M1CD, Child and Dependent Care Credit M1CD, Child and Dependent Care Credit 2022-2026

What is the M1CD?

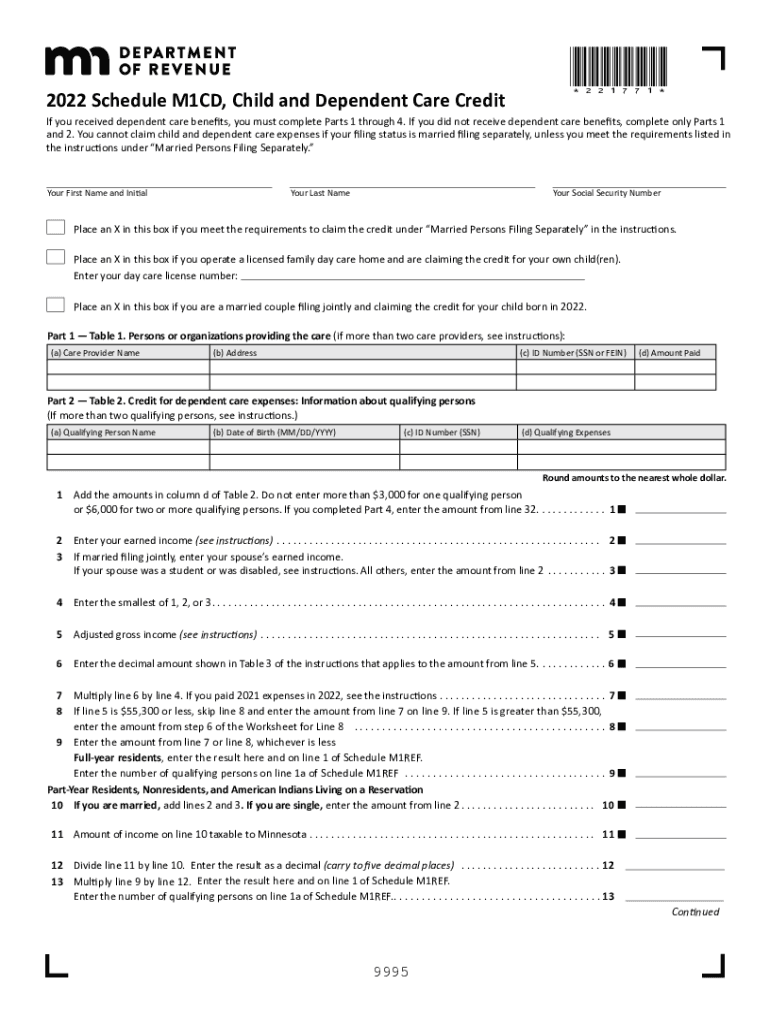

The M1CD, or Child and Dependent Care Credit, is a tax form used in the United States to claim a credit for expenses incurred while caring for qualifying children or dependents. This credit is designed to assist families who are working or looking for work and need childcare services. The M1CD allows taxpayers to offset a portion of their childcare expenses, making it easier for them to balance work and family responsibilities.

Eligibility Criteria for the M1CD

To qualify for the Child and Dependent Care Credit, certain conditions must be met:

- The taxpayer must have earned income from employment or self-employment.

- Care must be provided for a child under the age of thirteen or a dependent who is physically or mentally incapable of self-care.

- The care must be necessary for the taxpayer to work or look for work.

- Expenses must be incurred for care provided to a qualifying individual.

Steps to Complete the M1CD

Filling out the M1CD involves several key steps:

- Gather necessary documentation, including receipts for childcare expenses and the provider's tax identification number.

- Complete the M1CD form, ensuring all required fields are filled accurately.

- Calculate the credit amount based on the total qualifying expenses and the applicable percentage.

- Submit the completed form along with your tax return, either electronically or by mail.

How to Obtain the M1CD

The M1CD form can be obtained through various channels:

- Visit the official IRS website to download the form directly.

- Request a physical copy from a tax professional or local tax office.

- Utilize tax preparation software that includes the M1CD as part of the filing process.

Required Documents for the M1CD

When filing the M1CD, it is essential to have the following documents ready:

- Receipts or invoices from childcare providers.

- The provider's tax identification number or Social Security number.

- Proof of the taxpayer's earned income, such as W-2 forms or pay stubs.

Filing Deadlines for the M1CD

Timely filing is crucial to ensure that you receive your credit. The deadline for submitting the M1CD typically aligns with the federal tax return deadline, which is usually April 15. If additional time is needed, taxpayers may file for an extension, but they must still pay any owed taxes by the original deadline to avoid penalties.

Quick guide on how to complete 2022 m1cd child and dependent care credit m1cd child and dependent care credit

Prepare M1CD, Child And Dependent Care Credit M1CD, Child And Dependent Care Credit effortlessly on any device

Online document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage M1CD, Child And Dependent Care Credit M1CD, Child And Dependent Care Credit on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign M1CD, Child And Dependent Care Credit M1CD, Child And Dependent Care Credit with ease

- Locate M1CD, Child And Dependent Care Credit M1CD, Child And Dependent Care Credit and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Purge the hassle of lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow manages your documentation needs in just a few clicks from any device you choose. Modify and eSign M1CD, Child And Dependent Care Credit M1CD, Child And Dependent Care Credit and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 m1cd child and dependent care credit m1cd child and dependent care credit

Create this form in 5 minutes!

People also ask

-

What is m1cd and how does it relate to airSlate SignNow?

M1cd is a key feature in airSlate SignNow that enhances the document signing process. By utilizing m1cd, businesses can ensure quick and secure electronic signatures, streamlining their documentation workflow. This integration not only saves time but also increases accuracy in document management.

-

How much does airSlate SignNow cost with the m1cd feature?

The pricing for airSlate SignNow varies based on the plan selected, but the m1cd feature is available across all subscription tiers. Each plan is designed to provide excellent value by offering cost-effective solutions for businesses of all sizes. You can check the website for current pricing details and potential discounts.

-

What benefits does m1cd provide for document management?

One of the main benefits of m1cd in airSlate SignNow is its ability to automate the document signing process. This leads to enhanced productivity and reduced turnaround times for important contracts and agreements. Additionally, m1cd ensures that all signed documents are securely stored and easily accessible.

-

Can I integrate m1cd with other software?

Yes, m1cd within airSlate SignNow can seamlessly integrate with various software applications. This includes popular CRM, ERP, and cloud storage solutions. These integrations allow you to automate workflows and elevate your document management processes.

-

Is m1cd suitable for all types of businesses?

Absolutely, m1cd is designed to meet the needs of businesses of all sizes and industries. Whether you're a small startup or a large enterprise, airSlate SignNow's m1cd feature can facilitate efficient document signing. It scales easily to accommodate your business processes.

-

How secure is the m1cd feature in airSlate SignNow?

The m1cd feature in airSlate SignNow incorporates robust security protocols to protect your documents. This includes encryption and compliance with industry standards to ensure that all signed documents are safe from unauthorized access. You can trust that your sensitive information is secure.

-

What types of documents can I sign using m1cd?

With the m1cd feature, you can sign a wide variety of documents, including contracts, agreements, and forms. airSlate SignNow supports various file formats, making it easy to convert and sign documents as needed. This versatility makes it an ideal solution for any business need.

Get more for M1CD, Child And Dependent Care Credit M1CD, Child And Dependent Care Credit

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497318056 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair nebraska form

- Letter from tenant to landlord containing notice that doors are broken and demand repair nebraska form

- Letter from tenant to landlord with demand that landlord repair broken windows nebraska form

- Letter from tenant to landlord with demand that landlord repair plumbing problem nebraska form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497318061 form

- Letter from tenant to landlord with demand that landlord repair unsafe or broken lights or wiring nebraska form

- Ne tenant landlord form

Find out other M1CD, Child And Dependent Care Credit M1CD, Child And Dependent Care Credit

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT