Minnesota Form M1C Other Nonrefundable Credits Onscreen 2020

What is the Minnesota Form M1C Other Nonrefundable Credits onscreen

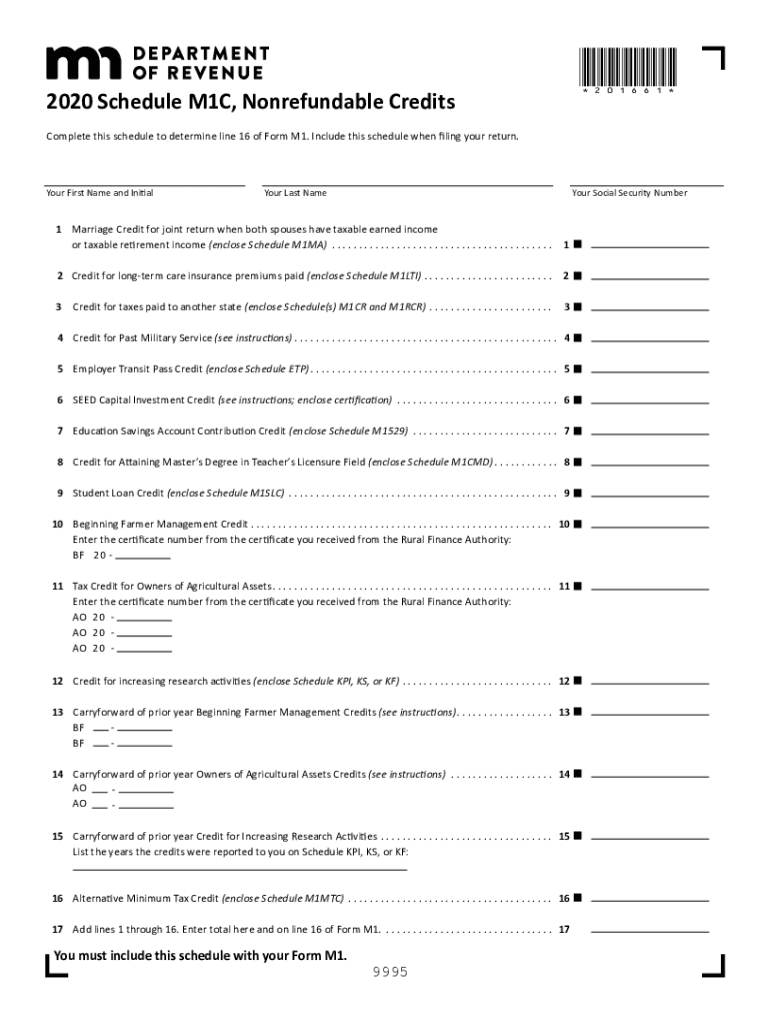

The Minnesota Form M1C is designed to allow taxpayers to claim various nonrefundable credits on their state income tax returns. These credits can help reduce the overall tax liability for individuals and businesses. The form is specifically tailored to capture information related to credits that do not result in a refund if they exceed the tax owed. Understanding this form is essential for taxpayers looking to maximize their eligible credits while ensuring compliance with state tax regulations.

How to use the Minnesota Form M1C Other Nonrefundable Credits onscreen

Using the Minnesota Form M1C involves several straightforward steps. First, access the form through a reliable source, ensuring it is the most current version. Next, gather all necessary documentation related to the credits you intend to claim. This may include receipts, tax identification numbers, and any relevant prior tax returns. Once you have the required information, fill out the form carefully, ensuring accuracy to avoid delays or issues with your tax return. After completing the form, review it for any errors before submission.

Steps to complete the Minnesota Form M1C Other Nonrefundable Credits onscreen

Completing the Minnesota Form M1C involves a series of methodical steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Identify the specific nonrefundable credits you are eligible for, such as the credit for taxes paid to other states or the credit for charitable contributions.

- Carefully input the amounts associated with each credit, ensuring they align with your documentation.

- Double-check all entries for accuracy and completeness.

- Submit the form electronically or print it for mailing, depending on your preference and the submission guidelines.

Legal use of the Minnesota Form M1C Other Nonrefundable Credits onscreen

The legal use of the Minnesota Form M1C is governed by state tax laws and regulations. To ensure the form is legally binding, it must be filled out accurately and submitted within the designated filing period. Additionally, when using electronic signatures, it is crucial to comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws help validate the authenticity of electronic documents, making them legally acceptable in the eyes of the law.

Eligibility Criteria

To qualify for the credits claimed on the Minnesota Form M1C, taxpayers must meet specific eligibility criteria. Generally, these criteria include:

- Being a resident of Minnesota or having income sourced from Minnesota.

- Meeting income thresholds that may affect eligibility for certain credits.

- Providing documentation that supports the claim for each credit.

- Filing a complete and accurate state income tax return.

Filing Deadlines / Important Dates

Filing deadlines for the Minnesota Form M1C are crucial to ensure compliance and avoid penalties. Typically, the form must be submitted by the same deadline as your state income tax return. For most taxpayers, this is April 15 of each year. However, if you are unable to meet this deadline, consider filing for an extension. Keep in mind that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Quick guide on how to complete minnesota form m1c other nonrefundable credits onscreen

Create Minnesota Form M1C Other Nonrefundable Credits onscreen effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Minnesota Form M1C Other Nonrefundable Credits onscreen on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Minnesota Form M1C Other Nonrefundable Credits onscreen with minimal effort

- Locate Minnesota Form M1C Other Nonrefundable Credits onscreen and click Access Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review all the details and click on the Finish button to secure your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Minnesota Form M1C Other Nonrefundable Credits onscreen and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota form m1c other nonrefundable credits onscreen

Create this form in 5 minutes!

How to create an eSignature for the minnesota form m1c other nonrefundable credits onscreen

The way to generate an eSignature for your PDF file online

The way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What is airSlate SignNow and how can it help me schedule m1c?

airSlate SignNow is a powerful document signing platform that streamlines the process of sending and eSigning documents. With its user-friendly interface, you can easily schedule m1c, ensuring that important agreements and transactions are handled efficiently. The platform’s features help reduce turnaround time and improve overall productivity.

-

How much does airSlate SignNow cost for scheduling m1c?

Pricing for airSlate SignNow varies based on the plan you choose. All plans include the ability to schedule m1c, simplifying document management for organizations of all sizes. You can explore the pricing options on our website to find a solution that fits your budget and needs.

-

What features does airSlate SignNow offer to aid in scheduling m1c?

airSlate SignNow includes various features designed to enhance your ability to schedule m1c, such as customizable templates, automatic reminders, and real-time tracking. These features ensure that you stay organized and can manage your document workflows seamlessly. The platform is designed to empower businesses, making document routing simple and effective.

-

Can I integrate airSlate SignNow with other software for scheduling m1c?

Yes, airSlate SignNow offers integration with numerous applications that facilitate easy scheduling of m1c. You can connect it with CRM systems, project management tools, and other software to automate your workflows. This integration ensures that you maximize productivity and maintain a cohesive operational environment.

-

What are the benefits of using airSlate SignNow to schedule m1c over traditional methods?

Using airSlate SignNow to schedule m1c provides several advantages, including faster processing times and increased efficiency in handling documents. Unlike traditional methods, which can be prolonged and cumbersome, airSlate SignNow's digital solution reduces delays and enhances collaboration among stakeholders. Businesses can signNowly improve their operations and responsiveness to their clients.

-

Is it easy to learn how to schedule m1c with airSlate SignNow?

Absolutely! airSlate SignNow is designed to be user-friendly, allowing anyone to quickly learn how to schedule m1c without extensive training. The intuitive interface, along with helpful resources and support, ensures a smooth onboarding experience for all users. You'll be managing your document workflows in no time.

-

What types of documents can I manage while scheduling m1c on airSlate SignNow?

You can manage a wide variety of documents while scheduling m1c on airSlate SignNow, including contracts, agreements, and forms. The platform supports multiple file formats, making it versatile for different use cases. It's an all-in-one solution for businesses looking to streamline their document processes.

Get more for Minnesota Form M1C Other Nonrefundable Credits onscreen

Find out other Minnesota Form M1C Other Nonrefundable Credits onscreen

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now