Minnesota Form M1C Other Nonrefundable Credits Onscreen Version 2022-2026

What is the Minnesota Form M1C Other Nonrefundable Credits?

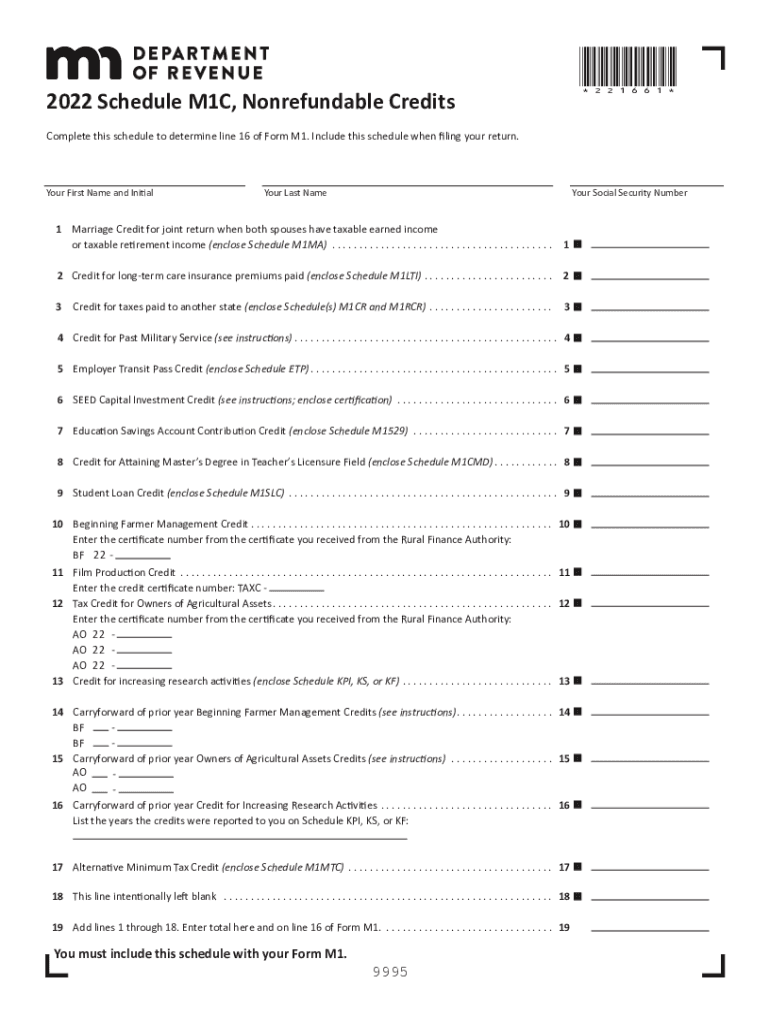

The Minnesota Form M1C is designed to help taxpayers claim various nonrefundable credits on their state income tax return. These credits can reduce the amount of tax owed but cannot result in a refund if they exceed the tax liability. The form includes sections for different types of credits, such as those for renters, property tax refunds, and other specific state incentives. Understanding the purpose of the M1C is essential for maximizing potential tax benefits while ensuring compliance with Minnesota tax laws.

Steps to Complete the Minnesota Form M1C Other Nonrefundable Credits

Completing the Minnesota Form M1C involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including income statements and details of any eligible expenses. Next, follow these steps:

- Fill out personal information, including your name, address, and Social Security number.

- Identify the specific credits you are eligible for and enter the corresponding amounts in the designated fields.

- Double-check all calculations to ensure they are accurate.

- Review the completed form for any missing information or errors before submission.

By carefully following these steps, you can ensure that your M1C form is completed correctly and submitted on time.

Eligibility Criteria for the Minnesota Form M1C Other Nonrefundable Credits

To qualify for the credits available on the Minnesota Form M1C, taxpayers must meet specific eligibility criteria. Generally, these criteria include:

- Residency in Minnesota for the entire tax year.

- Filing a Minnesota income tax return.

- Meeting income thresholds that determine eligibility for various credits.

- Providing documentation for any claimed credits, such as proof of property taxes paid or rent paid during the year.

Understanding these criteria is crucial for ensuring that you can claim the credits for which you are eligible.

Legal Use of the Minnesota Form M1C Other Nonrefundable Credits

The Minnesota Form M1C is legally recognized as a valid means for taxpayers to claim nonrefundable credits. To ensure its legal standing, it must be filled out accurately and submitted according to state regulations. Compliance with tax laws, including accurate reporting of income and expenses, is essential to avoid penalties. The form must be filed alongside your Minnesota income tax return, adhering to the deadlines set by the Minnesota Department of Revenue.

Form Submission Methods for the Minnesota Form M1C Other Nonrefundable Credits

Taxpayers have multiple options for submitting the Minnesota Form M1C. The available submission methods include:

- Online: Submit electronically through the Minnesota Department of Revenue's e-filing system, which is often the fastest method.

- By Mail: Print the completed form and send it to the appropriate address as specified in the filing instructions.

- In-Person: Deliver the form directly to a local Minnesota Department of Revenue office if preferred.

Choosing the right submission method can streamline the filing process and ensure timely processing of your tax return.

Key Elements of the Minnesota Form M1C Other Nonrefundable Credits

The Minnesota Form M1C includes several key elements that are important for taxpayers to understand. These elements consist of:

- Personal Information: Required details about the taxpayer, including name and Social Security number.

- Credit Types: Sections dedicated to different nonrefundable credits, each with specific eligibility requirements.

- Calculation Fields: Areas where taxpayers enter amounts for each credit, which are then totaled to determine the final credit amount.

- Signature Line: A section for the taxpayer's signature, affirming the accuracy of the information provided.

Familiarity with these key elements can help ensure that the form is completed accurately and efficiently.

Quick guide on how to complete minnesota form m1c other nonrefundable credits onscreen version

Complete Minnesota Form M1C Other Nonrefundable Credits onscreen Version seamlessly on any device

Online document administration has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any delays. Manage Minnesota Form M1C Other Nonrefundable Credits onscreen Version on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Minnesota Form M1C Other Nonrefundable Credits onscreen Version effortlessly

- Find Minnesota Form M1C Other Nonrefundable Credits onscreen Version and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive details with features provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose your preferred method of submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from any device you choose. Modify and eSign Minnesota Form M1C Other Nonrefundable Credits onscreen Version and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota form m1c other nonrefundable credits onscreen version

Create this form in 5 minutes!

People also ask

-

What are Minnesota credits and how do they work with airSlate SignNow?

Minnesota credits refer to incentives or allowances that can benefit businesses and individuals in Minnesota. With airSlate SignNow, you can seamlessly integrate the management of these credits into your document signing process, making it easier to manage compliance and documentation.

-

How can airSlate SignNow help manage Minnesota credits for my business?

airSlate SignNow provides an intuitive platform that streamlines the process of eSigning documents related to Minnesota credits. By utilizing templates and electronic signature capabilities, you can ensure that all documentation is handled efficiently, saving time and resources.

-

What pricing options are available for airSlate SignNow users looking for Minnesota credits solutions?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs, including those specifically focused on managing Minnesota credits. You can select a plan that aligns with your business requirements, ensuring a cost-effective solution to handle document management.

-

Are there specific features of airSlate SignNow that support Minnesota credits?

Yes, airSlate SignNow includes features such as customizable templates, automated workflows, and reporting tools that specifically address the management of Minnesota credits. These features enhance efficiency and accuracy in document handling related to financial incentives.

-

What benefits does airSlate SignNow offer when dealing with Minnesota credits documentation?

The primary benefits of using airSlate SignNow for Minnesota credits documentation include improved speed, enhanced security, and reduced paper usage. By digitizing the process, businesses can quickly obtain signatures and track their documents, ultimately increasing productivity.

-

Can airSlate SignNow integrate with other software to manage Minnesota credits?

Absolutely, airSlate SignNow supports integrations with various third-party applications to help manage Minnesota credits efficiently. This capability allows you to connect your existing tools for streamlined workflows, ensuring a smooth process for documentation and eSigning.

-

How secure is the airSlate SignNow platform for handling documents related to Minnesota credits?

Security is a top priority at airSlate SignNow; the platform employs advanced encryption protocols and compliance with industry standards to protect documents related to Minnesota credits. Your data remains safe throughout the signing process, giving you peace of mind.

Get more for Minnesota Form M1C Other Nonrefundable Credits onscreen Version

- Ga landlord 497303747 form

- Ga landlord 497303748 form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497303749 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement georgia form

- Letter about increase form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants georgia form

- Tenant landlord utility 497303753 form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat georgia form

Find out other Minnesota Form M1C Other Nonrefundable Credits onscreen Version

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document