invoices for child care services.

- The provider's name, address, and tax identification number.

- Your Social Security number or the Social Security numbers of dependents receiving care.

- Proof of earned income, such as W-2 forms or pay stubs.

Having these documents ready will facilitate a smoother application process and help ensure compliance with state requirements.

How to Use the Child And Dependent Care Credit Minnesota Department Of Revenue

Using the Child and Dependent Care Credit effectively requires understanding how to calculate the credit amount based on your eligible expenses. The Minnesota Department of Revenue provides guidelines on the percentage of expenses that can be claimed, which varies based on income levels. After determining the eligible expenses and calculating the credit, you can apply it directly to your state tax return, reducing the amount of tax owed. It's important to stay informed about any changes to the credit guidelines or eligibility requirements each tax year.

Filing Deadlines / Important Dates

Filing deadlines for the Child and Dependent Care Credit align with the general tax filing deadlines set by the IRS and the Minnesota Department of Revenue. Typically, individual income tax returns must be filed by April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any specific deadlines for submitting the Child and Dependent Care Credit forms to ensure timely processing and avoid penalties.

Quick guide on how to complete child and dependent care creditminnesota department of revenue

Complete Child And Dependent Care CreditMinnesota Department Of Revenue effortlessly on any gadget

Digital document management has gained signNow traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Child And Dependent Care CreditMinnesota Department Of Revenue on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Child And Dependent Care CreditMinnesota Department Of Revenue with ease

- Locate Child And Dependent Care CreditMinnesota Department Of Revenue and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your delivery method for your form—via email, text message (SMS), or invitation link—or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Modify and eSign Child And Dependent Care CreditMinnesota Department Of Revenue and guarantee superior communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct child and dependent care creditminnesota department of revenue

Create this form in 5 minutes!

How to create an eSignature for the child and dependent care creditminnesota department of revenue

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the Child And Dependent Care CreditMinnesota Department Of Revenue?

The Child And Dependent Care CreditMinnesota Department Of Revenue is a tax credit available to help offset the costs of childcare for working families. This credit allows eligible taxpayers to receive a percentage of their qualifying expenses, ultimately reducing their overall tax liability. It's designed to provide financial relief for those balancing work and family responsibilities.

-

Who qualifies for the Child And Dependent Care CreditMinnesota Department Of Revenue?

To qualify for the Child And Dependent Care CreditMinnesota Department Of Revenue, you must have earned income and pay for childcare expenses that enable you to work or look for work. Additionally, your child or dependent must be under the age of 13, and the care must be provided to allow you to work. Review the specific requirements on the Minnesota Department Of Revenue website for full eligibility criteria.

-

How can airSlate SignNow help with the documentation for the Child And Dependent Care CreditMinnesota Department Of Revenue?

AirSlate SignNow simplifies the documentation process associated with claiming the Child And Dependent Care CreditMinnesota Department Of Revenue. With our eSigning and document management solutions, users can easily gather necessary signatures and securely store receipts and proof of payment. This streamlines the process of documenting your childcare expenses.

-

What features does airSlate SignNow offer that can assist with tax credits like the Child And Dependent Care CreditMinnesota Department Of Revenue?

AirSlate SignNow offers features such as customizable templates, secure document storage, and electronic signatures that make managing tax-related documents efficient. These tools help ensure that all necessary forms and receipts for the Child And Dependent Care CreditMinnesota Department Of Revenue are organized and accessible when tax time arrives. Another benefit is the ability to share documents easily with your tax preparer.

-

Is there a cost associated with using airSlate SignNow for Child And Dependent Care CreditMinnesota Department Of Revenue documentation?

Yes, while airSlate SignNow does have associated subscription costs, it provides a cost-effective solution compared to traditional document management methods. The pricing is designed to cater to businesses of all sizes, and the time saved in managing your documents effectively may far outweigh the costs. Explore our pricing plans to find the best fit for your needs.

-

How does airSlate SignNow enhance collaboration on documents related to the Child And Dependent Care CreditMinnesota Department Of Revenue?

AirSlate SignNow allows multiple users to collaborate on documents related to the Child And Dependent Care CreditMinnesota Department Of Revenue in real-time. Participants can leave comments, share feedback, and track revisions, making it easier to finalize applications and claims. This collaborative feature ensures everyone has input and is on the same page.

-

Can I integrate airSlate SignNow with other software for filing the Child And Dependent Care CreditMinnesota Department Of Revenue?

Absolutely! AirSlate SignNow provides easy integrations with various accounting and tax preparation software, which can streamline your process for claiming the Child And Dependent Care CreditMinnesota Department Of Revenue. These integrations allow for seamless transfer of data and documents, enhancing workflow efficiency. Check our integration options to see what fits your needs.

Get more for Child And Dependent Care CreditMinnesota Department Of Revenue

- Dcf f dwsc 15295 form

- Continuing education record wisconsin department of form

- Transport operation road use management act 1995 form

- Letter of authority nsw form

- Transport operations passenger transport act 1994 tow truck act 1973 support transport qld gov form

- Sa456 form

- Fillable online licensing registered dietitian referral form

- Form 519

Find out other Child And Dependent Care CreditMinnesota Department Of Revenue

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free