Www Revenue State Mn Uschild and Dependent CareChild and Dependent Care CreditMinnesota Department of Revenue 2021

Understanding the Child and Dependent Care Credit

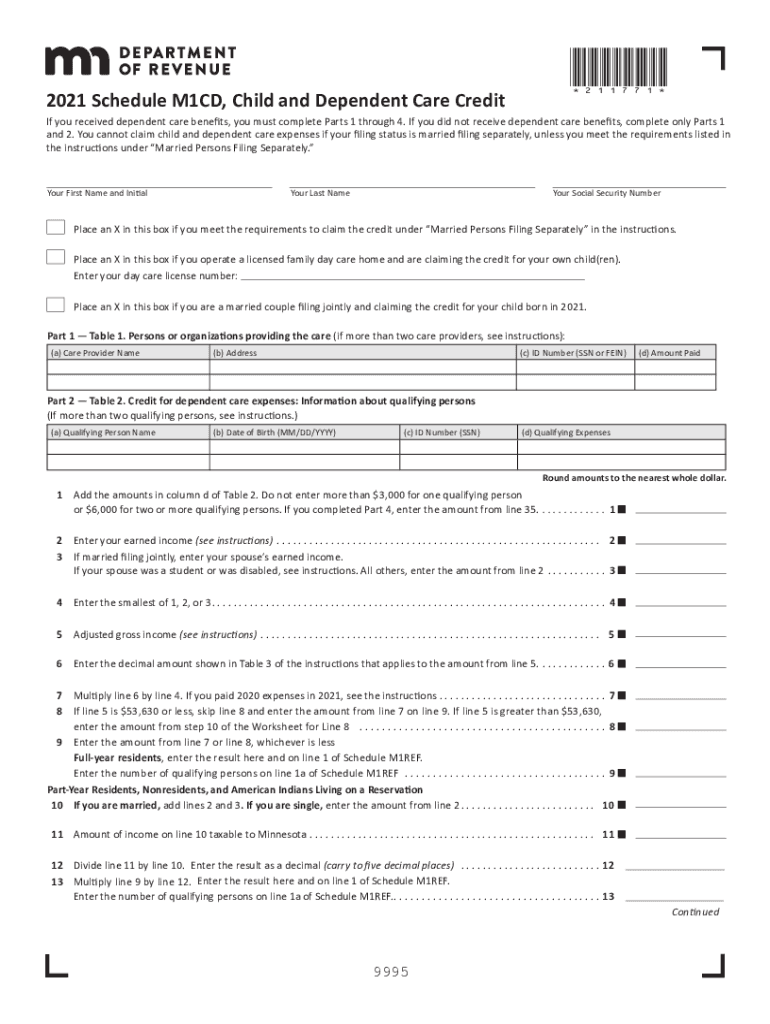

The Child and Dependent Care Credit is a tax benefit designed to assist working families with the costs of childcare. This credit can be claimed by taxpayers who incur expenses for the care of a qualifying child under the age of thirteen or a dependent who is physically or mentally incapable of self-care. The credit is intended to help alleviate the financial burden of childcare, enabling parents to work or look for work while ensuring their children are cared for in a safe environment.

Eligibility Criteria for the Credit

To qualify for the Child and Dependent Care Credit, several criteria must be met:

- The taxpayer must have earned income from employment or self-employment.

- The care must be provided for a child under the age of thirteen or a dependent who cannot care for themselves.

- The care must be provided so that the taxpayer can work or look for work.

- Expenses must be incurred for care provided during the tax year for which the credit is claimed.

Steps to Complete the Schedule M1CD

Filling out the Schedule M1CD requires careful attention to detail. Here are the steps to complete this form:

- Gather all necessary documentation, including receipts for childcare expenses and information about your dependents.

- Fill out your personal information at the top of the form, including your name, address, and Social Security number.

- Report your total qualifying expenses for childcare in the designated section.

- Calculate the credit amount based on your income and the number of qualifying dependents.

- Review the completed form for accuracy before submission.

Required Documents for Filing

When filing for the Child and Dependent Care Credit, certain documents are essential:

- Receipts or statements from childcare providers detailing the costs incurred.

- Tax identification numbers for the childcare providers, if applicable.

- Proof of employment or self-employment, such as pay stubs or tax returns.

Legal Use of the Credit

The Child and Dependent Care Credit is legally binding when claimed correctly on your tax return. It is important to ensure that all information is accurate and that you retain documentation to support your claim. Misrepresentation or failure to comply with IRS guidelines may result in penalties or disqualification from claiming the credit in future tax years.

Filing Deadlines and Important Dates

To ensure timely processing of your tax return and the Child and Dependent Care Credit, be aware of the following important dates:

- Tax filing deadline: Typically April 15 of each year.

- Extensions: If you file for an extension, ensure that you submit your return by the extended deadline.

Quick guide on how to complete wwwrevenuestatemnuschild and dependent carechild and dependent care creditminnesota department of revenue

Effortlessly Prepare Www revenue state mn uschild and dependent careChild And Dependent Care CreditMinnesota Department Of Revenue on Any Device

Online document management has surged in popularity among companies and individuals. It offers a seamless eco-friendly substitute to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without any holdups. Manage Www revenue state mn uschild and dependent careChild And Dependent Care CreditMinnesota Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The Easiest Way to Modify and eSign Www revenue state mn uschild and dependent careChild And Dependent Care CreditMinnesota Department Of Revenue Effortlessly

- Locate Www revenue state mn uschild and dependent careChild And Dependent Care CreditMinnesota Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Www revenue state mn uschild and dependent careChild And Dependent Care CreditMinnesota Department Of Revenue and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwrevenuestatemnuschild and dependent carechild and dependent care creditminnesota department of revenue

Create this form in 5 minutes!

How to create an eSignature for the wwwrevenuestatemnuschild and dependent carechild and dependent care creditminnesota department of revenue

How to make an e-signature for a PDF file in the online mode

How to make an e-signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

The best way to make an e-signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is the process to schedule m1cd using airSlate SignNow?

Scheduling m1cd with airSlate SignNow is a straightforward process. You simply log into your account, navigate to the scheduling feature, and follow the prompts to set your desired time. Our platform integrates seamlessly with your calendar, ensuring you never miss an important deadline.

-

How much does it cost to schedule m1cd with airSlate SignNow?

The cost to schedule m1cd varies based on the plan you choose. Our pricing is designed to be cost-effective, catering to businesses of all sizes. You can view detailed pricing options on our website and select the plan that best fits your needs.

-

What features are included when I schedule m1cd?

When you schedule m1cd with airSlate SignNow, you gain access to a comprehensive set of features. These include document templates, team collaboration tools, and advanced security measures. Our user-friendly interface also makes it easier to manage and track your scheduled documents.

-

What are the benefits of choosing to schedule m1cd with airSlate SignNow?

The primary benefits of scheduling m1cd with airSlate SignNow include increased efficiency and ease of use. You can reduce the time spent on document management while ensuring compliance with eSignature standards. Additionally, our solution helps improve workflow, allowing your team to focus on core business activities.

-

Can I integrate airSlate SignNow with other software when I schedule m1cd?

Yes, airSlate SignNow offers robust integration capabilities that let you connect with various CRM and productivity tools. This means that when you schedule m1cd, you can easily sync your documents with other applications, streamlining your workflows and enhancing productivity.

-

Is it easy to manage scheduled m1cd documents?

Absolutely! Managing scheduled m1cd documents with airSlate SignNow is designed to be user-friendly. The platform provides a clear overview of all scheduled documents, and you can edit or reschedule them as needed directly from your dashboard without any hassle.

-

What types of businesses benefit from scheduling m1cd?

Scheduling m1cd is beneficial for businesses across various sectors, including healthcare, finance, and education. Any organization looking to streamline document signing and approval processes will find value in our solution. airSlate SignNow caters to both small businesses and large enterprises.

Get more for Www revenue state mn uschild and dependent careChild And Dependent Care CreditMinnesota Department Of Revenue

- Letter from tenant to landlord containing request for permission to sublease florida form

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages florida form

- Fl tenant form

- Fl landlord form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration florida form

- Tenant vacating premises form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement florida form

- Tenant landlord rent form

Find out other Www revenue state mn uschild and dependent careChild And Dependent Care CreditMinnesota Department Of Revenue

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT