Form M1, Individual Income Tax Return 2021

What is the Form M1, Individual Income Tax Return

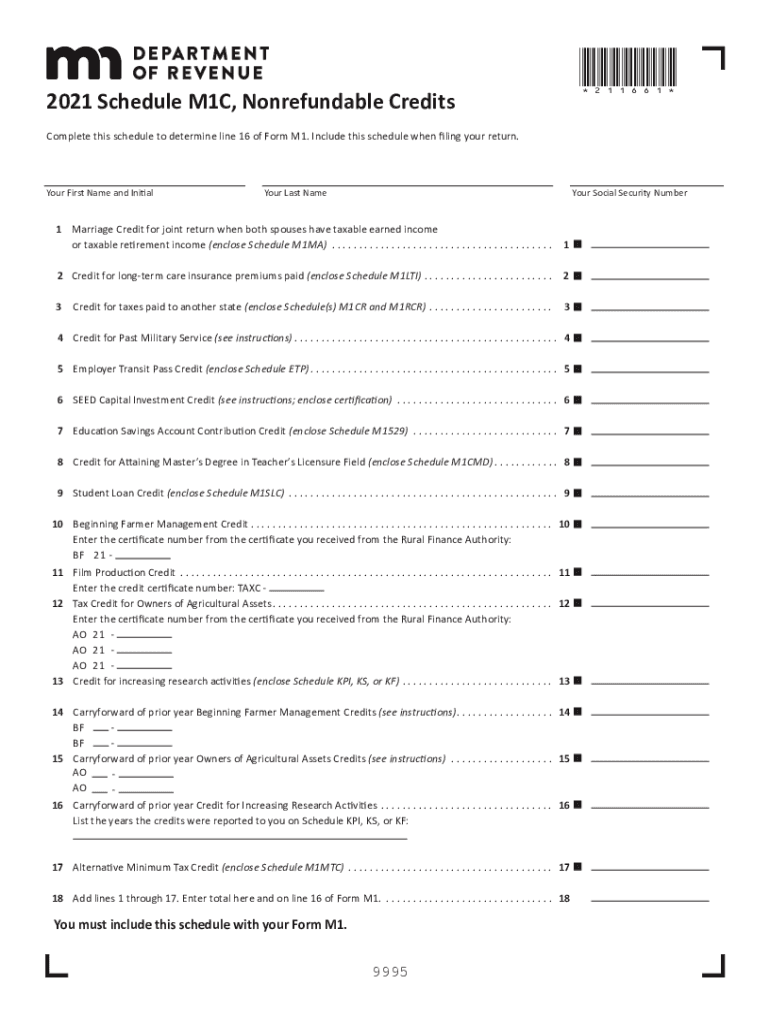

The Form M1, known as the Individual Income Tax Return for Minnesota residents, is a crucial document used to report income, calculate taxes owed, and claim refunds. This form is specifically designed for individuals who are residents of Minnesota, allowing them to fulfill their state tax obligations. It includes various sections to detail income sources, deductions, and credits, ensuring taxpayers can accurately report their financial situation to the Minnesota Department of Revenue.

Steps to complete the Form M1, Individual Income Tax Return

Completing the Form M1 involves several key steps to ensure accuracy and compliance with Minnesota tax laws. Begin by gathering all necessary documents, such as W-2s, 1099s, and any other income statements. Next, follow these steps:

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income from all sources on the appropriate lines.

- Claim any eligible deductions, such as those for student loans or mortgage interest.

- Calculate your tax liability using the provided tax tables or software tools.

- Include any tax credits you qualify for, which can reduce your overall tax bill.

- Review your completed form for accuracy before submission.

Legal use of the Form M1, Individual Income Tax Return

The legal use of the Form M1 is governed by Minnesota tax laws, which require residents to file their income tax returns annually. The information provided on this form must be truthful and accurate, as any discrepancies can lead to penalties or audits. By signing the form, taxpayers affirm that the information is correct to the best of their knowledge, making it a legally binding document.

Filing Deadlines / Important Dates

Filing deadlines for the Form M1 are crucial for compliance. Typically, the deadline for submitting the form is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available, which can provide additional time to file without incurring penalties.

Required Documents

To complete the Form M1 accurately, several documents are required. These include:

- W-2 forms from employers, detailing annual wages and taxes withheld.

- 1099 forms for any freelance or contract work, showing additional income.

- Documentation for deductions, such as mortgage interest statements or student loan interest.

- Any relevant receipts or records that support claimed credits or deductions.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the Form M1. These methods include:

- Online submission through the Minnesota Department of Revenue's e-filing system, which is often the fastest and most efficient method.

- Mailing a printed version of the form to the appropriate address, ensuring it is postmarked by the filing deadline.

- In-person submission at designated tax offices, although this may require an appointment and is less common.

Examples of using the Form M1, Individual Income Tax Return

Examples of using the Form M1 can vary based on individual circumstances. For instance, a full-time employee may use the form to report wages and claim standard deductions, while a self-employed individual might report business income and expenses. Each scenario requires careful attention to detail to ensure all income is reported and eligible deductions are claimed, maximizing potential refunds or minimizing tax liabilities.

Quick guide on how to complete 2021 form m1 individual income tax return

Complete Form M1, Individual Income Tax Return seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the suitable template and securely store it online. airSlate SignNow provides all the features necessary to create, modify, and eSign your documents swiftly and without interruptions. Manage Form M1, Individual Income Tax Return on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Form M1, Individual Income Tax Return effortlessly

- Obtain Form M1, Individual Income Tax Return and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Form M1, Individual Income Tax Return and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form m1 individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2021 form m1 individual income tax return

How to make an e-signature for a PDF file online

How to make an e-signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to create an e-signature straight from your mobile device

The best way to make an e-signature for a PDF file on iOS

How to create an e-signature for a PDF document on Android devices

People also ask

-

What is the 'schedule m1c' feature in airSlate SignNow?

The 'schedule m1c' feature in airSlate SignNow allows users to efficiently plan and automate the signing process for their documents. This means you can set specific times for documents to be sent out for signature, enhancing your workflow and ensuring timely responses.

-

How can I utilize the 'schedule m1c' feature for my business?

To utilize the 'schedule m1c' feature, simply log in to your airSlate SignNow account and select your document. You can then set the desired date and time for it to be sent out, ensuring seamless and organized communication with your clients or stakeholders.

-

Is there an additional cost to use 'schedule m1c' in airSlate SignNow?

No, the 'schedule m1c' feature is included in the standard pricing of airSlate SignNow. This makes it a cost-effective solution for businesses looking to streamline their document signing processes without incurring extra costs.

-

What are the key benefits of scheduling documents with 'schedule m1c'?

The key benefits of using 'schedule m1c' include improved efficiency, reduced delays in document signing, and enhanced organization. By scheduling documents, you can ensure that important contracts and agreements are signed on time, which is crucial for business operations.

-

Can 'schedule m1c' integrate with other software tools?

Yes, airSlate SignNow's 'schedule m1c' feature integrates easily with various software applications through APIs. This allows you to manage your document workflows seamlessly alongside your existing business systems, such as CRMs and project management tools.

-

How do I track the status of documents sent with 'schedule m1c'?

You can track the status of documents sent using 'schedule m1c' in your airSlate SignNow dashboard. The platform offers real-time updates, allowing you to see when documents are viewed and signed, helping you stay informed throughout the signing process.

-

Is 'schedule m1c' suitable for businesses of all sizes?

Absolutely! The 'schedule m1c' feature is designed to accommodate businesses of all sizes, from small startups to large enterprises. It provides an effective solution for any organization looking to improve their document workflow and signing efficiency.

Get more for Form M1, Individual Income Tax Return

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant florida form

- Letter tenant rent 497302981 form

- Florida tenant landlord form

- Temporary lease agreement to prospective buyer of residence prior to closing florida form

- Fl eviction form

- Letter from landlord to tenant returning security deposit less deductions florida form

- Return security deposit florida form

- Tenant deposit return form

Find out other Form M1, Individual Income Tax Return

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document