Printable Montana Form EST I Underpayment of Estimated Tax by Individuals and Fiduciaries 2020

What is the Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries

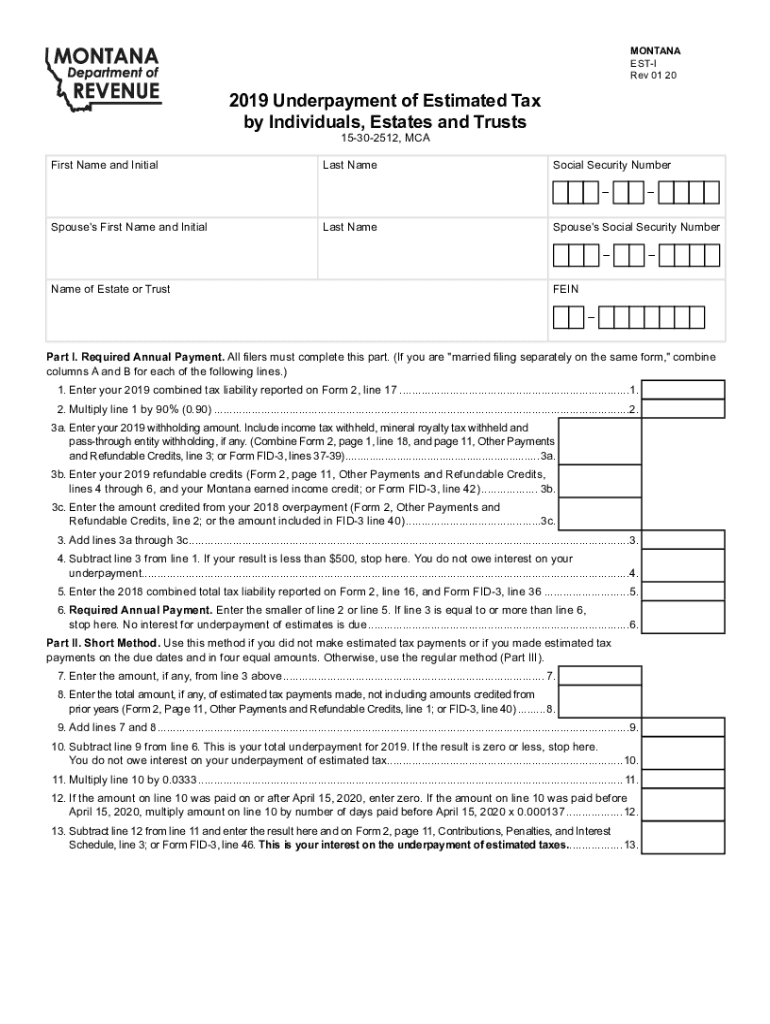

The Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries is a tax form used by individuals and fiduciaries in Montana to report underpayment of estimated taxes. This form is essential for ensuring compliance with state tax obligations, particularly for those who may not have withheld enough tax throughout the year. It allows taxpayers to calculate any penalties due for underpayment and helps maintain accurate tax records.

How to use the Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries

Using the Printable Montana Form EST I involves several steps. First, gather all necessary financial information, including income sources and any taxes already paid. Next, complete the form by accurately entering your details and calculations regarding your estimated tax payments. After filling out the form, review it for accuracy before submitting it to the Montana Department of Revenue. It is crucial to ensure that all information is correct to avoid penalties.

Steps to complete the Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries

Completing the Printable Montana Form EST I requires careful attention to detail. Follow these steps:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total estimated tax liability for the year.

- Determine the amount of tax you have already paid through withholding or estimated payments.

- Fill out the form, providing all required information, including your name, address, and financial details.

- Review the form for accuracy, ensuring all calculations are correct.

- Submit the completed form to the Montana Department of Revenue by the specified deadline.

Legal use of the Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries

The Printable Montana Form EST I is legally binding when completed and submitted in accordance with state tax laws. To ensure its legal validity, taxpayers must follow all guidelines set forth by the Montana Department of Revenue. This includes accurate reporting of income, timely submission, and adherence to any additional state-specific regulations. Failure to comply with these requirements may result in penalties or legal consequences.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Printable Montana Form EST I. Generally, the form must be submitted by the due date for your estimated tax payments. Taxpayers should check the Montana Department of Revenue website for specific dates, as they may vary each year. Missing these deadlines can result in additional penalties and interest on any unpaid taxes.

Penalties for Non-Compliance

Failure to submit the Printable Montana Form EST I or underpayment of estimated taxes can lead to significant penalties. The Montana Department of Revenue may impose fines based on the amount of underpayment and the duration of non-compliance. Understanding these penalties is crucial for taxpayers to avoid unnecessary financial burdens and ensure compliance with state tax laws.

Quick guide on how to complete printable 2020 montana form est i underpayment of estimated tax by individuals and fiduciaries

Complete Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the correct format and securely save it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly and without hold-ups. Manage Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries on any system with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to edit and eSign Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries with ease

- Locate Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 montana form est i underpayment of estimated tax by individuals and fiduciaries

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 montana form est i underpayment of estimated tax by individuals and fiduciaries

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is the Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries?

The Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries is a tax form that individuals and fiduciaries in Montana use to report any underpayment of estimated taxes. This form helps ensure compliance with state tax laws and allows taxpayers to calculate any penalties or interest owed due to underpayment.

-

How can I obtain the Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries?

You can easily obtain the Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries from the Montana Department of Revenue's website or use airSlate SignNow to access, complete, and eSign the form digitally for convenience.

-

Are there any fees associated with using airSlate SignNow for the Printable Montana Form EST I?

Using airSlate SignNow to handle your Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries involves a subscription fee that varies depending on the chosen plan. However, the cost-effective solution offers a range of features that can save you time and enhance your document management experience.

-

What features does airSlate SignNow offer for managing the Printable Montana Form EST I?

With airSlate SignNow, you have access to features like document templates, eSignature capabilities, and real-time collaboration, which streamline the process of managing the Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries. These tools ensure that your tax forms are completed accurately and submitted timely.

-

Can I integrate airSlate SignNow with other applications while handling my tax forms?

Yes, airSlate SignNow offers several integrations with popular applications such as Google Drive, Dropbox, and various CRM systems. This flexibility allows you to manage your Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries seamlessly within your existing workflow.

-

What are the benefits of using airSlate SignNow for the Printable Montana Form EST I?

Using airSlate SignNow for the Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries provides numerous benefits, including enhanced efficiency, security features, and an intuitive user interface. These advantages ensure that your tax form management is stress-free and compliant with state regulations.

-

Is airSlate SignNow suitable for both individuals and fiduciaries who need to complete the form?

Absolutely! airSlate SignNow is designed to cater to both individuals and fiduciaries who are required to fill out the Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries. The platform's user-friendly features make it easy for anyone to navigate the form and ensure accurate submission.

Get more for Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries

- Mo 780 0408 form

- Mo 780 0408 missouri department of natural resources form

- Fillable online request a domestic wire transfer charles form

- Application for primary american source registration atc dps mo form

- Application to upgrade from a temporary resort atc dps mo form

- 2570 bcd 1 08doc form

- Marijuana business llc questionnaire form

- Employee electric vehicle charging application state of form

Find out other Printable Montana Form EST I Underpayment Of Estimated Tax By Individuals And Fiduciaries

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document